Yields Pause, Metals Jump, Dax Breaks out

Biden relayed on US TV late Thursday that Democratic Sen Sinema said she will block any tax raises at all on corporations or high earners. Perhaps that's a tactic to put pressure on her but it likely means that avenue for raising funds for a reconciliation package is done.

It will likely mean a considerably smaller package but ongoing low taxes will maintain the US corporate advantage and keep money flowing into dollars. We will continue to keep a close eye on what comes next and the potential fallout.

In the bigger picture on Thursday, there was a retracement in yen weakness that ran counter to continued stock market gains and the rise in bond yields. It's likely to be a standard dip after an extended one-way move but it bears watching closely on Friday in case it's foreshadowing a broader market move.

Economic data continues to send positive signals with a strong US existing home sales report on Thursday and a new cycle low in initial jobless claims.

For Canada, the final piece of economic data ahead of next week's BOC will be the August retail sales report. That sector has been a drag in Q3 while the rest of the economy hums. It would take an especially weak print to spoil a hawkish turn from the BOC.Latest IMTs

-

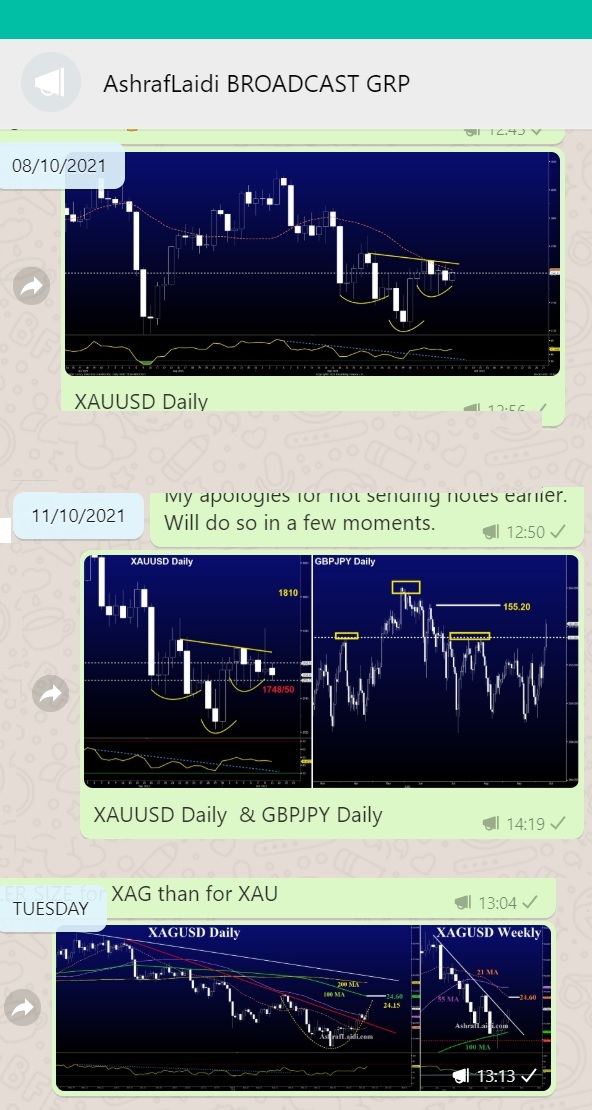

Gold Enters Week 9

by Ashraf Laidi | Oct 13, 2025 10:39

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33