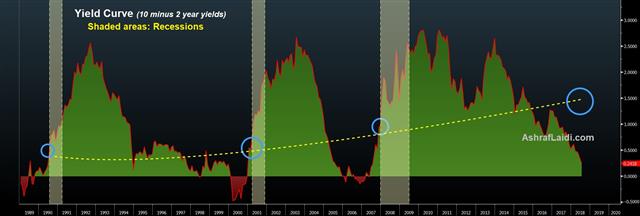

Yield Curve Considerations

The US yield curve fell to its flattest level since the crisis on Tuesday as Fed chair Powell dismissed the potentially recessionary signal. All currencies are down against the USD. GBP is the biggest loser on weaker than expected UK inflation, but with the headline CPI at 2.4% 00 well over the BoE target, the case for an Aug 2nd rate hike remains. The Premium DAX short was stopped out.

Not always recessionary but.

There is a raging debate inside the Fed about the implications of an inverted yield curve. Over the past half-century every inversion has triggered an interest rate cut by the Fed but not always a recession. On Tuesday, the difference between 10-year and 2-year yields fell to just 24 basis points. If the Fed hikes as anticipated, it will almost surely invert in the year ahead. Chapter 6 of Ashraf's book goes deeper in each of the yield curve inversions over the past 40 years. In it, Ashraf asserts that the inversion of 1998 did not lead to recession, but certainly predicted a series of Fed rate cuts in autumn of that year in light of the LTCM debacle. For traders, it is more important to be able predict rate cuts, or changes in the tightening cycle, than actual recessions.So is it a signal? Powell doesn't think so. On Tuesday he weighed in to say that the only real signal from the yield curve is in regards to neutral rates. Time will tell if that's true or not but in the short term, the takeaway is that an inverted yield curve, or the threat of it, won't pevent Powell from continuing to hike rates.

Like in quantum physics, since the market now knows Powell won't stop hiking because of an inverted curve, it makes a recession more likely. That's because 1) it's a sign Powell will be more aggressive 2) Yields won't be restrained (as much) by the implied or real threat of the Fed slowing down because of inversion.

In the short run, Powell's comments helpe boost the US dollar, but in the longer-term, his stance may prove to be a risk to the US and global economy.

Insurance

The crux of the problem continues to be that developed-market inflation remains restrained due to globalization and automation. The Fed is hiking because it believes a tighter jobs market will inevitably lead to inflation but that may no longer be true. More importantly, the Fed intends to normalize interest rates as far as it want in order to secure sufficient firepower in the event of the next recession. i.e. Fed funds rates will be high enough to be reduced.| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) | |||

| 2.4% | 2.6% | 2.4% | Jul 18 8:30 |

Latest IMTs

-

Why I Bought Gold & Silver

by Ashraf Laidi | Jan 9, 2026 16:53

-

Beware of US Supreme Court Ruling on Tariffs

by Ashraf Laidi | Jan 8, 2026 19:38

-

Falling to 11 Percent

by Ashraf Laidi | Jan 7, 2026 20:28

-

Dollar Cannot Wait for Q1 to End

by Ashraf Laidi | Jan 6, 2026 12:40

-

Silver's Signal to Gold Full Explanation

by Ashraf Laidi | Dec 30, 2025 20:04