Intraday Market Thoughts Archives

Displaying results for week of Jan 18, 2015Draghi Delivers, Euro Crushed

The ECB unleashed a 1.14 trillion euro QE package to exceed market expectations. The euro was the laggard on the day as it suffered its sixth-worst loss on record but it wasn't the only currency to suffer as the US dollar ripped higher. The China HSBC PMI is next amidst reports the PBOC could ease further if January data is soft.

Draghi pledged 60 billion euros in asset purchases until at least Sept 2016. Leaks a day earlier suggested 50 billion a month with an end date of either December or Dec 2016. The ECB also lowered the borrowing rate on TLTROs.

The euro initially fell a full cent to 1.1510 but recovered most of the losses when Draghi revealed asset purchases would be made by the national central banks. But the rebound didn't last long and it was a straight shot lower from there to as low as 1.1315.

The pain wasn't restricted to euro bulls as cable fell more than 2 cents and broke 1.5000. The Australian dollar fell below 0.8000 and USD/JPY touched above 1.2400. Early in US trading, USD/JPY was under pressure and fell to 117.75 but it quickly turned around and is nearly a cent higher.

Some of the technical levels taken out Thursday were key long-term barriers and it seems as if the US dollar rally is gathering momentum. When the euro didn't slide on the euro leaks yesterday, the idea of a sell-the-fact sort of market reaction entered the discussion but it was anything but.

Technically, the Australian dollar break of 0.80 may be particularly notable because it also represented the 2010 low and talk of rate cuts is spreading.

There are also short-term risks with HSBC set to deliver its January preliminary manufacturing PMI at 0145 GMT. The consensus is 49.5 and the prior was 49.6. The China Securities Journal reports today that the PBOC may ease liquidity further if data disappoints in January so a soft reading may turn out to be a blessing for the Aussie but not right away.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (JAN) [P] | |||

| 54.0 | 53.9 | Jan 23 14:45 | |

| PMI | |||

| 49.8 | 49.5 | 49.6 | Jan 23 1:45 |

| Eurozone Markit PMI Composite (JAN) [P] | |||

| 51.8 | 51.4 | Jan 23 9:00 | |

| Eurozone Markit PMI Manufacturing (JAN) [P] | |||

| 51.0 | 50.6 | Jan 23 9:00 | |

| Eurozone Markit Services PMI (JAN) [P] | |||

| 52.0 | 51.6 | Jan 23 9:00 | |

Draghi takes the plunge & euro follows

The ECB finally announced the much anticipated the outright monetary transactions (OMT), involving the purchase of €1.1 trillion in private and public debt at the rate of €60 bn per month starting in March into September 2016. Full chart & analysis

BOC Shocks, ECB Next, RBA Eyed

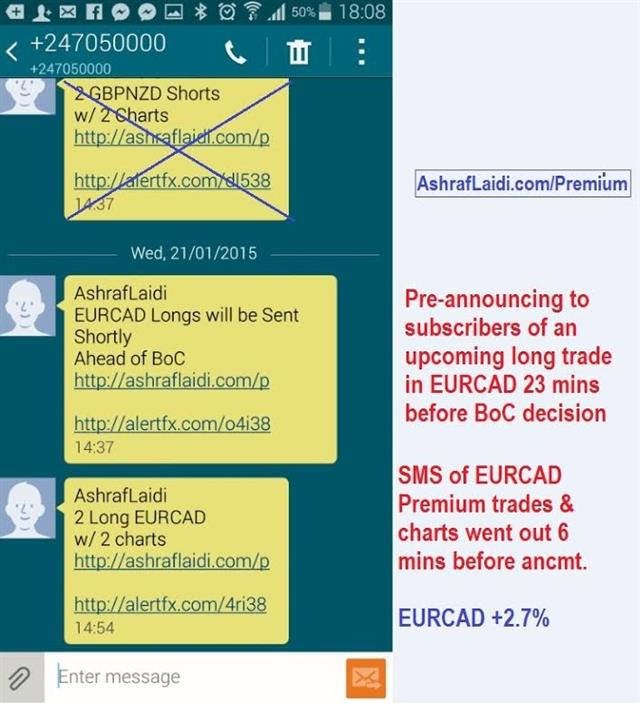

If the warm-up is any indication then the ECB main event will be epic. The Canadian dollar had its worst day since 2011 after a surprise BOC cut and the Swiss franc continues to rally following the SNB. The market is eyeing the RBA as well with inflation expectations data due next. The 2 Premium shorts in CADJPY hit both targets for a total of 490 pips, while 1 of 2 GBPNZD shorts hit the final for +290 pips--the other trade was stoppped out. 1 of the 2 EURCAD longs issued minutes before the BoC decision pocketed +200 pips, while other trade missed the fill. Attached a is snapshot of the SMS on going long EURCAD 30 mins before the BoC decision.

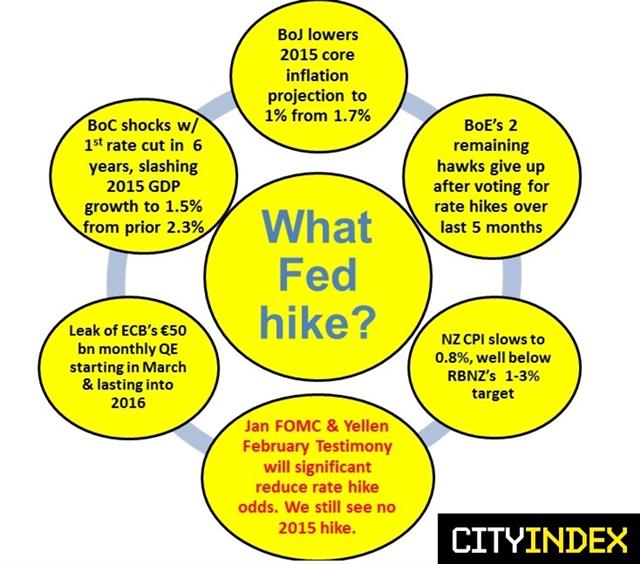

Starting with the BOJ on Oct 31, nearly every major central bank has delivered some kind of surprise. Nothing will top the SNB but the Bank of Canada rocked markets Wednesday with a surprise rate cut. No economist was predicting a cut although Ashraf mulled the possibility on twitter shortly before the decision and has been a noted CAD bear.

The loonie instantaneously fell 200 pips, pushing USD/CAD up to 1.2270 on the headlines. It would continue all the way to 1.2394 before paring back. In the press conference and statement, Poloz didn't offer any clear forward guidance but left the door open to more cuts by saying they have the “ability to take out more insurance” against risks. Oil is clearly the chief risk as it was mentioned 10 times in the statement.

The BOC forecasts assume WTI at $60 and with prices at $47.46, oil might not even need to fall further to inspire another cut. Technically, USD/CAD has very little in the way of resistance to 1.30.

In Europe, a preview of the ECB volatility came after a trio of leaks suggested the Executive Board proposed 50 billion euros in monthly QE. All the reports suggested it will run at least from March until year-end but BBG sources said through 2016, which would bring the tally to 1.1 trillion euros – much more than markets were expecting.

Yet the euro was a confused mess after the reports and squeezed up to 1.1680 before falling back to 1.1570. Traders should be very aware that no matter what the headlines on Thursday, the positioning risks are extreme and market moves may not be driven by fundamentals until the dust settles.

A signal of how touchy markets have grown is Australia. RBA rate cut implied probabilities rose to 36% from 21% directly after the BOC. AUD/USD also dropped 140 pips. It goes without saying that they're separate central banks but nerves are frayed. They may be even more frazzled if Jan Australian consumer inflation expectations fall at 0000 GMT. The prior reading was 3.4%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Inflation Expectation (JAN) | |||

| 3.4% | Jan 22 0:00 | ||

| Eurozone ECB Monetary policy statement and press conference | |||

| Jan 22 13:30 | |||

Central banks’ dovish attack

Today's onslaught of dovish surprises from the world's major central banks is a stark reminder of deflation realities creeping into policymakers' priorities, regardless of multi-year lows in unemployment rates in the US, Canada and the UK. Our Premium trades issued a long EURCAD and added to CADJPY shorts. Full charts & analysis.

A Central Bank Extravaganza

The first central bank decision is Japan. There's no set time for the BOJ but it's generally between 0230 GMT and 0330 GMT. A tip-off toward any surprise generally comes with a later release. We've heard some chatter about more easing but nothing from the BOJ suggested a shift. Instead, Kuroda will likely lower the inflation outlook to 1.3% from 1.7% for FY2015 but blame oil and leave 2016 unchanged at 2.1%. A one-year extension in the bank lending facility and measures to strengthen the facility have been leaked and shouldn't be a surprise.

In Europe, ECB expectations have grown so substantial and concrete that it leaves Draghi with little room to surprise and traders are fearful about euro selling on the 'fact' afterwards. However, if the amount of buying is left ambiguous or open-ended, it's a green light for fresh selling.

In Canada, USD/CAD rose to a fresh 5-year high above 1.21 with the BOC decision looming. Another nearly 5% drop in oil along with a soft manufacturing sales report (-1.4% vs -0.7% exp with downward revisions) were catalysts for the move but positioning ahead of Poloz was another factor.

The BOC is likely to follow the IMF's lead in revising down Canadian growth forecasts but a key with Canada's central bank is the output gap. Last week Lane hinted the return to full capacity in the economy could be threatened and with oil down another $22 since the last BOC decision, there's a good chance of a shift to dovish from neutral. If so, the upside in USD/CAD continues to look attractive.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Manufacturing Shipments (NOV) (m/m) | |||

| -1.4% | -0.7% | -1.1% | Jan 20 13:30 |

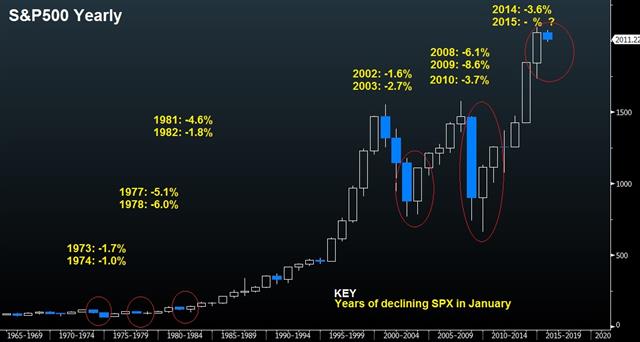

Back-to-Back January Declines are Ominous

10 days remain in January and stocks are already down 3% as measured by the S&P500. Many are familiar with the old adage “As January goes, so goes the rest of the year”, but do you know what happened when the S&P500 had 2 or 3 CONSECUTIVE JANUARY DECLINES? The chart & analysis will reveal here.

ECB Coming but China in the Spotlight

The US dollar was generally stronger on Monday as the ECB decision nears but trading was thinned by a US holiday. The euro was the top performer on the day while the Swiss franc lagged. A drop in Chinese stock markets to start the week sharpened the focus ahead of GDP numbers later.

Leaks surrounding ECB sovereign QE continued on Monday as Hollande said QE is coming this week. He later backtracked but and said it was only a hypothesis but it was most-interesting to note that the market didn't react to either of his comments.

A separate report hinted at a fight behind the scenes with the Bundesbank trying to limit and delay QE and that might have helped the euro claw back as high as 1.1640 to erase most of the post-SNB losses.

Overall, the lack of kneejerk moves on ECB headlines suggests a program is fully priced in and it will be the details that move the market. The size of the program (+/- 500B euros), the collectivisation of risks and the ability of Germany to remain on the sidelines will be the focus.

Before the ECB, however, China is in the spotlight with Q4 GDP data due along with industrial production and retails sales (all at 0200 GMT). The consensus is for 7.2% y/y growth but there is plenty of market chatter about a 7.0% reading so the market may be braced. If it breaks the 7% barrier, however, it could stoke jitters that may only be placated if the PBOC takes steps.

On Monday, Chinese stocks tumbled a whopping 7.7%. That cut into a more-than 50% rally since September and leaves the market in negative territory for the month. What's interesting is how well the Australian dollar held up. That kind of resilience bodes well.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PPI (m/m) | |||

| -0.4% | -0.6% | -0.7% | Jan 19 8:15 |

| Germany PPI (DEC) (m/m) | |||

| -0.4% | 0.0% | Jan 20 7:00 | |

| Germany PPI (DEC) (y/y) | |||

| -1.4% | -0.9% | Jan 20 7:00 | |

Sigbn up for Ashraf's ECB Webinar

Ashra's webinar tomorrow at 20:30 London/GMT will focus on the euro & USDJPY ahead of Thursday's ECB decision & the implications of last week's SNB surprise. Registration link

Markets Steady as ECB Countdown Begins

The retail forex world remains upside down after the SNB ended the 1.20 EUR/CHF floor but weekend news didn't jar the market. Early week moves gave the yen a slight boost while the Swiss franc is modestly lower after an 18% gain last week. The CFTC data showed more traders piling into euro shorts. 8 Premium trades are currently in progress. Full susbscriber access is found here.

As the market finds a footing the focus will shift to the ECB. Most skeptics about sovereign QE this month have relented and it's near unanimous that an announcement is coming so the emphasis is now on the details.

Comments from the ECB's Knot on Friday cemented expectations as he hinted it was pretty much a done deal. He said Draghi presented a plan to Merkel where national central banks buy their own debt with a limit of 20-25% of outstanding bonds. The big question that arises is, what if the Bundesbank says it doesn't want to buy? If so, that would cripple any QE program before it gets underway but would give the euro a short-term lift.

Other news that was overshadowed was some mild easing in China as the central bank announced the equivalent of $8.1B in discounted loans in a money-for-lending type scheme. The dollar figures aren't large but it emphasizes that the PBOC is in a dovish phase.

Early in the week, the Asia-Pacific calendar is light but the Japanese consumer is a highlight. Consumer confidence is due at 0500 GMT and expected at 38.8. Thirty minutes later department store sales data due. Neither is likely to drive markets but the BOJ could begin to sound less aggressive if consumer spending picks up.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -168K vs -161K prior JPY -94K vs -90K prior GBP -37K vs -26K prior AUD -45K vs -48K prior CAD -21K vs -17K prior CHF -26K vs -24K prior NZD -2K vs -1K prior

Heading into the SNB bombshell, Swiss franc net shorts were the highest since June 2013. It's another example of the massive transfer and destruction of wealth after the surprise move.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Confidence Index (DEC) | |||

| 37.7 | Jan 19 5:00 | ||