Intraday Market Thoughts Archives

Displaying results for week of Jul 17, 2016Draghi Punts, Trump Leaks on Trade

The ECB decision was a dud as it pushed the key decisions until September. The yen was the top performer after comments from Kuroda surfaced; the kiwi lagged. The speech from Donald Trump at the RNC is due later but a draft copy leaked early. There are 8 Premium trades, including 2 in metals and 2 in JPY.

The ECB didn't make any changes or tweaks to policy Thursday. Draghi said officials didn't even discuss rates or its QE program and will instead wait for new forecasts in September before acting.

The market sniffed out that nothing was coming when he used the early part of his statement to implore governments towards structural reforms. That was Draghi's way of saying the central bank has done enough and it's time for governments to do more. It's ground he's covered many times before but it's also symptomatic of the ECB waving the white flag and that led to a temporary 50-pip bounce in the euro.

Earlier in the day, the BBC published comments from Kuroda ruling out helicopter money. USD/JPY initially fell 130 pips but it recovered the majority of the losses when it was revealed the comments were five weeks old. Later, talk of mistranslations circulated to add to the confusion.

Another problem with all the 'helicopter money' chatter over the past two months is it's a poorly defined term. It certainly doesn't mean literally dumping cash from helicopters and most don't view it as widespread gifts to taxpayers. Yet something like the BOJ converting its holdings to perpetual zero-yield debt and ramping up buys along with government fiscal spending is closer to the gray area. That's essentially monetization and certainly yen-negative but not necessarily helicopter money.

Looking ahead, the highlight later is Donald Trump's nomination speech. A draft of his speech was leaked and the main theme is immigration but it's also heavy on trade. Most of it is broad and covers familiar ground but in one passage he takes square aim at China and its “outrageous theft of intellectual property” and “devastating currency manipulation.”

Other events on the calendar include the 0200 GMT release of the Nikkei Japan PMI for July and a 0325 GMT roundtable discussion between Chinese Premier Li Keqiang, Lagarde, Carney and others.

Capital Key to the Euro

The euro was calm ahead of the ECB decision but the reaction on Thursday will depend how Draghi tweaks bond buying. GBP was the top performer on the day while the yen underperformed all currencies. NZD took another tumble in early Thursday Pacific trade after the RBNZ signalled further easing in its latest economic assessment.

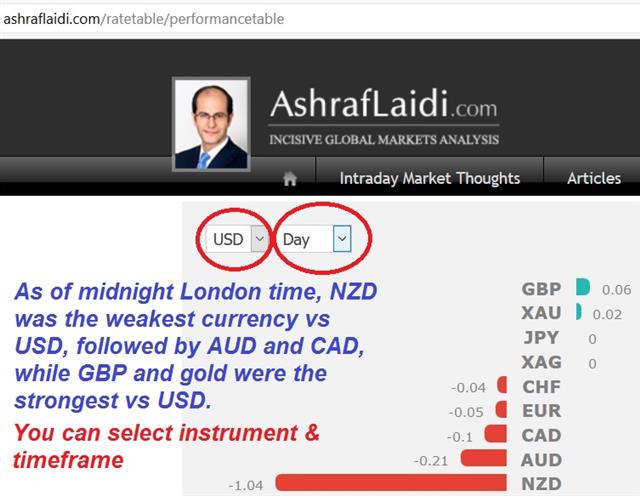

The calculator below shows NZD is the worst performing currency so far this week.

The ECB is running out of bonds to buy. The central bank has bought more than 900 billion euros in its various QE programs but its complex set of rules will need to be changed if it wants to hits its planned 1.7 trillion target.

Those rules are referred to as the capital key and various 'sources' reports suggest the ECB may tweak the rules on Thursday. Otherwise, the meeting is rumored to be focused on banking issues and a move on rates isn't believed to be on the table.

The problem at the moment is that the ECB can't buy sovereign bonds with a yield below the deposit rate of -0.4%. It also must buy bonds in ratios that correspond to the size of each Eurozone economy and no more than a predetermined ratio of each issue. What's limiting purchases is finding enough bonds to buy, particularly German bonds where maturities out to 7 years yield less than -0.4%.

There are constraints in other programs as well, such as supranational bonds and corporates. A main restriction is the ban on buying bank debt. Loosening that may solve financial sector problems and QE restraints but it could be seen as a backdoor bailout. The issue is that any solution to the shortage would create a liquidity or political problem.

The aim for Draghi will be to slowly expand the universe of buy-able bonds without creating a communications nightmare. It's a tricky task but it's also critical to his ability to go beyond the 1.7 trillion in promised QE.

The aim for Draghi will be a smooth delivery, rather than a combative approach. He may attempt to hide the changes in dull language but that's a dangerous game. If he can deliver some effective changes or lay clear groundwork to make them in the future, that should weigh on the euro.

Otherwise, the focus will be on his overall assessment of the economy. Watch for upbeat comments in-line with other central bank positivity as the Brexit panic recedes.

An interesting turn in GBP trading came Wednesday as the BOE's Forbes wrote an op-ed clearly arguing not to ease in August. It helped to lift the pound and threatens to undermine the market's near-certain belief in a move next month.

Technically, USD/JPY broke above the pre-Brexit high Wednesday. The gains came after a report the Japanese government could deliver a 20T yen stimulus budget. That's about double what had been rumored and another sign Abe and Kuroda are planning to go all-in.

Another central bank that's in focus is the RBNZ. Last week, they announced the special publication of an economic update. That was taken to be a sign of a downgrade in economic forecasts that will justify an August rate cut. The report is due at 2100 GMT.

Cable Clipped Again, AUD Sags

UK CPI data was a touch higher than expected but the pound plunged again anyway. The yen was the top performer while the Australian dollar lagged after the RBA minutes. More Australian data is due later with the skilled vacancies report. The latest Premium video, discussing our FX & metals trades is found below. It also includes a preview for Wednesday's UK jobs report and Thursday's ECB press conference. Last week's JPY trades has now been filled and is in progress.

The clearest sign of a bear market is when something can't rally on good news. UK core CPI rose 1.4% compared to 1.3% y/y expected led to a momentary rise in the pound but it crashed down soon afterwards. Steady selling continue throughout the latter half of the day and the pound finished down 170 pips and just below 1.31 at a one-week low.

The IMF weighed in on the Brexit vote by cutting its 2016 global growth forecast for the fourth time. They lowered the estimate to 1.7% this year from 1.9% and for 2017 to 1.3% from 2.2%. Those numbers remain a touch higher than consensus views but it's all highly changeable given Brexit uncertainty.

What stands out is how sanguine the market is on 2017 given some of the estimates. There may be a sense that Brexit won't happen or won't be that bad. That's a dangerous assumption.

Looking ahead, the lone main data point on the calendar is Aussie skilled vacancies at 0100 GMT. The market is increasingly pricing in RBA and RBNZ moves in August and that weighed on AUD and NZD Tuesday. Skilled vacancies are a lower tier indicator but the market is growing more sensitive.

Another sensitive topic is Donald Trump as the Republican primary continues. Betting markets give him a 30% of winning the Presidency. Financial markets are likely lower. If he is to make it a close race, it's imperative that the RNC avoid any further gaffes. We will also be paying close attention to how hard he rails against trade and or globalization for a sign of how he will steer his campaign.

Yen Sags, RBNZ Actions Point to Cut

Yen weakness was the dominant theme on Monday. The pound was the top performer in light, choppy trading. Japan returns from holiday but the calendar is focused on Australia and the July RBA meeting minutes. The kiwi fell in early trading after the RBNZ introduced loan restrictions. Ashraf warned Premium clients in Friday's London session against NZD by opening a AUDNZD long, followed by another NZD trade on Sunday night. Both NZD trades are currently in progress. Premium videos will be released later tonight ahead of Tuesday's UK CPI.

http://ashraflaidi.com/ratetable/performancetable

Yen weakness to start the week was generally ascribed to the failure of the coup in Turkey but BOJ speculation and positioning is a better bet. The July 29 BoJ meeting is critical for the near-term outlook in yen crosses and there is a growing sense that Abe wants to go all-in on another round of stimulus and easing.

Technically, USD/JPY is pushing up against Friday's high of 106.31 and then may challenge the pre-Brexit high of 106.81.

Economic data was light on the day. The lone notable release was the NAHB housing survey and it fell to 59 from 60 but US housing is not a market concern at the moment.

Turning to New Zealand, the chance of an RBNZ August cut jumped in the past week, now surpassing 80% and signals increasingly point to action. Last week, Wheeler revealed that an unusual economic forecast update will be published before the August meeting. Yesterday, Q2 CPI missed estimates. Today, the RBNZ said it plans to introduce tougher home-lending rules on Sept 1. The RBNZ's Spencer said two weeks ago those rules might not come until year-end so the latest action appears to be a rushed decision. Taken together, the 76% chance of a cut that's priced into the OIS market appears too low.

The only event on the economic calendar in Asia-Pacific trading is the release of the July RBA minutes. The market is pricing in a 53% chance of an August cut and this is a clear opportunity to signal what's coming next. The minutes are out at 0130 GMT.

The action will pick up later with the UK CPI and German ZEW reports.

The Age of Instability

In charts – and in life – volatility is usually a sign of a turning point. Another weekend of unexpected events underscores the instability everywhere. Last week the pound was the top performer while the yen lagged in a minor reversal of the Brexit trade. CFTC positioning data showed growing GBP and EUR shorts. An NZD Premium trade is among the 6 open trades agead ahead of the all-important NZ data later this evening (see below).

The present always feels more unstable than the past and in many ways 2016 has been no more volatile than the years of crisis, natural disaster, war and revolution over the past decade. What's striking, however, is how a seemingly different set of factors are driving uncertainty.

The attempted coup in Turkey on the weekend comes at a time when the balance of world power is in flux. It's tempting to point to it as an extension of MidEast instability beyond the Arab Spring, or a sign of domestic mismanagement, and that may be the case, but it's yet another event where investors and the public are left with a feeling like the rules have changed.

It comes at the same time as another ambush on police officers in the United States, this time with six shot. The week also marks the beginning of the Republican National Convention. A black swan event to watch in the day ahead if the possibility of a minority report from the rules committee of the RNC. That would force a vote on Tuesday on the convention floor on something that could steal the nomination from Trump.

But even if things inside the convention go as smoothly as possible inside the convention, the possibility of violence outside is high and the likelihood of inane comments inside is a near-certainty.

All this without touching on upheaval in Europe and the rest of the world.

In terms of economic data, the first event to watch this week is the New Zealand Q2 CPI report at 2245 GMT. The market is pricing in a 66% chance of a cut on August 11 but that could shift wildly based on this data point.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -88K vs -75K prior JPY +48K vs +64K prior GBP -60K vs -49K prior CHF +6.7K vs +8.7K prior AUD +16K vs +5K prior CAD +17K vs +12K prior NZD +1.0K vs -1.4K prior

The cable position is approaching the most extreme of the year (and the most extreme since 2013). The market was looking for a BoE move and will have covered a bit on Thursday but with more easing assured in August and the inability of the pound to hold gains, shorts will continue to grow.