Intraday Market Thoughts Archives

Displaying results for week of Nov 23, 2014Oil plummets on OPEC status quo

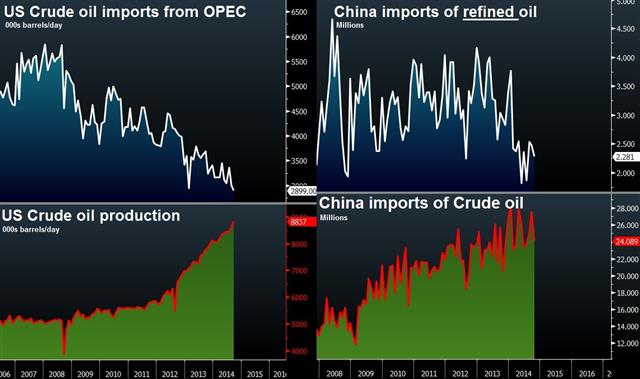

Following OPEC's decision to leave supply unchanged in the midst of a sharp price decline, we must watch China's currency. Full charts & analysis here.

US data drags USD , Aussie capex next

US durable goods orders have been flat since March and that was one of the reasons the US dollar was the laggard on Wednesday. The kiwi and pound sterling where the top performers. Australian capex is due later as the US bows out of the week for holidays. Today's 2 Premium Trades are driven by a developing Head-&-shoulder formation in the 10 and 2-year yield spreads between two particular nations. this is leading us to issue 2 new shorts as highlighted by the 3 charts in today's Premium Insights.

Thanksgiving meant several US data points were squeezed in Wednesday. The most notable was durable goods orders; excluding air and defense, orders fell 1.3% compared to a 1.0% rise expected. The average over the past seven months has been close to flat – something that's at odds with the US recovery narrative.

In the PCE report, income and spending were both a touch soft while core PCE rose 1.6% y/y compared to 1.5% expected in a tentative sign of inflation. Initial jobless claims were high at 313K vs the 288K consensus.

It's also growing increasingly clear that the hyper-strong Philly Fed last week was an outlier. The Chicago PMI fell to 60.8 from 66.2, about 3 points below estimates in a sign of solid but not strong manufacturing. Homes sales data and the final U Mich consumer sentiment survey were also soft.

The numbers sparked a roughly 30 pip decline in the US dollar across the board, which is a surprisingly sturdy performance for the buck despite some worrisome numbers. The euro in particular took advantage and rallied up to 1.2534 in the third day of gains after the slump on Draghi's comments Friday. EUR/USD eventually stalled at the downtrend from Oct 15.

The main event in the day ahead is the OPEC decision, which will leak out around 1400 GMT. All signs are pointing to no change in quotas and that will threaten the Nov low of $73.25 in WTI.

Before that, Australian private capex data for Q3 is due. Spending has generally been in decline since mid-2012 and it's no surprise that the Aussie peaked about a year earlier. For Q3, spending is expected down 1.9%. The data is due at 0030 GMT.

Another data point to watch is the net currency sales report from the RBNZ. That will likely confirm intervention over the past few months in NZD

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods Orders (OCT) | |||

| 0.4% | -0.6% | -0.9% | Nov 26 13:30 |

| Durable Goods Orders ex Transportation (OCT) | |||

| -0.9% | 0.5% | 0.2% | Nov 26 13:30 |

| Continuing Jobless Claims (NOV 14) | |||

| 2.316M | 2.350M | 2.333M | Nov 26 13:30 |

| Initial Jobless Claims (NOV 21) | |||

| 313K | 288K | 292K | Nov 26 13:30 |

When Yield Spreads Show Head & Shoulders

A developing head-&-shoulder formation in the 10 and 2-year yield spreads between two certain nations is leading us to issue two new shorts in today's Premium Insights. Charting technical dynamics among macroindicators may not be common, but in the rare occasions when we capture such developments, we must not miss the opportunity to take action, especially as it makes sense from a fundamental perspective and technical standpoint on the spot rate. Full charts & trades found here

Dollar Pauses for Breath

It could be a holiday-shortened week near the end of the month but the inability of the US dollar to rally on good GDP numbers should be a concern. Overall, the yen was the best performer Tuesday in a modest relief rally while the Aussie lagged. The Asia-Pacific calendar features Japanese small business confidence. This week's Premium Insights include 2 new trades in USDJPY alongside 2 charts ahead of what will be a busy first two weeks of December, including Japan's elections, the Fed meeting and prolonged equity market gains.

The US dollar rose near the best levels of the day after GDP revisions but only for a moment. Afterwards a wave of selling took USD sharply lower.

Q3 GDP rose a hearty 3.9%, solidly better than the 3.3% reading expected. The gains came despite a downward revision in net exports and govt spending. Instead it was consumers and private investment that carried the growth, which is a good sign going forward.

EUR/USD fell to a session low 1.2402 after the data but quickly rebounded up to 1.2475 and then continued another 10 pips higher after soft US data from the Richmond Fed and weak consumer confidence.

What's most troubling is the lack of USD gains on GDP. It's not the first time recently that that dollar has struggled to capitalize on good news and oftentimes that's a warning for the bulls. Wednesday's durable goods orders and PCE numbers might send a clearer signal.

The other obsession in the markets is OPEC and oil. Crude is near the cycle lows after all signs on Tuesday pointed to no production cuts at Thursday's meeting. Instead, countries may pledge to follow current quotas more closely but that will be a disappointment to markets.

The Canadian dollar remains caught between lower oil and better economic data. In the past month, employment, CPI and manufacturing sales have all been bullish for the loonie. On Tuesday retail sales rose 0.8% versus 0.5% expected but the loonie struggled to hold onto gains.

Even if oil can stabilize, there could be some upside in CAD as fundamentals improve.

In the hours ahead, the focus will shift to Japan with the relatively minor release of small business confidence at 0500 GMT. The consensus is for a slight improvement to 47.5 from 47.4 but the risks may be to the downside given the drop in GDP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (Q3) | |||

| 1.4% | 1.3% | 1.3% | Nov 25 13:30 |

| Durable Goods Orders (OCT) | |||

| -0.6% | -1.1% | Nov 26 13:30 | |

| Durable Goods Orders ex Transportation (OCT) | |||

| 0.5% | -0.1% | Nov 26 13:30 | |

| Retail Sales Less Autos (SEP) (m/m) | |||

| 0.0% | 0.3% | -0.2% | Nov 25 13:30 |

US Dollar Losing its Mojo

It could be a holiday-shortened week near the end of the month but the inability of the US dollar to rally on good GDP numbers should be a concern. Overall, the yen was the best performer Tuesday in a modest relief rally while the Aussie lagged. The Asia-Pacific calendar features Japanese small business confidence. This week's Premium Insights include 2 new trades in USDJPY alongside 2 charts ahead of what will be a busy first two weeks of December, including Japan's elections, the Fed meeting and prolonged equity market gains.

The US dollar rose near the best levels of the day after GDP revisions but only for a moment. Afterwards a wave of selling took USD sharply lower.

Q3 GDP rose a hearty 3.9%, solidly better than the 3.3% reading expected. The gains came despite a downward revision in net exports and govt spending. Instead it was consumers and private investment that carried the growth, which is a good sign going forward.

EUR/USD fell to a session low 1.2402 after the data but quickly rebounded up to 1.2475 and then continued another 10 pips higher after soft US data from the Richmond Fed and weak consumer confidence.

What's most troubling is the lack of USD gains on GDP. It's not the first time recently that that dollar has struggled to capitalize on good news and oftentimes that's a warning for the bulls. Wednesday's durable goods orders and PCE numbers might send a clearer signal.

The other obsession in the markets is OPEC and oil. Crude is near the cycle lows after all signs on Tuesday pointed to no production cuts at Thursday's meeting. Instead, countries may pledge to follow current quotas more closely but that will be a disappointment to markets.

The Canadian dollar remains caught between lower oil and better economic data. In the past month, employment, CPI and manufacturing sales have all been bullish for the loonie. On Tuesday retail sales rose 0.8% versus 0.5% expected but the loonie struggled to hold onto gains.

Even if oil can stabilize, there could be some upside in CAD as fundamentals improve.

In the hours ahead, the focus will shift to Japan with the relatively minor release of small business confidence at 0500 GMT. The consensus is for a slight improvement to 47.5 from 47.4 but the risks may be to the downside given the drop in GDP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (Q3) | |||

| 1.4% | 1.3% | 1.3% | Nov 25 13:30 |

| Durable Goods Orders (OCT) | |||

| -0.6% | -1.1% | Nov 26 13:30 | |

| Durable Goods Orders ex Transportation (OCT) | |||

| 0.5% | -0.1% | Nov 26 13:30 | |

| Retail Sales Less Autos (SEP) (m/m) | |||

| 0.0% | 0.3% | -0.2% | Nov 25 13:30 |

From Vienna to Zurich: Commodities accumulators panic

Will the broadening risk of deflation be diminished by this week's OPEC summit and Swiss gold vote? Full charts & analysis.

ECB and OPEC in Focus

The ECB and OPEC are feeling pressure to act as the Eurozone economy and oil prices slide. To start the week, the euro was the top performer while the Australian dollar lagged. The minutes of the key Oct 31 BOJ meeting and a speech from Kuroda are due later. GBP traders await another appearance tomorrow from Bank of England governor Carney and some of his MPC colleagues on last week's inflation report. EURGBP also awaits the BoE, while the and USDCAD trade awaits key Canada retail sales and the OPEC decision later in the week.

The ECB meeting on Dec 4 and the OPEC decision on Thursday are filled with uncertainty. Draghi hinted he was open to more action on Friday but Weidmann and Nowotny preached patience on Monday to boost the euro.

Despite the euro gains, EUR/USD and EUR/JPY failed to breach the 61.8% retracements of the large falls on Friday. Goldman Sachs revised its call on ECB sovereign QE to include a better than 50/50 chance of in the first half of 2015. However, many market watchers want a stronger hint sooner.

Coeure said sovereign bond buys should be up for discussion next week and with that kind of talk the ECB risks backing itself into a corner.

OPEC has been reluctant to fan the flames of supply-cut talk. Venezuela and others have been pushing for supply cuts but the Saudis appear reluctant. The Saudi Arabian oil minister arrived in Vienna for the meeting on Thursday and was dismissive to oversupply concerns and his comments led to oil price declines.

The US economic calendar was light to start the week and it will be light to end the week with the US Thanksgiving holiday on Tuesday. In the middle, however, there are GDP and durable goods reports over the coming two days.

But first, traders will be watching out for headlines from the Oct 31 BOJ minutes at 2350 GMT. That's the meeting where the surprise QE announcement was made. If any clarification is needed, Kuroda speaks at 0100 GMT. Be careful for comments that indicate worry about the swift decline in the yen.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Deputy Governor Lowe Speech | |||

| Nov 25 9:05 | |||

| Retail Sales (SEP) (m/m) | |||

| 0.5% | -0.3% | Nov 25 13:30 | |

| Retail Sales ex Autos (SEP) (m/m) | |||

| 0.4% | -0.3% | Nov 25 13:30 | |

| GDP Annualized (Q3) [P] | |||

| 3.3% | 3.5% | Nov 25 13:30 | |

| GDP Price Index (Q3) [P] | |||

| 1.3% | 2.1% | Nov 25 13:30 | |

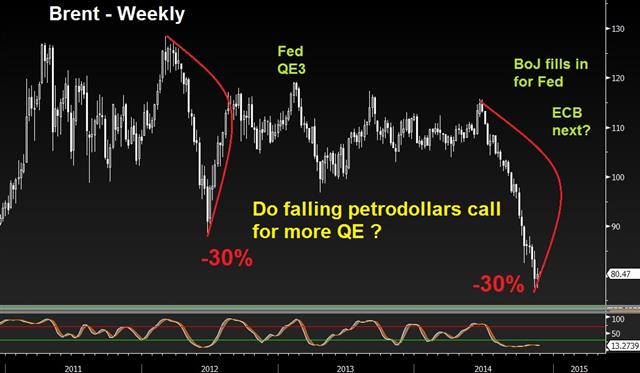

Do falling petrodollars mean more QE?

The last time oil plummeted 30% in less than five months was in March-June 2012, coinciding with a period of a rising US dollar and the most recent episode of the Eurozone debt crisis. Three months later, the ECB announced its readiness to do QE, and three months after that the Fed started QE3. Today, oil prices are 30% lower than five months ago, and calls for ECB QE are louder than ever, while the Fed has just ended its own stimulus measures. Will OPEC need its own QE? Full charts & analysis.

The China Question

The implications of whether China's move on rates is the start or end of a program are enormous. In reports on Friday it was characterized as a quick liquidity move but an exclusive report from Reuters on the weekend said top officials were more open to further loosening because of disinflation fears.

While most central banks are essentially out of ammunition to fight economic malaise, China has a multitude of weapons it can still deploy. If they move in that direction, the commodity currencies in particular stand to benefit, especially AUD.

On the flip side, AUD could face some early selling pressure because of a BHP Biliton announcement to cut $13b in capital spending planned for 2016.

The early move in FX is to sell the euro in a continuation of Friday's selloff. There is a risk the market is overly excited about Draghi's latest comments. His hints at QE were highly conditional and although his tone was slightly more overt, he's said before that the ECB is prepared to use more tools.

The Asia-Pac calendar is quiet to start the week.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -169K vs -164K prior

JPY -92K vs -83K prior

GBP +23K vs +13K prior

AUD +38K vs +38K prior

CAD +20K vs +22K prior

CHF -22K vs -23K prior

NZD -1K vs -1K prior

The two notable moves this week were yen and sterling selling. A rise in yen shorts is long overdue but showed that specs just couldn't find a good dip to buy – no one likes to chase. In cable, the market is getting the sense that Carney's rate hikes might be a long way out.