GBP Can't Shake off Brexit Reality

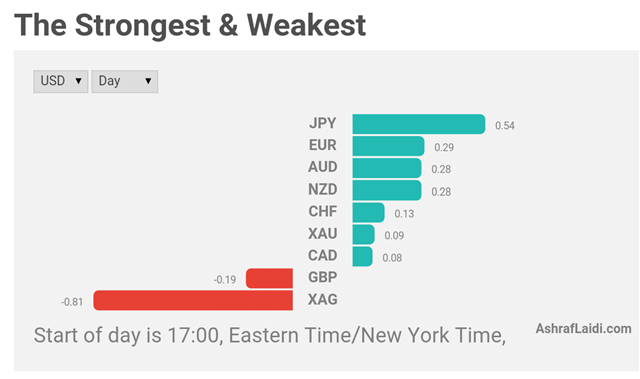

GBP is the weakest currency and JPY is the strongest as sterling is burdened by further reports that the UK won't be able to clinch any special treatment on its way out from the EU. JPY on fresh declines in equities brought by BoJ desperation and Deutsche Bank sinking to new lows.

Euro powers ahead thanks to 2-year highs in Germany's IFO survey.

Comments from Larry Fink grabbed our attention last week; he's the CEO of Blackrock, which is the world's largest asset manager. He forcefully warned that the Brexit vote is having a larger impact than it appears. He warned that investment plans are falling, companies will not be hiring and that it will begin to hit in Q4.Cable is certainly beginning to act like trouble is on the horizon. A two-day rally after the FOMC was wiped out Friday in a 130 pip fall.

In Canada, the story is similar with USD/CAD jumping on the combination of OPEC disappointment and weak numbers. CAD had been under pressure since Poloz warned about slow growth and inflation earlier in the week.

Friday's numbers underscored the point with July retail sales down 0.1% compared to +0.5% expected and CPI at 1.1% y/y vs 1.4% forecast.

On the week, oil finished higher despite the Friday swoon but with the Algeria meeting coming up, the risks for CAD and crude are high.

The Australian dollar was the top performer last week while its kiwi cousin lagged. Comments from Lowe suggest his RBA will push for more targeted measures rather than using monetary policy. Meanwhile the RBNZ continues to hint at near-term rate cuts.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -85K vs -81K prior

JPY +59K vs +57K prior

GBP -59K vs -83K prior

CHF +8.4K vs +1.3K prior

AUD +7K vs +36K prior

CAD +16K vs +17K prior

NZD -8K vs +5K prior

These numbers highlight positioning shortly before the Fed, BOJ and RBNZ decisions. There was a clear rush to unload cable positions despite a sharp fall last Friday. Otherwise, the trend was to buy the US dollar, especially against AUD. Ultimately, that proved to be a mistake as AUD gains on Wed and Thurs.Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33