Polls, Trillion Bitcoin, SPX Gap & VIX Count

Bitcoin's market capitalisation regains $1 trillion for the 1st time since late 2021, it reminds us that it was 3 years ago minus 4 days when it first broke this landmark. As Bitcoin approaches Meta, the inevitable cross-over (BTC > META) will draw more scrutiny as Meta is the 2nd fastest gainer YTD of the Magnificent7 at 38%, versus NVDA (51%), AMZN (12%), MSFT (9%), GOOG (2%) and AAPL (-2%).

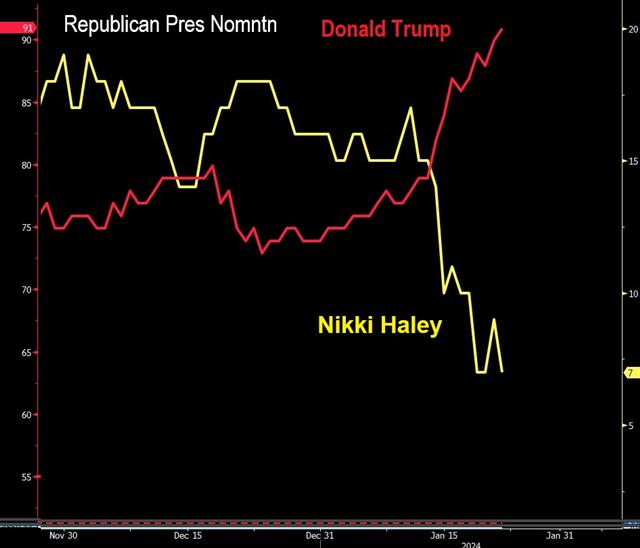

The 2nd chart shows the evolving standing of Trump's improving polling numbers in the US presidential polls as well as the candidacy for Republican leadership. As Haley's numbers tumble further, Trump's fortunes improve to the extent of helping his SPAC Digital World Acquisition Corp (DWAC). What does the polling gap in favour of Trump over Biden? Think oil and ETFS such as the XME. More on the Unfilled SPX Gap & VIX Count below

Other levels we're watching with the Whatsapp Broadcast Group is the 4.20% trendline support on the US 10yr yield and the 104 support of DXY, both of which are colluding to block XAUUSD at the 2010 level. This intermarket analysis sheds light on the potential inability of SPX to fill Tuesday's DownGap. Thus, as long as there's no close above 5015, the gap goes unfilled on a closing basis. Adding the VIX into the mix, we can observe Tuesday's successful close above the 200-DMA for the 1st time since the SVB crisis, followed two failed attempts (Jan 17 & 29) to break the 200-DMA for the VIX. Although the VIX has dropped back below the 200 DMA and 100 DMA today, it remains on an upward trend (higher lows) -- & that is the exact "failure pattern" followed on Aug 8 & 18, before soaring on Sep 26-Oct 25.

Latest IMTs

-

Why I Bought Gold & Silver

by Ashraf Laidi | Jan 9, 2026 16:53

-

Beware of US Supreme Court Ruling on Tariffs

by Ashraf Laidi | Jan 8, 2026 19:38

-

Falling to 11 Percent

by Ashraf Laidi | Jan 7, 2026 20:28

-

Dollar Cannot Wait for Q1 to End

by Ashraf Laidi | Jan 6, 2026 12:40

-

Silver's Signal to Gold Full Explanation

by Ashraf Laidi | Dec 30, 2025 20:04