FedSpeak Train & Unwinding Underway

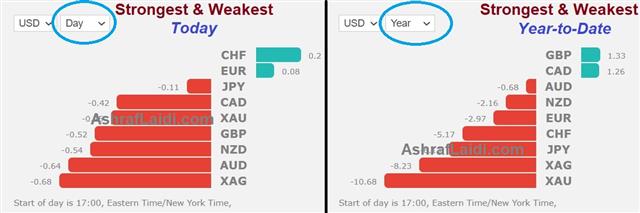

Little has changed in the underlying economic fundamentals this week but a potential unwinding is underway in indices, especially tech/Nasdaq. We will hear from 4 Fed speakers today (Evans, Kaplan, Barkin & Daly) see more below. More US data strength emerged yesterday with the JOLTS job openings at 7367K in Feb compared to 6900K expected. The US dollar stabilises against most currencies following a 2-day retreat, but remains weak vs EUR and CHF. The charts below show that since the start of the day (after 10 pm London), CHF and EUR are the only currency strengthening via USD, while the Year-to-Date chart shows GBP and CAD are the strongest currencies of the year, while gold and silver are weakest. Today is an opportunity for the Fed to make waves.

The IMF yesterday upgraded its global growth forecast on Tuesday to 6.0% from 5.5% in the January forecasts. That's mostly due to US stimulus but it's also important to note that European forecasts ticked higher despite further lockdowns and Canadian growth was the strongest upgrade despite a third wave. That speaks to the resilience of growth so far this year.

Both news items are a continuation of recent macro strength, yet markets are moving in the opposite direction. US yields fell below pre-NFP levels and a number of unwinds are way in FX, including EUR/USD and USD/JPY.

Beyond Stimulus Impact

Skeptics will point out that March was likely boosted by stimulus payments but a picture of a better-than-anticipated year is crystalizing. The question is whether inflation will rise too high and if the Fed will be good on its word in letting it run hot. The prices paid component in the ISM survey was the highest since 2008.Looking ahead, the highlight will be Fedspeak with Kaplan, Barkin, Daly and the minutes of the March FOMC meeting. There's a détente at the moment with the market pricing in Fed hikes in 2022 and the Fed insistent that's not going to happen. The Fed has pushed back on the idea but Powell also conceded that the only way to prove you're going to let inflation run hot is to do it. Meanwhile the bond market also hasn't pushed beyond what the Fed will tolerate so it's turned into a waiting game that will likely last the remainder of the year.

What could change? The Fed could indicate an early withdrawal of stimulus but that would set of a flurry of bond market selling and reinforce the lack of credibility that they're trying to counter. At the moment though, none of that is in play, though Dallas' Kaplan (at 1500 GMT) is one to watch because he's admitted his dot is one of the earliest ones to show a hike. Still, even if he doubles down on that idea or pushes harder, he's in a decided minority.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33