Intraday Market Thoughts Archives

Displaying results for week of Aug 18, 2019Monday Alert & Trade

China Acts, Powell Next

Less than two hours before Powell's speech at Jackson Hole, China announced 5% tariffs on US oil and soya beans, sending S&P and Dow futures down by 10 pts and 150 pts respectievly. A handful of comments emerged from Mester and Bullard indicating their willingness to ease further in the event of further deterioration. The pound was the star mover yesterday after markets misinterpreted Merkel's comments. 2 out of the 3 Premium trades are firmly in the green. Powell up next at the top of the hour. No Q&A after the speech.

The market is trying to figure out what the Fed is going to do next. A quarter point cut is fully priced in at the Sept 18 meeting with the odds of a 50 bps move falling to just 3.0%.

That sense of confidence from markets was not confirmed by Fed talk on Thursday. KC Fed President George will again likely dissent against a rate cut to leave rates unchanged, saying it's not the time for accommodation. On the other side was Dallas Fed President Kaplan who said risks were to the downside and that if they wait for consumers to slow down it might be too late. At the same time, he said that he doesn't want to cut rates unless they have to. Finally, Philly Fed President Harker said he doesn't see the case for further easing and would rather take some time to see what unfolds.

Harker and Kaplan are currently non-voters but will vote in 2020. Mester (non-voter) and Bullard (voter) will both speak Friday before Powell's 1400 GMT speech.

The comments from the Fed chairman will be critical. The market is expecting a strong signal or at the very least something akin to what Kaplan said. If Powell's speech fits more the frame of Harker, expect a dive in risk trades and a rally in the yen. It's extremely unlikely that Powell would close the door on a Sept cut but the market is pricing in a series of cuts. After Sept, an Oct move is already 63% priced in and yet another move in Dec is at almost 40%. That's aggressive but it may be counting on kicking and screaming in equity markets if there's anything less than a dovish message.

In other news, cable leaped to the highs of the month after Merkel cracked open the door to changes on the Irish border backstop. She had sent mixed signals after first talking about a 30 day deadline, then noting that was only symbolic and that they have until the end of October. None of it was game-changing and the price action may have said more about the market than her words – it's a market that's deeply short GBP and anything upbeat risks a squeeze.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Speaks | |||

| Aug 23 14:00 | |||

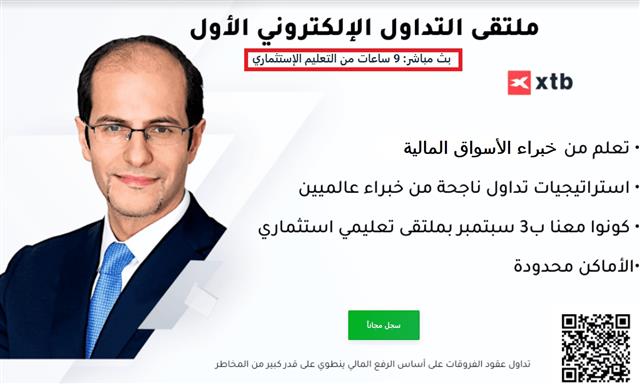

ملتقى التداول الإلكتروني مع أكس تي بي و أشرف العايدي

ملتقى التداول الإلكتروني مع إكس تي بي يوم الثلاثاء 3 سبتمبر الساعة 9 صباحاً بتوقيت مكّة المكرّمة بوجود 10+محاضرين و منهم أشرف العايدي الذي سيبدأ محاضرته الساعة 3 عصرا بتوقيت مكة المكرمة و للمشاركة في البث المباشر إضغط هنا

Exuberant Demands?

There's a mismatch between financial markets's expectations and policymakers willigness to deliver and this dissent should come into sharp focus soon enough. The yen and Swiss franc were the top performers Tuesday while the US dollar lagged. The FOMC minutes from the Jul 31 rate hike are due up at 7 pm London. For a reminder of what the Fed said and reasoned on that day, please read on below. Both of the Premium English and Arabic videos were part of one single video posted yestserday here and here.

Financial markets increasingly expect fiscal and monetary policymakers to stimulate the economy, but so far there's no clear signs such action is coming. It's a paradigm that plays out repeatedly during periods of economic slowdown and remains unresolved until market turmoil has manifested itself to spark genuine fears into policy makers.

Two big tests of whether we've come that far are coming up. The first test will be this evening's release of Fed minutes from the July 30-31 meeting. These will undoubtedly skew hawkishly because they were taken before the latest tariffs and market slide. They will also reflect Powell's assertions that the domestic economy is strong and that worries stem from trade and a foreign slowdown.

To recall what the FOMC did, Powell said and how markets reacted on Jul 31st, click here.

The second test will offer a current take as Powell delivers his Jackson Hole address. The market will demand a chance in tone from Powell's July 31 press conference but he's unlikely to be dovish enough to placate fears. On Tuesday, SF Fed President Daly (not a voter at this year's FOMC) said she sees solid domestic momentum and a continuing expansion.

At the same time, fiscal hopes are also precarious. The lack of enthusiasm for US tax cut talk underscores how difficult it will be to pass anything through Congress. In Italy, a snap election would risk an automatic VAT hike. The UK is a prime candidate for some fiscal help but is essentially paralyzed through the fall due to Brexit and the likelihood of an election. Canada also faces an October vote.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Meeting Minutes | |||

| Aug 21 18:00 | |||

Fiscal Stimulus on the Agenda

Will central banks get a helping hand from fiscal policy as talk of deficit spending gains momentum? Chatter of govt stimulus from Germany and now talk of tax cuts from the White House are making the rounds. The Washington Post reported that the White House may push for a temporary cut in the 6.2% Federal payroll tax. Trump backed the idea today. GBP was the 2nd strongest currency of the day (behind CHF) after German Chancellor Merkel said the EU would consider practical solutions regarding the post-Brexit bakcstop. EURGBP dropped back near session lows but GBPUSD clinged near the highs. Below is the English and Arabic videos combined in one video, highlighting yesterday's Premium trade.

Both reports from Berlin and Washington highlight the conditional nature of the promises. Both are framed as options governments would only consider in the event of intensifying economic weakness. The trouble with the US report is that it would need to get through Democrat-controlled House without having to give up something the Republican-controlled Senate would agree to.

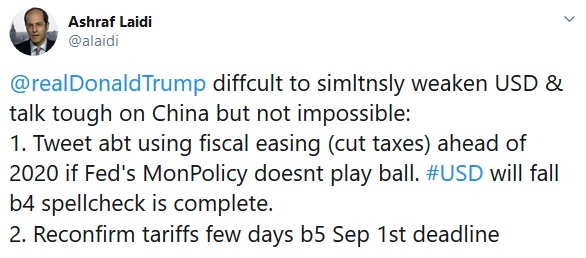

Ashraf predicted two weeks ago in this tweet that below tax cuts would resurface from the White House

In other news (or more of the same), Trump stepped up criticism of the Fed once again, calling for 100 basis points of easing and fresh QE. That chatter is increasingly falling flat in the markets but it highlights the risks for the Fed, including the risks around the FOMC Minutes on Wednesday.

Fed dissenter Eric Rosengren appeared on TV Tuesday and reiterated that he wasn't prepared to ease further because the FOMC is currently on track to meet its objectives. That said, he also indicated he would be willing to switch to cuts if a foreign slowdown was causing enough domestic weakness to significantly weaken his forecast for 2% US growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Meeting Minutes | |||

| Aug 21 18:00 | |||

Risk on as Germany Hints at Turning Taps

Germany is under increasing pressure to abandon a balanced budget but the hints so far only indicate a willingness to act after a recession is assured. By then it will be too late. What about the solution of talking down the euro? See more below. CFTC positioning data showed a shift into the yen (see chart below), with the highest net speculative net longs vs USD since autumn 2016 when USDJPY fell below 102. A new Premium trade has been issued today ahead of this week's highlights-- Wednesday's release of the FOMC minutes from the Fed meeting (7pm London) and Friday's Powell speech at Jackson Hole (3 pm London with the possibility text released 90 mins earlier). More detail on these in this week's Premium video coming up tonight.

Germany's Finance Minister said on the weekend it could deploy up to 50 billion euros in extra spending if needed. It was more of an assurance that the government has ammunition and not a promise to start preparations. Germany is essentially the battleground and the tipping point for looser fiscal policy in Europe and perhaps the rest of the world. If the bond market is right, it might be the final chance to avoid a deep global slowdown.

FX Solution to German Problem not a Done Deal

From the German perspective, some may posit the economic challenges might be better solved with a weaker euro. The weekly close on Friday was a two year low but German manufacturing is in a slump. A deeper fall would be a 'cheaper' way to engineer stimulus. The risk is that it sparks retaliation from the White House, or forces Beijing to devalue further to compete. Another problem is: Can the euro fall substantially from here, when it's: i) used as a funding currency to finance carry trades and rises on risk aversion; ii) the biggest FX region presenting trade CA surpluses.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -47K vs -44K prior GBP -96K vs -102K prior JPY +25K vs +11K prior (Biggest since autumn 2016) CHF -13K vs -16K prior CAD +14K vs +24K prior AUD -63K vs -55K prior NZD -13K vs -12K prior

The yen position has switched to net long 25,000 contracts from short 4,000 contracts two weeks ago. The net long is now the largest since November 2016. An interesting contrast is the Swiss franc. The market is so far reluctant to bet on it; perhaps owing to fear of the Swiss National Bank.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PPI Input (q/q) | |||

| 0.3% | -0.6% | -0.9% | Aug 18 22:45 |

حاسبة الجنيه الإسترليني واليورو

هناك من متأكد بأن الإسترليني سينخفض تحت ١.٢٠ دولار و البعض يصر ان اليورو سوف يكسر تحت ١.١٠ دولار. و ماذا عن اليورو مقابل الإسترليني؟ تفضل بإستعمال حاسبة اليورو/دولار/استرليني للوصول إلى سيناريوهات مختلفة مبنية على معادلة ثلاثية العملات في الفيديو الكامل