Risk on Right on Time

We wrote about positive April seasonals earlier in the week and that trade delivered with markets in a great mood to start the new month. The S&P 500 rallied 1.2% to a new record high and above 4000 for the first time.

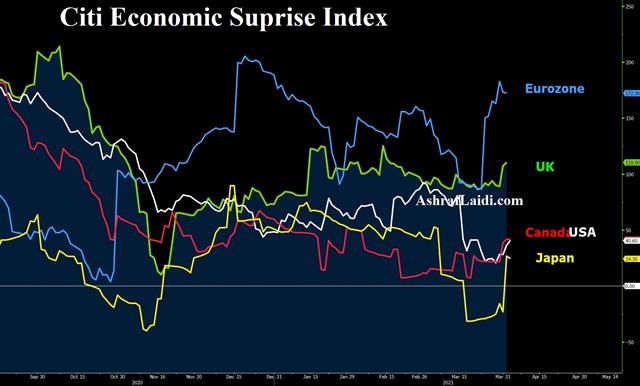

US services ISM shot up to a new record of 63.7 vs exp 59 after manufacturing ISM hit 64.7 compared to exp 61.5. The surveys from Markit were also strong, including a survey high (since 2011) in the Canadian measure. Importantly, all the surveys highlighted shortages of raw and intermediate materials, suggesting pricing pressures in the months ahead.

OPEC+ appeared to do its part to loosen the oil market with a surprise decision to raise quotas in May. They also pre-announced higher production in June and July, adding more than 2mbpd total. Initially the market balked but had a re-think and crude rose 3.5%, perhaps owing to the slow paces of increases, along with the certainty three months out.

In FX, the dollar slid as 10-year Treasury yields back off by 7 bps to 1.67%. That led to a relief rally in the euro and commodity currencies.Latest IMTs

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20