Intraday Market Thoughts Archives

Displaying results for week of Apr 19, 2015Total Data Domination

During many periods, markets ignore the second and third tier US economic data and focus on the general trend but with the Fed undecided on raising rates and the market suddenly less-confident in a US growth pickup, every release is market moving. We can't remember a time – at least since 2007 – when markets were so hung-up on data.

On Thursday it was the combination of new home sales, initial jobless claims and the Markit PMI. All were moderately weaker than expected and combined to send the US dollar into a spiral. Stocks also rallied to a record high and Treasury yields slipped; the combination points to expectations of a more-dovish Fed.

The debate about weather and early-year seasonality rages but from a trading perspective the theme right now has to be to go where the data takes you. Durable goods orders are due on Friday and have been weak for 6 months. The Bloomberg economic surprise index for the US is also at one of the lowest levels since the crisis.

Before that, the focus will be on Japan and the red-hot Nikkei in the next few hours. At 2350 GMT, the Japanese services PPI is expected up 3.3% y/y. Much later, at 0430 GMT, the all-industry activity index is expected to fall 1.0%. BOJ member Nakaso also speaks at 0300 GMT as mixed signals about further QE continue.| Act | Exp | Prev | GMT |

|---|---|---|---|

| All Industry Activity Index (FEB) (m/m) | |||

| -0.9% | 1.9% | Apr 24 4:30 | |

| New Home Sales (MAR) (m/m) | |||

| 0.481M | 0.513M | 0.543M | Apr 23 14:00 |

| New Home Sales Change (MAR) (m/m) | |||

| -11.4% | 5.6% | Apr 23 14:00 | |

| Markit Manufacturing PMI (APR) [P] | |||

| 54.2 | 55.5 | 55.7 | Apr 23 13:45 |

| Nomura/ JMMA PMI Manufacturing (APR) [P] | |||

| 49.7 | 50.3 | Apr 23 1:35 | |

| Durable Goods Orders (MAR) | |||

| 0.6% | -1.4% | Apr 24 12:30 | |

| Durable Goods Orders ex Transportation (MAR) | |||

| 0.3% | -0.4% | Apr 24 12:30 | |

| BoJ Deputy Governor Nakaso Speech | |||

| Apr 24 3:00 | |||

| Continuing Jobless Claims (MAY 11) | |||

| 2325K | 2330K | 2275K | Apr 23 12:30 |

| Initial Jobless Claims (MAY 18) | |||

| 295K | 288K | 294K | Apr 23 12:30 |

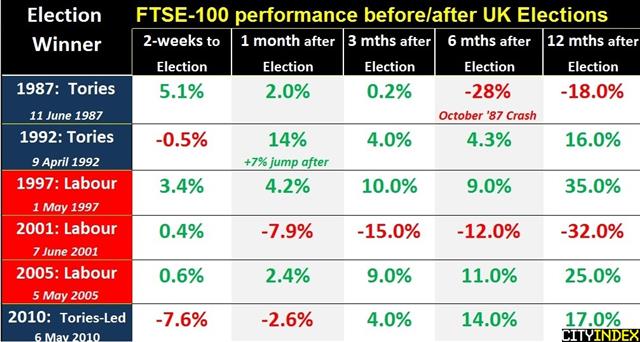

FTSE braces for Election ucertainty

Dealing with the challenges associated with a Labour-SNP coalition (fiscal tightening for businesses and the wealthy & likelihood of undershooting budget targets) and those from Conservatives (pushing for referendum on UK's EU status) has already become a topic of discussion among traders, to the extent that they may no longer cast such a negative spell on the stock market. Full chart & analysis.

Franc in the Tank

The SNB made a small move that sends a large signal about how it feels about the franc. The CHF was easily the worst performer on the day while the pound surged to lead the way. The China flash manufacturing PMI from HSBC is due later.

The Swiss National Bank has tried jawboning to stem the renewed rally in the Swiss franc but a steady slide in EUR/CHF to the lowest since early February – even with the euro broadly rallying -- prompted action. Officials added negative rates to a wider variety of instruments, removing most of the exceptions.

The rules won't take effect until May 1 so there was no reason for panic moves but it was a signal that the SNB is unhappy with the level of EUR/CHF and the pair climbed more than 150 pips to 1.0404. By almost any measure, the franc is overvalued but in a world of increasing QE, it remains a safe haven.

The broader theme in US trading was a move out of safe havens. Corporate earnings so far have been decent and all the talk Wednesday was about early-year seasonal weakness once again. Bond yields climbed, gold slumped and stocks rallied.

In FX, the general theme was consolidation after an earlier rally in the pound. Yen weakness also continued (but 120.00 in USD/JPY is proving tough to break). Once again, even minor economic data proved noteworthy. Existing home sales rose 5.19m compared to 5.03m expected and that added a quick bid into USD.

The Australian dollar continued higher in Asia after higher CPI numbers but the gains began to erode in Europe and that continued in US trading. It will remain in focus with the flash HSBC China manufacturing PMI due at 0145 GMT. The consensus is for no change from the 49.6 reading in March.

The Aussie has been less sensitive to Chinese data but that could change. AUD/USD was unable to hold gains after this week's rate cut. A soft reading would stoke fears about a sharper slowdown and could weigh.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (APR) [P] | |||

| 55.7 | Apr 23 13:45 | ||

| PMI (APR) [P] | |||

| 49.6 | 49.6 | Apr 23 1:45 | |

| Eurozone Markit PMI Composite (APR) [P] | |||

| 54.4 | 54.0 | Apr 23 8:00 | |

| Eurozone Markit PMI Manufacturing (APR) [P] | |||

| 52.6 | 52.2 | Apr 23 8:00 | |

| Eurozone Markit Services PMI (APR) [P] | |||

| 54.5 | 54.2 | Apr 23 8:00 | |

| Existing Home Sales (MAR) (m/m) | |||

| 5.19M | 5.03M | 4.89M | Apr 22 14:00 |

| Existing Home Sales Change (MAR) (m/m) | |||

| 6.1% | 3.0% | 1.5% | Apr 22 14:00 |

| New Home Sales (MAR) (m/m) | |||

| 0.523M | 0.539M | Apr 23 14:00 | |

| New Home Sales Change (MAR) (m/m) | |||

| 7.8% | Apr 23 14:00 | ||

| Consumer Prices Index (1Q) (q/q) | |||

| 0.2% | 0.1% | 0.2% | Apr 22 1:30 |

| Consumer Prices Index RBA Trimmed Mean (1Q) (q/q) | |||

| 0.6% | 0.6% | 0.6% | Apr 22 1:30 |

| Consumer Prices Index RBA Weighted Median (1Q) (q/q) | |||

| 0.6% | 0.5% | 0.7% | Apr 22 1:30 |

| Consumer Prices Index (1Q) (y/y) | |||

| 1.3% | 1.3% | 1.7% | Apr 22 1:30 |

| Consumer Prices Index RBA Trimmed Mean (1Q) (y/y) | |||

| 2.3% | 2.2% | 2.2% | Apr 22 1:30 |

| Consumer Prices Index RBA Weighted Median (1Q) (y/y) | |||

| 2.4% | 2.3% | 2.4% | Apr 22 1:30 |

Euro Rebounds as Greece Finds the Funds

Last week, the FX market grabbed onto second-tier economic data like new home sales as a reason to move the dollar. This week, the options are even thinner with no notable US economic data until Friday.

Instead, traders were looking to Greece on reports of the country running out of money. But a decree ordering local governments to send excess liquidity to Athens appears to have relieved the pressure and there is speculation Greece may have bought enough time to hold out until June.

At the same time, the tone from Greece is starting to improve with Varoufakis seeing a 'clear convergence' and a prediction of a deal – although not this week. The euro had fallen on a soft ZEW in European trading but it recouped all the loses and more in a rally to 1.0780. It later slipped back to 1.0735, finishing the day virtually unchanged.

Overall, it was a choppy day of trading. USD/CAD was strong and rallied to 1.2305 as oil prices slipped. The key level in the day ahead is 1.2352, which was the bottom of the Jan-March range.

But the immediate focus will now shift to commodity cousin AUD. In a dollar dip Tuesday, it climbed as high as 0.7755 and recouped all the losses from Stevens and the RBA minutes. It later sagged back to 0.7709 with CPI numbers due at 0130 GMT. Australian inflation is reported only quarterly so it has an extra impact. It's expected at +0.1% with a trimmed mean at +0.6% m/m. A soft reading would clear the way for a May rate cut and would likely send AUD/USD back to 0.7600 and lower.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q1) (q/q) | |||

| 0.2% | 0.2% | Apr 22 1:30 | |

| RBA trimmed mean CPI (Q1) (q/q) | |||

| 0.6% | 0.7% | Apr 22 1:30 | |

| Consumer Price Index (Q1) (y/y) | |||

| 1.3% | 1.7% | Apr 22 1:30 | |

| RBA trimmed mean CPI (Q1) (y/y) | |||

| 2.2% | 2.2% | Apr 22 1:30 | |

| Existing Home Sales (MAR) (m/m) | |||

| 5.05M | 4.88M | Apr 22 14:00 | |

| Existing Home Sales Change (MAR) (m/m) | |||

| 3.0% | 1.2% | Apr 22 14:00 | |

GBP vs AUD, CAD, NZD Ahead/After UK Elections

My take on the likely GBP reaction to the various UK Election scenarios against AUD, CAD and NZD. Video 1 w/ charts and GBP Majors Video

Stevens Jawbones, RBA Minutes Next

Divergent comments from Stevens and Poloz sent AUD and CAD in opposite directions Monday. On the day, the US dollar was the best performer while the Aussie lagged. The RBA minutes are next. The RBA talk helped the Premium GBPAUD long, while weighing on EURAUD short. EURUSD, USDCAD, NZDUSD, EURGBP remain in progress.

We warned to start the week that the optimism about AUD after the Chinese rate cut might not last. The high of the day came minutes after the open at 0.7840 and a steady slide turned into a drop after Stevens spelled out the RBA stance by saying rate cuts are still on the table.

AUD/USD fell to 0.7715 as he said the RBA had clearly signaled rates could be cut again. It fell a few more pips when he said he would be surprised if the Australian dollar doesn't fall further. The comments come ahead of the RBA minutes at 0030 GMT and diminish the importance of the report. The risk might be for further losses if the minutes sound like a cut could be coming sooner rather than later.

In Canada, Poloz was singing a completely different tune – different from the man who cut rates less than three months ago. On Monday he talked about a Q2 recovery, was upbeat about global growth. The 'biggest risk', he said, was that the US economy would be stronger than anticipated. To further drive home the point, he said the BOC is neutral. The Canadian dollar also got a boost from a rally in oil prices and USD/CAD fell back to 1.2180 at the lows.

A month ago, talk of BOC cuts was rampant but now it's off the table in the short term. USD/CAD has some downward momentum at the moment but there is still some trouble in the Canadian pipeline, at least more than Poloz lets on.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| Apr 21 1:30 | |||

Trading GBP vs USD, EUR & JPY ahead of UK Election

Here is Ashraf's video on the key tehncial & fundamental factors in trading GBPUSD, GBPJPY and EURGBP ahead and into the May 7 UK election. Full video

China's Big RRR Cut, NZ CPI Next

A Chinese interest rate cut isn't a surprise but a full percentage point in the required reserve ratio for large banks is a dramatic step. We warned about a cut last week and we now look at the implications. Last week the US dollar fell more than 1.2% against every G10 currency and it starts the new week generally lower. The immediate focus will be on whether the cut is interpreted as reason for excitement or for concern. NZ Q! CPI is next, exp at 0.2% q/q from 0.8%.

The full percentage point cut in the RRR to 18.5% is the largest cut in 7 years and follows a half-point cut in February. Village banks and smaller credit unions were allowed to ease an additional 100 basis points to in order to stimulate rural growth. It comes after Chinese officials tightened stock market margin trading requirements late on Friday in a move that sent Chinese-listed ETFs down 5%.

In most case, a rate cut would be cheered by markets but China is an opaque economy and it may raise concerns that the PBOC is attempting to arrest a more dramatic slowdown. The statement touched on those fears, saying that although growth met official targets, retail sales and industrial production numbers point “cause concern.”

The playbook for most of the past decade has been to buy AUD on good Chinese news but that hasn't worked over the past year as China moves away from a model based on construction/investment and more towards a consumer economy. The early reaction in markets has been a half-cent rally in AUD/USD but it bears watching closely and continued gains aren't guaranteed.

China will dominate the conversation on Monday but in the background, the worries about Greece are escalating as Tsipras digs in his heels on labour and pension reform. A quip from Draghi may also do the rounds at some point; “It is pointless to go short the euro,” he said. The context was in relation to betting on a breakup of the Eurozone but the words could be an excuse for a bid/squeeze higher in the euro early in the week. If so, it may prove wise to fade it because there is no threat of action behind his comment.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q1) (q/q) | |||

| -0.2% | -0.2% | Apr 19 22:45 | |

| Consumer Price Index (Q1) (y/y) | |||

| 0.2% | 0.8% | Apr 19 22:45 | |