Intraday Market Thoughts Archives

Displaying results for week of May 12, 2019Lame Duck May?

UK Labour leader Corbyn has just announced the breakdown of Brexit talks with PM May's Conservatives. May blamed it on divisions in the Labour Party. This sets set the stage for her departure, whether or not a Brexit withdrawal agreement passes in the first week of June. But what about the indicative votes? (see below). Could this eventually set the stage for a rebound in the pound as it fell once again Thursday. All currencies are down against the USD with the exception of the yen as risk dips back down. Monday's long DOW30 Premium trade was closed yesterday at 25870 for 450-pt gain. The other index trade remains open.

The final act of Theresa May's leadership of the UK will take place in early June as she makes one final effort (effort # 4) to forge a Brexit deal. She had previously pledged to leave after a deal on a meaningful vote but now she will try to score a win on a withdrawal bill. According to 1922 Committee chairman Graham Brady, May will leave regardless of the vote's outcome.

May is attempting to introduce indicative votes in order to not only avoid MPs answering yes or no, but to hold an exercise over what kind of majority Parliament would want to back. More on this next week. GBP weakness is certainly UK-specific, but it is also exacerbated by USD strength.

It appears to be a lost cause with Labour and the ERG already lining up against it. Labour is even reluctant to engage in futher deal talks with May because they believe any deal may not survive a leadership challenge. That leaves little hope of any political tailwinds until May officially quits.

Pound vs Volatility

The turmoil and uncertainty has sent cable lower in eight of the past nine days, including a half-cent fall on Thursday to the worst levels in three months. At this point the market will grab onto any positive signs or developments but a leadership challenge will add new risks. The better hope for a near-term rebound may be better economic data. Note in the above chart how sterling implied volatility has remained supressed despite the currency's free-fall. Does this imply the lack of surprise element? Will volatility pick up when (if) May leaves? Ashraf tells me he sees the final support 1.2650/70 on a closing basis before a sharp move higher.On that front, there were positive signs Thursday in North America. US housing starts and the Phily Fed beat estimates, leading to a rebound in USD/JPY. Canadian ADP employment data was also extremely strong in what should be confirmation of the official jobs report released last week.

US-China Trade talks remain the dominant story in the backdrop and markets were positive Thursday but there was some worrisome news. China struck a defiant tone saying it will never make concessions in important matters of principle. Reports also said that the US is asking the EU and Japan for auto quotas that are likely to be seen as unacceptable and in violation of WTO rules.

بين الذهب والداو جونز

هل العلاقة بين الذهب والداو جونز دائماً عكسية؟ سنتحدث اليوم عن هذه العلاقة والعوامل المؤثرة على الذهب مع أوربكس في هذا الفيديو المفصل

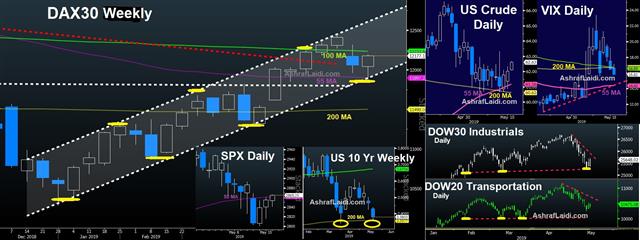

Risk on as No War on Two Fronts

Multiple reports on Wednesday said Trump will delay a decision on auto tariffs, allowing for a major reprieve in indices throughout Europe and Asia. The move boosted risk assets and the Canadian dollar was (and is today) the top performer while the pound continues to lag. Watch out for comments from the Fed's Brainard on Thursday. US jobless claims, Philly Fed survey and hiusing starts are due next. The 7 charts below highlight the supporting technicals across the intermarket landscape, justifying why we went long indices during the selloff. The index trades are netting +500 pt in the green.

Risk assets reversed positively on reports that Trump won't use national security powers to put tariffs on auto imports. He had been scheduled to deliver a decision by Friday but he has decided to delay it by as much as six months. We have noted previously that the plan was likely to settle with China and then pivot to Europe and Japan on autos. Yet, the reccent breakdown in China talks meant Trump had to reorganize and decided he didn't want to fight two battles at once.

In a sense, that's good news – especially for automakers, Germany and Japan – but it may also be a signal that he's braced for a longer battle with China. DAX30 has regained the 12200 level, bouncing off the 5-month channel and 55 WMA.

Along those same lines, the White House also appeared to make moves to end steel and aluminum tariffs against Mexico and Canada. Several reports indicated a deal is close after ministers from the NAFTA countries met Wednesday in Washington. That news helped to lift the loonie.

Looking ahead, comments from the Fed's Brainard at 1615 GMT (17:15 London) will be worth heeding. What we're trying to evaluate now is how stubborn and committed the Fed is to holding rates and remaining patient. Low inflation, tariffs and further disappointing data like Wednesday's retail sales report have made the Fed fund futures market increasingly confident about a rate cut late this year (odds are at 76%). So far policymakers haven't genuinely opened that door but Brainard has floated key signals in the past and is a risk to do that again.

Risk Can't Stay on, Bass Gives up

Risk trades pare yesterday's gains, which were caused by Trump downplaying trade tensions with China. But follow-up is lacking as markets return to macro factors. The yen and franc are the only gainers vs USD since the start of the Asian session. US retail sales (exp 0.2%) and Canada CPI (exp 2.0%) due at 13:30 London and US industrial production (exp unchanged) due 45 mins later. More on what Kyle Bass did below.

تعمق في الصفقات (فيديو المشتركين)

Trump's attempt at defusing tensions helped global equities rallya across the board on Tuesday by calling the dispute with China “a little squabble” and said his relationship with Xi remains “extraordinary.” A spokesman for the US Treasury Secretary also said he would head to Beijing soon for another round of talks. The commentary lifted USD/JPY by 30 pips and led to a 22 point rebound in the S&P 500 after Monday's 69-point plunge. But USDJPY is back down to 109.20s on decline in risk appetite.

Beneath the surface the market is concerned about increasingly hawkish and nationalistic commentary in Chinese state-approved press. That could be a sign of the government preparing the domestic audience for a prolonged and worsening battle. The talk from Mnuchin is also double-edged because it appears he may not travel with lead negotiator Lighthizer.

Kyle Bass Throws Towel

One of the most notable stories of the week is of renowned hedge fund China bear Kyle Bass announced the closing of his 4-year old short bet against the Chinese currency. The bet, started in July 2015 gave luster to Bass' star as it occured one month ahead of one of the currency's biggest declines in history. In March of this year, Bass posited China would eventually erode its $3.0 trillion in FX reserves in trying to shore up the yuan. Another well known hedge fund China bear is Mark Hart, who abandoned his his 8-year old yuan short in 2017.The day ahead will be an opportunity to refocus on the US economy and the crowded long-USD trade. April retail sales are expected to rise 0.2%, or 0.7% excluding autos. Watch the control group closely; it's forecast to rise 0.3%. A strong reading may strengthen Trump's belief that tariffs are working.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| May 15 13:30 | |||

| CPI (m/m) | |||

| 0.4% | 0.7% | May 15 12:30 | |

عودة بتكوين ـ الى أين؟

هناك عدة أسباب تساعد في تفسير صعود بيتكوين ب 120٪ منذ بداية العام. ولكن من الأهمية إتقان الديناميات الفنية وراء حركة الصعود من أجل المساعدة توقع الحركات السعرية القادمة. التحليل المفصل

Trump Tweets Hold Intermarket Levels

Pres Trump has just tweeted moments ago "when the time is right we will make a deal with China" demanding that China has to give more for the US to regain lost ground. Markets up off their lows, with SPY futures +16, DOW futures +127 pts and USDJPY at 109.66. UK employment rate fell to 3.8% from 3.9%, earnings growth (pay) dropped to 3.2% y/y from 3.5%. German ZEW business sentiment was mixed. A new index trade has been issued with 4 supporting charts for Premium subscribers. The full details are covered in the Premium video below.

Every negotiation involves some element of bluff. There's always the risk the other party will walk away from the table and spoil a win-win deal. In a political deal, the domestic side is always another voice in discussions and appearing strong is as important as the real thing.

What's clear is that a US-China deal is in the best interest of both countries and both leaders. Although mutual benefit was almost always the case in the past, history is filled with innumerable miscalculations leading led to far worse outcomes than trade wars.

So here we are with the US scheduled to hit China with harsher tariffs and contemplating even more. China has announced retaliation and no talks are scheduled on either side. The market wasted no time in reacting to the 2.4% fall in the S&P500, more than doubling the cumulative loss over the past six sessions. The Shanghai Composite is down 11.5% in less than two weeks.

It could all change in an instant. The sides aren't terribly far apart. That makes trading in this environment deeply risky. If nothing changes, the latest trends will continue but the further markets fall, the large the risk of a headline-driven reversal.

Three Realities

Three facts that are troubling in the short term: i) Despite Trump's tweeting his willingness to strike a deal, the US has not yet scheduled a return visit to. Mnuchin said a meeting is likely but there's not a timetable yet. ii) Trump stating he will meet Xi at the G20 is positive but the summit isn't until June 26 and that would leave businesses (and markets) to manage a month with the tariffs in place; iii) tariffs on the final $300B of goods would be scheduled for June 24.Trade will continue to dominate markets this week but economic data is worth watching.We continue to watch 11820 on the DAX, 25380/400 on the DOW30, but the more crucial levels stand in other markets mentioned in today's video, which are the basis for today's new trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's George Speaks | |||

| May 14 16:45 | |||

China Retaliates, Gold Nears 1300

A full-scale trade war between the US and China is closer than ever after Beijing hit back with retaliatory tariffs on Monday. The Chinese yuan fell by more than 1%, prompting a selloff in copper, while gold jumped $11 to 1299 and Bitcoin hits $7400. USD fell across the board on reports that some Chinese scholars have mentioned Beijing taking the "nuclear option" -- selling US treasuries. Risk trades have been hit hard to start the week with safe haven assets surging. CFTC positioning data continues to show crowded USD longs. The Premium short in USDJPY hit its final target of 109.40 from 111.30 entry.

Beijing announced it will hit $60 billion in US imports with 5-25% tariffs on June 1. The announcement worsened a sour mood in markets. It was also coupled with reports that China will cut purchases of US agriculture, energy and services along with the chatter about selling Treasuries.

The announcement came after Trump ramped up the rhetoric throughout the weekend, tweeting about tariffs more than 30 times.

The reaction in the FX market was to buy the yen. USD/JPY is down nearly a full cent to start the week with commodity currencies even lower against the yen. The euro is near the highs of the month as dollars are sold on USD-centric risk.

The talk of Treasury selling was overwhelmed by demand for safe haven assets with yields 4-8 bps lower across the curve. Gold is up nearly 1% and Bitcoin gapped 18% to $7430. US stocks sink more than 2%.

The escalation and rhetoric from both sides mean it will be difficult to engineer a quick climb-down. Trump has relentlessly emphasized the cash gains from tariffs and tied them to 3.2% GDP growth in Q1. However a sharp fall in US equities could have him quickly changing course.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -106K vs -105K prior GBP -7K vs -5K prior JPY -92K vs -100K prior CHF -40K vs -40K prior CAD -46K vs -47K prior AUD -57K vs -59K prior NZD -13K vs -11K prior