Intraday Market Thoughts

Gold & Yen Positioning vs Hedging

by

Mar 31, 2022 18:23

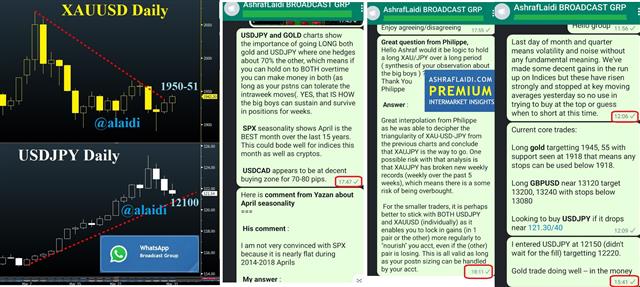

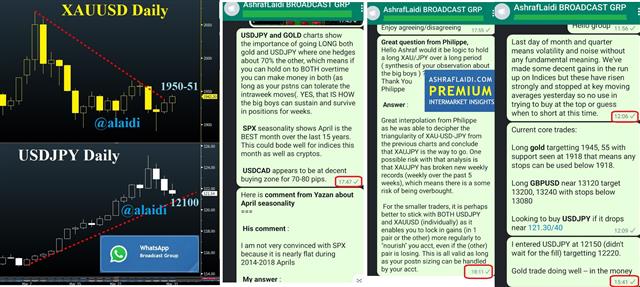

At a time when correlations break down to the point of no return, the Gold-JPY correlation remains generally intact. Far from perfect, but sufficiently positive to the extent that if you had bought USD/JPY as well as XAUUSD, you'd have fared well—assuming you're able to sustain intraday (and intraweek drawdowns). I explain below the relationship between gold and the yen, as well as evidence of tradable actions in gold/yen from our Whatsapp Broadcast Group.

Click To Enlarge

The general fundamental reason to the positive relationship between JPY and gold is their relative vulnerability to rising bond yields. I emphasize “general”, because we saw earlier in the year how gold rose alongside rising real yields and declining yen. One reason to the breakdown in real yields-gold relationship is the breakouts in short-term breakevens covered in more detail here.The above messages from our Whatsapp Broadcast Group illustrate today's trades (far right box), followed by the explanation of the relationship (far left box) and a response to Group member in (center box). Hope you learn as well as you profit from it.

The general fundamental reason to the positive relationship between JPY and gold is their relative vulnerability to rising bond yields. I emphasize “general”, because we saw this year how gold rose alongside rising real yields, but a declining yen. The reason to the breakdown in real yields-gold relationship is the breakouts in short-term breakevens covered in detail here.

The below messages from our Whatsapp Broadcast Group illustrate today's trades (far right box), followed by the explanation of the relationship (far left box) and a response to Group member in (center box)Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55