Intraday Market Thoughts Archives

Displaying results for week of Feb 14, 2016USDX Diamonds Ahead of GDP & G20

Now things become more interesting. Stocks are no longer in a free fall, yields stabilize, gold holds up and oil is back down after traders take a language lesson in the difference between “freezing”, “raising” and “cutting” oil production. Above all, they ought to remember where oil production currently stands relative to consumption, without the need to be an expert in MidEast geopolitics.

On Friday, 2 things will be in traders' minds—the 2nd revision of US Q4 GDP (due Friday)-- and the rumours/denials ahead of the Feb 26-27 G20 meeting in Shanghai.

But before that, a chorus of Fed speeches is set for this week, the most important of which, will be Fed vice chair Fischer at the annual CERA energy conference in Houston--the same event when Saudi oil minister Ali Al Naimi is due to speak. Ahead of the weekend's G20 meeting and the related soundbites.

Fed speakers:Fischer (Wed 1:30 GMT), Bullard (Thurs 0:00 GMT), Lockhart (Thurs 13:15 GMT) and Williams (Thurs 17:00)

USD and equity bulls have a reason to breathe a sigh of relief in a week when US indices have had the first 3-consecutive day advance since the Santa Rally and the USD index ended a back-to-back weekly decline at a level, coinciding with a 5-month trendline support and the 55-week MA. The chart above suggests grounds for both USD bulls and bears, with the former anticipating the index to sustain support inside diamond #2 before making its way to the 99.80 resistance and break on to diamond 3(a), while the latter expect a failure of this attempt before heading back to diamond #3(b).

Our approach towards the above is already being reflected in the 6 existing trades of our Premium Insights, backed by the necessary charts & fundamental rationale. 5 of the 6 trades are currently in the green.

Yen Rebounds, Kuroda Awaited

The euro fell for the fifth consecutive day as the market begins to focus on potential ECB easing but theyen was the top performer on the day with AUD lagging as a touch of risk aversion returned follow three days of positive momentum. The Asia-Pacific week ends on a quieter note with the Japanese all-industry index and Tokyo department store sales due.Kuroda is set to speak to Parliament from 1:40 am GMT. A 5th Premium trade was added to our existing four trades, which was a little surprising to some clients. Two "parallel" charts join the rationale for the trade.

The five day fall in the euro has been driven by the combination of better risk sentiment and expectations for ECB easing. A near term level to watch is the 200-day moving average at 1.1050.

The Fed's Williams spoke Thursday and underscored what we wrote yesterday. He said his outlook for the economy and inflation is unchanged and characterized the trouble in global markets as 'short-term fluctuations'. “The economy is actually doing fine,” he said and blamed low inflation on 'global factors' like oil and the dollar.

You wonder if Williams read the news from Wal-Mart, the world's largest retailer. It forecast flat sales in 2016 and revealed just 0.6% y/y sales growth in the US, well below the pace of inflation. Yet his upbeat tone underscored how the Fed is biased towards hiking and seems to selectively focus on data affirming its view. The ECB minutes, meanwhile, contemplated emergency easing towardsm which Draghi has guided.

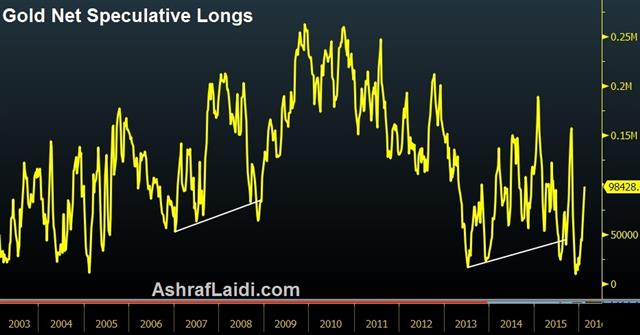

Gold remains a key focus as it shined again on Thursday, rising $28 to $1230. The latest flush stalled at $1191, which is just above the Oct high. It's also above the 61.8% retracement in two positive technical signs. What stands out more was the aggressiveness of the demand despite a relatively tame environment. The US dollar was slightly soft, stocks were marginally lower and bonds were bid but it was nowhere near the level of risk aversion that boosted gold last week. The ability to hold technical levels and rally in a modest environment should be comforting to gold bulls.

Economic data to watch includes the Japan all-industry index, due at 0430 GMT and expected -0.3%. The yen was stronger Thursday despite fresh talk of easing from Kuroda. An hour later, Tokyo dept store sales data are due. The prior reading was +2.2%.

The focus is likely to be on stock markets after China's pension fund said overnight that it plans to increase its allocation to stocks. Japan Post made a similar announcement yesterday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| All Industry Activity Index (DEC) (m/m) | |||

| -0.3% | -1.0% | Feb 19 3:30 | |

| FOMC's Mester speech | |||

| Feb 19 13:00 | |||

The Fed Still Has Some Fight

The FOMC Minutes showed that policymakers are tentative but also that they remain biased towards a hike. That will come into play in the medium term but on the day oil and risk sentiment were much larger factors that the Minutes. In the day ahead, Japanese trade and Australian jobs data are due. In the Premium Insights, Ashraf closed the GBPNZD short at a 210-pip gain ahead of the disappointing NZ PPI figures. There are 4 trades currently in progress.

The main headlines from the Minutes focused on chatter about increasing downside risks and confusion about what was going on in markets. That's what sent USD/JPY lower by 40 pips in the aftermath of the report (it later recovered).

What's important to keep in mind was that for 'most' of the FOMC, the broader story remained intact. The Minutes said most saw inflation rising to 2% in the medium term. They expect disinflationary pressures from oil and the US dollar fading. Most saw moderate growth and a solid jobs market.

The divergence between Fed and market views at the moment is as stark as it has been in a decade. The Fed sees four-hikes in 2016 while the market sees no rate rises at least until this time next year.

Even if the market is proven right, there is a great chance there will be an ebb and flow. The pendulum is likely to swing towards the Fed next. The three-day rally in stocks along with a selloff in bonds is a reminder that market sentiment can change quickly. We highlighted economic data yesterday and it remains critical.

On Wednesday, the PPI was a slightly higher than expected at 1.4% y/y compared to the 1.3% consensus estimate. If there are a half-dozen solid economic data points between now and the March FOMC, it's certainly possible the Fed could deliver a hawkish statement that puts a June hike firmly on the table (a March hike is out of the question).

Other central banks are struggling with the same questions and they will also look to economic data. Up first is Japan with the January trade report at 2350 GMT. It's expected to show exports down 10.9% y/y and imports down 15.8% y/y.

The big report of the night is at 0030 GMT when the January Australian jobs figures are due. The numbers have consistently beat estimates over the past year but economists believe some weakness will show up eventually. The consensus is for 13K new jobs with unemployment at 5.8%. AUD/USD is trading near the highest since Feb 4.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Producer Price Index - Input (Q4) (q/q) | |||

| -1.2% | 1.6% | Feb 17 21:45 | |

| Producer Price Index - Output (Q4) (q/q) | |||

| -0.8% | 1.3% | Feb 17 21:45 | |

| Employment Change s.a. (JAN) | |||

| 15K | -1K | Feb 18 0:30 | |

| Fulltime employment (JAN) | |||

| 17.6K | Feb 18 0:30 | ||

| Part-time employment (JAN) | |||

| -18.6K | Feb 18 0:30 | ||

| Unemployment Rate s.a. (JAN) | |||

| 5.8% | 5.8% | Feb 18 0:30 | |

أشرف العايدي على قناة العربية

Refocusing on the Data

Markets go through periods of confusion and comfort but ultimately, the data is what tells the story and that's what will answer all the questions that have been plaguing markets. The yen was the top performer and the New Zealand dollar lagged after a soft dairy auction and poor inflation figures overnight. Japanese machine tool orders and a speech from the Fed's Rosengren are due later. A new Video Analysis on existing and possible trades has been posted here.

فيديو جديد: فيديو جديد: التركيز على العملات و التوازن بين الدولار و اليورو

Central banks be hard pressed to stimulate economies in the foreseeable future as the struggle with the zero bound and a lack of ammunition. Comments – including Wednesday's FOMC Minutes – will continue to drive volatility but at some distant future point, rhetoric will trend towards background noise.

Economic data won't. The market doesn't yet have a strong sense of how growth in developed economies will unfold this year. The current conditions of the German ZEW sentiment survey fell to 52.3 from 59.7 as the entire survey deteriorated. It's not a big surprise given the declines in equity markets but if there is no near-term recovery, then it will spill into the broader economy.

In the UK, it's abundantly clear that Carney misread the inflation picture six months ago. The CPI fell 0.8% m/m and core inflation rose just 1.2% y/y compared to 1.3% expected. How much Brexit questions are weighing are a matter of opinion but ultimately the economic data will decide.

In the United States, the strong dollar continues to sap manufacturing with the Feb Empire Fed at -16.6 compared to -10.5 expected.

The Bank of Canada believes it will be on the other side of the equation and Dec manufacturing sales rose 1.2% on the heels of a strong export report. The worrisome detail was that new orders were down 2.1% so the optimism might be misplaced, especially after seeing the plunge in Chinese trade.

Japan is desperate to bet on a weak yen as a panacea with middling results. The latest data will come in the form of the January final machine tool orders report but the prior was down 17.2% so the bar is very low.

The Fed remains optimistic and will be the focus of the day ahead with the Minutes due Wednesday. Beforehand, the Fed's Rosengren will deliver a speech at 0000 GMT. Earlier, the Fed's Harker said a stabilization in the dollar was a key precondition for a hike. Kashkari said he still expects gradual hikes but financial market developments will be an important input at the March FOMC.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Federal Reserve Bank of Boston President Rosengren Speech | |||

| Feb 17 0:00 | |||

| FOMC Minutes | |||

| Feb 17 19:00 | |||

Euro Bull-Bear Division

Mario Draghi had no choice but to signal the willingness for the ECB “ready to do its part” in furthering policy stimulus at today's testimony to the EU Parliament. Draghi's dovish spin was inevitable due to two reasons: Shares of Eurozone banks have plunged partly due to supressed profit margins from tumbling interest rates; there is no ECB meeting scheduled this month. So Draghi had to give the equivalent of a dovish overture to the markets and extend the momentum of the 2-day bounce in global equities. Fed Chair Yellen also took a dovish stance at last week's Congressional testimony as there's no Fed meeting scheduled in February.

So where does this leave us in the policy divergence paradigm of “Fed policy vs the Rest” in assessing the value of EURUSD?

Euro bulls/USD bears claim are backed by the notion that the single currency is increasingly functioning as a funding currency, thereby benefiting from any renewed selling in asset markets. They add that FX traders have not completely priced the rising market probability (Fed Funds futures) that US policy rates will remain unchanged.

On the other hand, euro pessimists/USD bulls counter that further negative interest rates by the ECB and additional rate hikes from the Fed will boost the USD, and could break EURUSD below parity. And even if the Fed ends up doing nothing, further ECB action on QE and/or interest rates will keep euro pressured.

Both camps make sense. This week's release of the minutes from the January 26-27 FOMC and of the US January CPI figures will add a new set of two-way price action to EURUSD trading, not to mention a fresh chorus of Fed speakers. In our Premium Insights, a new EURUSD trade has been issued, backed by technical charts & fundamental rationalisation. To help subscribers better grasp the rationale of our conclusion, we asked (and answered) two questions. The full trade is here.

China Returns, Euro Shorts Cut Again

Chinese markets reopen after a week of holidays and that will set the tone for the week. The euro is slightly lower in early trading. Weekly CFTC data showed a second consecutive drop in euro shorts. 2 New Premium trades were issued on Thursday, bringing the total number of existing trades to 4.

Lunar New Year holidays are complete in China and that will bring a wave of trading as markets reopen. Since the Shanghai Composite closed the Nikkei has fallen 12.2%, the Hang Seng down 5.8%, Australia's ASX down 4.2% and Korea's Kospi -3.7%.

That doesn't bode well for China but the flipside is that the S&P 500 rose nearly 2% on Friday to trim the weekly loss to 0.8%. A further wrinkle is that US and Canadian markets are closed to start the week.

It all adds up to a dangerous day of trading, especially in oil. WTI crude soared an incredible 12.3% on Friday and the reverberations will be filtering through an illiquid USD/CAD market.

On the weekend, PBOC Governor Zhou spoke with Caixin and projected calm. He dismissed speculation about capital controls saying outflows were within the normal range. He also brushed off yuan devaluation there is no basis for a continued decline.

On the data front, Japan is in focus with the preliminary reading on Q3 GDP due at 2350 GMT. The consensus is for a 0.2% contraction after a 0.3% expansion in Q3.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -63K vs -87K prior JPY +43K vs +37K prior GBP -36K vs -47K prior CHF -7K vs -5K prior AUD -6K vs -26K prior CAD -52K vs -52K prior NZD -9K vs -8K prior

Euro shorts were heavily cut for the second consecutive week; the were -127K just two weeks ago. Short-covering is partly driving the euro move and a reversion to something close to flat positioning may be the signal for fresh shorts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q4) [P] | |||

| 1% | Feb 14 23:50 | ||

| GDP (Q4) (q/q) [P] | |||

| 0.3% | Feb 14 23:50 | ||

| GDP Deflator (Q4) (y/y) [P] | |||

| 1.8% | Feb 14 23:50 | ||