Intraday Market Thoughts Archives

Displaying results for week of Mar 01, 2015US jobs strong, earnings soft, USD soars

USD soared further, dragging EURUSD to fresh 11-year lows of $1.0845 on another solid US jobs report supporting the case for a Fed June or September rate hike as US non-farm payrolls powered ahead with a 295K increase in non-farm payrolls in February, overshooting expectations of a 3rd consecutive decline to 235K. The only negatives of the report standing the way of Q2 rate hike is the decline in the average hourly earnings to 0.1% m/m from 0.5% y/y and to 2.0% y/y from 2.2% y/y . Full charts & analysis here

Dollar Dominant Ahead of NFP

The ECB underscored the massive divergence in developed world monetary policy and a strong US jobs report would add to the argument. On Thursday, the dollar was the top performer while the kiwi lagged. The teetering Australian dollar will be the focus of Asia-Pacific trading. A new set of Premium trades will be issued tomorrow before the release of the US jobs report.

The euro fell as low as 1.0988 after Draghi but managed to close above 1.1000. Still, it was another tough day for the euro as even with better growth forecasts the ECB said it could buy bonds beyond 2016 and with yields lower than 0%.

An interesting corporate development that caught our eye was Warren Buffett's Berkshire Hathaway launching euro-denominated bonds for the first time. The 3 billion euro proceeds will then be immediately converted into US dollars and returned home. It's not hard to see why; the company will sell bonds extending to 20 years and pay yields less than 1.8%.

With the ECB pinning Eurozone yields to the floor and eating up supply, this type of corporate maneuver can't help but increase in popularity and it adds another reason to expect a weaker euro in the medium term.

Elsewhere, we warned yesterday that good news wasn't providing the usual boost for the Australian dollar and the bulls finally gave up on Thursday as AUD/USD sank back to pre-RBA levels. RBA Gov Lowe left the dollar open for future cuts in his comments and construction data today underscored why. The AiG performance of construction index fell to 43.9 from 45.9. Yesterday's trade balance numbers also showed only a 1% rise in exports. If exports can only nudge higher on a 30% drop in AUD, what can boost the economy?

Otherwise, the remainder of focus on the Asia-Pacific session is on the Fed's Williams, who is speaking in sunny Hawaii.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (JAN) | |||

| $-42.00B | $-46.56B | Mar 06 13:30 | |

Euro breaks $1.10 as ECB kicks off QE

The current 22% decline in EURUSD over the last ten months is comparable in magnitude to that of 2011-2012, 2009-2010 and 2008-2009. The recovery of inflation from its -0.6% lows in July 2009 to 1.9% in Nov 2010 took a little over 12 months, but the trough in core inflation at the time was at +1.3%, compared to the current +0.6%. Full charts & analysis.

Poloz to the Sidelines, EUR to the Pits

The surprise on Wednesday wasn't so much that the Bank of Canada held rates but the hint that no more rate cuts are coming. The Canadian dollar was the top performer while the euro was caught in wave of US dollar buying. Australian retail sales and trade balance are next. 1 of our GBPUSD trades was stopped out, today's issued GBPCAD short 15 minutes ahead of the BoC decision hit its final target for 170 pips, while the remaining AUDNZD short further nears its final target.

The market was stubbornly pricing a 25% chance of a BOC cut ahead of the decision and USD/CAD hit a session high of 1.2542 just before the data but it was a quick fall afterwards. The BOC held rates at 0.75% and said inflation risks are now 'more balanced', which is a sign that cuts aren't coming. The pair fell as much as 130 pips before a minor bounce late.

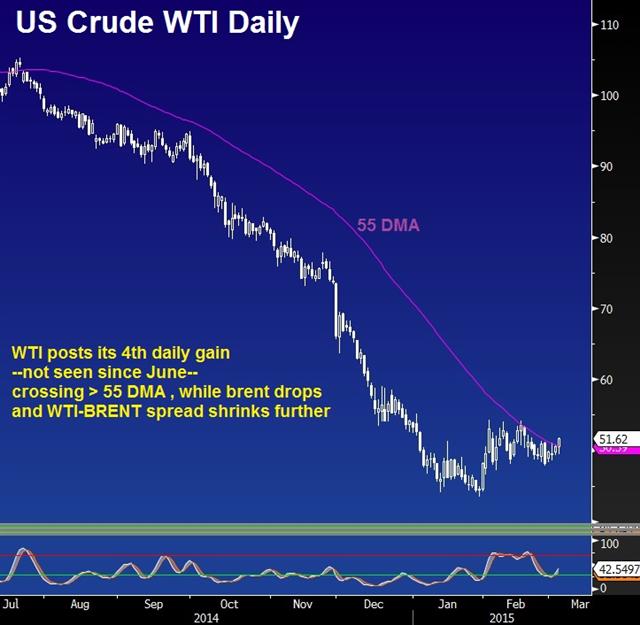

Considerable real money that has fled Canada in the expectation of more rate cuts but with oil continuing to show resilience – including a $1 rally today despite an enormous build in EIA supply data – the window for a run to 1.30 has been closed, at least temporarily. The focus now is on the recent series of lows, which extend down to 1.2350.

One spot where there are no recent lows is EUR/USD. The pair fell through 1.1100 to an 11-year low on Wednesday, leaving very little support aside from the psychological 1.10. There have been signs of better growth in the Eurozone but the wave of QE still hasn't hit and that's the dominant factor.

At the same time, the US dollar was broadly stronger on the day. ADP employment was close to expectations but a solid revision to the previous month spared some dollar buying. In addition, ISM non-manufacturing data at 56.9 was slightly stronger than 56.5 expected. The employment component was also strong.

Later, the Beige Book was cautious and said wage pressures were only moderate but that couldn't stop the dollar. Cable was also caught in the crosshairs as it fell to 1.5263 from 1.5340 in US trading.

Looking ahead, the focus shifts to the Australian dollar with two important releases at 0030 GMT. January retail sales are expected up 0.4% and the trade deficit is expected at A$925m. The problem for Australian dollar bulls right now is that they can't seem to get a foothold. The RBA didn't spark a lasting bounce and neither did a squeeze higher on Wednesday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (JAN) (m/m) | |||

| 0.2% | Mar 05 0:30 | ||

| Trade Balance (JAN) | |||

| -436M | Mar 05 0:30 | ||

CAD Spurred by BoC Inaction & Oil jump

The Canadian dollar jumps across the board after the Bank of Canada announced keeping rates unchanged at 0.75%, stating that “inflation is now more balanced” and current degree of policy stimulus remains “appropriate”. The first 4-day consecutive rally in crude oil since June also helped. Charts & analysis.

BOC Cut in Doubt

A drop in oil prices did little to stifle the Canadian economy in the second half of 2014. The first reading on Q4 GDP showed a 2.4% increase compared to 2.0% expected. Q3 was also revised to 3.2% from 2.8% and combined it put annual growth slightly ahead of the US at 2.5% for 2014.

The loonie initially jumped 80 pips on the report but later gave up more than half the gains. In part because two-thirds of the quarterly growth was due to inventory building. A late, broad recovery in the US dollar was also a factor.

The more important factor in the day ahead is the Bank of Canada. In mid-February the market was pricing a 75% chance of a cut but that's dwindled to 25% after a series of better data points including employment, retail sales and CPI. Poloz and Cote also dropped small hints about waiting on the sidelines while oil prices are about $3 higher than they were at the last meeting.

Overall, if Poloz had an doubt about a March rate cut a month ago, it would have been solidified by the latest economic numbers. With a large net short position in CAD, expect a bump on the announcement but not to the magnitude of the Aussie on Tuesday.

On that front, the AUD/USD bulls were likely disappointed with the lack of follow through following the RBA. The pair made a marginal fresh high in US trading but then sagged back down to 0.7810. A similar lack of follow through is likely in loonie trades if the BOC holds (barring any big moves in oil).

Before the BOC, it's a busy day for data in the Asia-Pacific region. It starts with Australian Q4 GDP at 0030 GMT. The consensus is for a 0.6% q/q rise in growth. But if the RBA could offer a lasting boost to the Aussie, why would a stale GDP report?

Next is a speech from Yellen at 0115 GMT. The topic is bank regulation and Yellen has never been known to go off script but a hint at removing 'patient' would send the dollar surging.

Next is the Japan services PMI from Markit at 0135 GMT and the China services PMI from HSBC 10 minutes later. Neither are traditional market movers but traders are beginning to get skittish about China so we rule nothing out.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product (Q4) (q/q) | |||

| 0.7% | 0.3% | Mar 04 0:30 | |

| Gross Domestic Product (Q4) (y/y) | |||

| 2.6% | 2.7% | Mar 04 0:30 | |

| Fed's Yellen Speech | |||

| Mar 04 1:15 | |||

| Fed's Evans Speech | |||

| Mar 04 14:00 | |||

| Fed's George Speech | |||

| Mar 04 18:00 | |||

| Fed's Richard Fisher's speech | |||

| Mar 04 22:00 | |||

| Markit PMI Composite (FEB) | |||

| 54.4 | Mar 04 14:45 | ||

| Markit Services PMI (FEB) | |||

| 54.2 | Mar 04 14:45 | ||

| ISM Non-Manufacturing PMI (FEB) | |||

| 56.5 | 56.7 | Mar 04 15:00 | |

| Markit Services PMI (FEB) | |||

| 51.3 | Mar 04 1:35 | ||

| PMI (FEB) | |||

| 51.8 | Mar 04 1:45 | ||

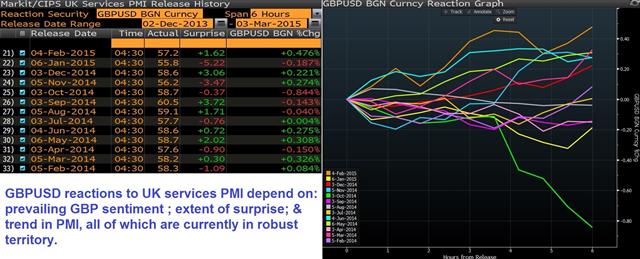

GBPUSD Reactions to UK Services PMIs

Wednesday's release of the UK services PMI will be key to GBP trades. Here is how the pair reacted to each of the last 13 releases . Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Services PMI (FEB) | |||

| 57.5 | 57.2 | Mar 04 9:30 | |

Aussie Traders Lean toward Cut in Close Call

The Australian dollar slumped in the hours ahead of the RBA decision in a sign that the market is leaning towards a cut. AUD was the weakest performer along with NZD on Monday while the US dollar led the way after ISM manufacturing data. AUDNZD Premium is the sole Aussie trade currently in progress ahead of the RBA decision. 1 of the 3 GBPUSD longs was stopped out, whhile the remaining GBPNZD hit its final target.

The CFTC data we wrote about to start the week showed a shift into Australian dollar shorts and that continued to be the theme on Monday. AUD/USD slumped by as much as a half-cent on the day and finished near the lows.

The RBA decision is as close as it gets with the rate futures market pricing the chance of a cut at 49.2% and no cut at 50.8%. But the momentum appears to be swinging toward a cut after soft jobs and capex data. JPMorgan economists switched to a cut on Monday in another sign of the momentum.

One of the factors market watchers have cited is the Australian dollar. The Aussie is at virtually the same level as before the most-recent cut that will prove frustrating to Stevens & Co. What may keep them on the sidelines is that China appears to be taking strong steps toward boosting the economy and the commodity rout has ended (at least for now).

In the event of a cut, look for a fall to the Feb lows of 0.7625-50 range. If not, a return to last week's high of 0.7900 would be in order unless Stevens strongly hints a cuts to come.

The other factor is the US dollar. It made a strong move to the upside to start the week. The main data point was the ISM manufacturing report. It only registered at 52.9 compared to the 53.0 consensus but after a soft Chicago PMI and other regional indexes, the market was looking for something lower than the consensus.

As a result, USD/JPY jumped to a two week high and the euro gave up all its earlier gains. Cable is continuing to retrace after failing at the 2015 high last week.

The RBA decision is at 0330 GMT.

Charting ISM lows vs QE absence

In assessing whether the current lows in the components of the manufacturing ISM would see similar bounce this time, let's compare the events prevailing at the time of the bounce to today's situation. Full charts & analysis.

AUD Unimpressed by Chinese Rate Cut

China was the focus of the weekend as the PBOC cut the lending, savings and deposit rates by a quarter-point. The required reserve ratio was left unchanged but the odds of a cut are rising. The move prompted speculation that the official Chinese manufacturing PMI would be soft but at 49.9, it was slightly better than the 49.7 consensus.

The lack of response from the Australian dollar has two facets. The first is that markets are starting to worry if things in China are worse than they appear with this move coming hot on the heels of a November cut. The Fed may know more than it's letting on; in Yellen's testimony she cited international weakness as a risk and the first country she mentioned was China. So rather than buying AUD on the stimulus, the market is worried about the Chinese economy.

Second is that AUD traders are reluctant to react with the RBA decision just over 24 hours away. The futures market implied pricing suggests it's a 50/50 decision and that will overwhelmingly be the AUD driver in the day ahead.

In the shorter-term, the RBA may look at the TD Securities inflation report for February. It's due at 0030 GMT and the previous reading was up 1.5% y/y. Yen traders will be focused on the Q4 capital spending data 20 minutes later. Capex is expected up a healthy 4.1% and give the BOJ some room to breathe.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -178K vs -186K prior

JPY -48K vs -49K prior

GBP -22K vs -29K prior

AUD -63K vs -54K prior

CAD -36K vs -33K prior

CHF -5K vs -6K prior

Specs are acting like they've sniffed out a second RBA rate cut after the soft capex data and jobs reports.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (FEB) | |||

| 54.3 | 53.9 | Mar 02 14:45 | |

| ISM Manufacturing PMI (FEB) | |||

| 53.5 | Mar 02 15:00 | ||

| PMI (FEB) | |||

| 50.1 | 49.7 | Mar 02 1:45 | |

| Former Fed's Bernanke speech | |||

| Mar 02 15:00 | |||

| Philadelphia Fed's Plosser speech | |||

| Mar 02 15:00 | |||

| TD Securities Inflation (FEB) (m/m) | |||

| 0.1% | Mar 01 23:30 | ||

| TD Securities Inflation (FEB) (y/y) | |||

| 1.5% | Mar 01 23:30 | ||