Quarterly Closes Point to More Ahead

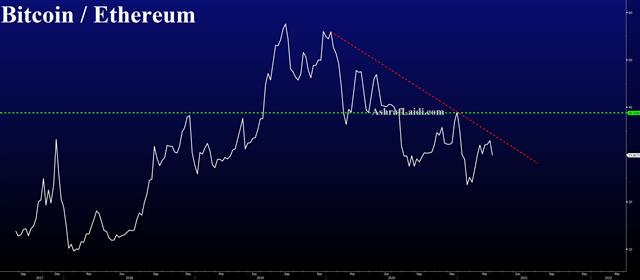

As risk on is empowerd ahead on the 1st day of Q2, let's assess a few items. The euro closed Q1 at its lowest since November among those crucial charts closing at extremes. OPEC+agreed on gradual hikes. (more below). On the day and on the quarter, CAD was the best performer and the yen lagged. Below is the latest Bitcoin/Ethereum ratio chart.

Quarter-end was a typically messy affair that saw some back and forth nonsensical 30-40 pip moves throughout the FX market. What stands out is how many charts finished at the extremes – something that's generally a continuation sign.

Given that we're right in the middle of the recover/reopening trade that's a good thing to keep in mind into Q2. CAD/JPY was the best trade in the quarter and it touched a fresh extreme on Wednesday. A number of currencies also hit new highs against the yen and Swiss franc. Both of these lagged badly in the quarter in a reminder that yield differentials are extremely powerful. EUR/USD also closed on the lows as Macron announced a one-month lockdown for France and the recovery fund efforts plod along.

Thursday's rally is interesting because non-farm payrolls will be released Friday with the market closed. One would expect some risk being pulled off the table in stocks and bonds. Yet we saw little in the way of portfolio rebalancing flows.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33