Intraday Market Thoughts Archives

Displaying results for week of Sep 13, 2020FX Shrugs, Indices Shaken

The strikes against the US dollar are adding up. Thursday's risk aversion produced a dollar bid for a time but it faded in fairly short order, even against commodity and emerging market currencies. It begs the question: If the dollar can't rally on a day like that, when can it rally?

The economic data was mixed once again. Initial jobless claims were a touch higher than estimates while continuing and PUA claims were better. Housing starts fell 5.1% in a rare miss on the red hot real estate market while the Philly Fed was bang-on expectations at +15.0.

Data has been more up-and-down in the past few weeks after months of consistently beating expectations. That run of data sent the Citi economic surprise index to the highest ever but – notably – even with that the dollar has struggled since March. We may now be seeing what happens when economists (and markets) finally get a handle on the direction of the economy.

Fed's 2023 Special, BoE Thinks Negative

The FOMC decision and communication were in line with expectations. There were tweaks to incorporate average inflation targeting and the 2020 growth estimate was boosted. Markets expressed some disappointed when the Fed didn't offer any hints at more QE or other easing, except to say that it retained tools in the toolbox.

The short-term market reaction is understandable but it's ultimately the long-term vision that will win out. The Fed's 2023 forecasts and dots were all new. They showed 4.0% unemployment, 2.5% GDP growth, 2.0% core PCE inflation and 13 of 17 policymakers said they still expected to have interest rates at zero at the end of that year.

Ashraf tells me to start focusing on US 5-year break-even rates (now at 1.55%) and a possible H&S formation in this little-noticed rate.

Forecasts change but the Fed's vision is clear: There will be no rate hikes even when the pandemic is forgotten and the economy is relatively strong. The 2023 economy that Powell laid out is similar to what we saw in 2019 – a year with 2.2% growth, 1.7% inflation and 3.7% unemployment. The big difference is that the Fed funds rate was 1.5% and the Fed's balance sheet was half its current size.

The picture the Fed paints of 2023 is paradise for risk assets, emerging market currencies, precious metals and commodities. It would argue for massive leveraging at ultra-cheap rates.

In the shorter term, there are undoubtedly mixed messages. The August US retail sales report missed estimates with core sales down 0.1% as the prior was also revised lower. At the same time, home builder sentiment jumped to a record and a US HHS official said the country could be vaccinated in April.

Trading in & out of the Fed

The FOMC decision is on Wednesday at 14:00 EST(18:00 GMT, 19:00 London, 22:00 Dubai) and it will include the latest economic projections and a press conference from Powell 30 mins later. (See Ashraf's view here on the Fed in orange).

There is little intrigue in the decision itself. Better economic data in Q3 has cut the chance of further easing to nearly nil. Instead the focus will be on communication about lower rates for longer, particularly via the dot plot.

This edition will feature the introduction of the 2023 dots and will also include some important changes to this year's forecasts. For 2023, the main question is on the median on rates. In the June forecasts, the median was still on the floor but some FOMC members likely see liftoff in 2023. If it's enough to move the dot, it could be seen as hawkish and USD positive.

Importantly, the pandemic has also unfolded better than the Fed anticipated. The 2020 growth forecast will illustrate that as the GDP estimate will move to around -3.5% from -6.5% along with better unemployment. A tail risk is that better economic outcomes lead some to see liftoff as soon as 2022.

There could also be a shift in PCE higher to account for average inflation targeting and if so, that could also underpin a selloff in bonds and bump in the dollar. Along those same lines, there is a seasonal bottom in Treasury yields that occurs in mid-September and a higher inflation forecast could be the tipping point.

A more-straightforward element to watch is the statement and whether it continues to include a nod to 'considerable risks' surrounding the outlook. Given the pandemic and election uncertainty, that's not likely to be altered but there is a chance.

Dollar Crosshairs

فيديو المشتركين قبل لقاء الفدرالي

Markets We are slowly shifting towards a clear paradigm where the default mode is to sell the US dollar. Mondays rebound in risk appetite was coupled with significant dollar selling, particularly against emerging market currencies.

The price action Monday also underscored the shifting post-pandemic paradigm: Risk trades were strong in New York trade but USD/JPY was the laggard. The breakdown in USD/MXN continued.

We're in the post-yield world and that means that valuations and growth prospects are the marginal growth drivers. There are plenty of pockets of value in the US – including real estate – but financial asset multiples are higher there than almost any developed market. Some of that is justified by past performance and the omnipresence of US technology but there is a limit, especially in a pre-election environment where Biden is pledging to raise corporate taxes.

Question about the Fed: Will the Fed finally make its formal amendment and upgrade the inflation target at this Wednesday's announcement? Markets have stabilised, so it's more likely that such a dovish action plan be saved for the next bout of volatility --when markets are gripped by a prolonged wave of selling, VIX is above the high 30s and US presidential uncertainty is surging. What do you think?

A good sign in the US and elsewhere is that GDP estimates in Q3 are climbing however that's coupled with unease about what will happen in Q4 and beyond. The latest indications will come in the September Empire Fed at 1230 GMT. The consensus is a +6.7 reading, up from +3.7 previously.

The Fed decision on Wednesdays should put a chill on trading in the lead-up but it might be less than usual. Talk around the Fed this time is minimal with few expecting any real policy changes.Narrative Disconnect

US stocks fell to fresh one-month lows on Friday before a late bounce but markets outside of stocks tell a different story. A classic risk trades is AUD/JPY and it's roughly where it was two weeks ago and still well-above the March and June highs. There has been some volatility but nothing like the correction in equities.

USD/MXN is another good risk barometer but the recovery in emerging market currencies has continued uninterrupted. Late last week, the pair made a major technical breakdown with the fall below the June low.

There's also the bond market where Treasury yields are only slightly below where they stared the month. The precious metals market also continues to consolidate in the centre of the two-month range.

Stepping back, we see idiosyncratic declines in three main markets. 1) Tech stocks and other high-flying pandemic stocks are seeing a clear correction. This is likely a reflection of overvaluation after a speculative mania; but could also reflect optimism about a return to 'normal'. 2) Sterling has fallen because Brexit negotiations are breaking down. 3) Oil is being hit by demand worries. This is the most concerning because it may reflect real economic weakness but there's also a seasonal component to falling demand and a return to full production too quickly.

One argument is that stock markets are simply ahead of the pack and that's worth pondering but it would be unusual. The message for now is not to transpose these moves on FX trades and expect the regular correlations to hold.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

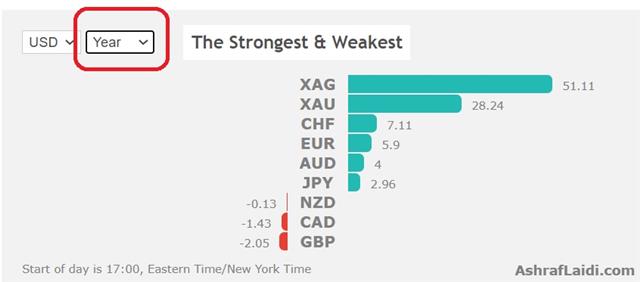

EUR +198K vs +197K prior GBP +13K vs +6K prior JPY +22K vs +30K prior CHF +12K vs +12K prior CAD -17K vs -27K prior AUD -2K vs 0K prior NZD +5K vs +7K prior

None of the moves in this week's report are large but climb in sterling longs shows a market that was caught wrong-footed on the Brexit drama.