Narrative Disconnect

US stocks fell to fresh one-month lows on Friday before a late bounce but markets outside of stocks tell a different story. A classic risk trades is AUD/JPY and it's roughly where it was two weeks ago and still well-above the March and June highs. There has been some volatility but nothing like the correction in equities.

USD/MXN is another good risk barometer but the recovery in emerging market currencies has continued uninterrupted. Late last week, the pair made a major technical breakdown with the fall below the June low.

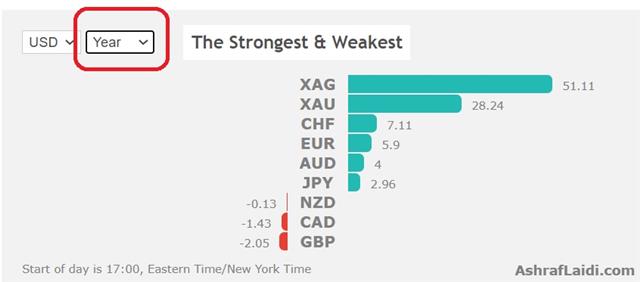

There's also the bond market where Treasury yields are only slightly below where they stared the month. The precious metals market also continues to consolidate in the centre of the two-month range.

Stepping back, we see idiosyncratic declines in three main markets. 1) Tech stocks and other high-flying pandemic stocks are seeing a clear correction. This is likely a reflection of overvaluation after a speculative mania; but could also reflect optimism about a return to 'normal'. 2) Sterling has fallen because Brexit negotiations are breaking down. 3) Oil is being hit by demand worries. This is the most concerning because it may reflect real economic weakness but there's also a seasonal component to falling demand and a return to full production too quickly.

One argument is that stock markets are simply ahead of the pack and that's worth pondering but it would be unusual. The message for now is not to transpose these moves on FX trades and expect the regular correlations to hold.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +198K vs +197K prior GBP +13K vs +6K prior JPY +22K vs +30K prior CHF +12K vs +12K prior CAD -17K vs -27K prior AUD -2K vs 0K prior NZD +5K vs +7K prior

None of the moves in this week's report are large but climb in sterling longs shows a market that was caught wrong-footed on the Brexit drama.Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35