Intraday Market Thoughts Archives

Displaying results for week of Nov 24, 2019Tories in Command, Turn to China

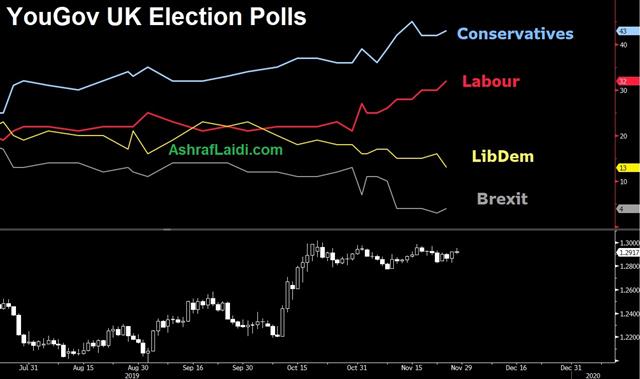

The highly-anticipated MRP model from YouGov helped to boost cable above 1.2950 and further extended it to the day's top performer. The US dollar also had a strong day on upbeat economic data while the yen lagged. German Nov CPI rose to 1.2% y/y from 0.9% --the highest since May. European indices and US futures moved lower in anticipation of potentially adverse reaction from Beijing following Trump's signing of the law giving more backing to HK protesters. Thursday is a holiday in the US. Oil began its downmove on supply data before indices pushed lower.

The MRP model showed Conservatives with 43% of the vote compared to 32% from Labour. The 11 point lead remains healthy but is above some other polls that have shown it as narrow as 7 points this week. Especially influential about this poll set is that it correctly predicted the past election. Digging deeper into the model, it showed a Conservative majority of 62 with 359 seats compared to 211 for Labour.

An early but vague leak suggested a strong Conservative majority and that lifted cable to 1.2950 from 1.2880 --the highest in 7 days.

GBP's gains would have been stronger vs USD in cable if not for broad USD strength Wednesday. The dollar was boosted by the durable goods orders report. It showed core orders up 1.2% compared to -0.2% expected; a sign that business investment may be perking up after years of disappointment.

USD/JPY tracked to 109.60 from 109.20 in the hours after the report. Importantly, that rally broke the November high of 109.47 to touch the best levels since May. There is an inverted head-and-shoulders pattern that's now formed on the chart and targets a further rally to the 2018 highs. Ashraf tells me USDJPY has pushed 0.5% above its 200-DMA, the most since December of last year.

In broader terms, risk trades also continue to improve. The S&P 500 hit another record and NZD/JPY climbed to the best levels since August. The market continues to price in calm in the trade war and a pickup in global growth next year. That may be premature but that's the nature of markets.

The rest of the weak will be liquidity-thinned with US traders shutting down for the Thanksgiving holiday. ECB watchers will furher mull the latest German CPI, further closing the door against a December rate cut.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash CPI (y/y) | |||

| 0.4% | 0.2% | 0.1% | Nov 28 8:00 |

| Eurozone CPI Flash Estimate (y/y) | |||

| 0.8% | 0.7% | Nov 29 10:00 | |

| Core Durable Goods Orders (m/m) | |||

| 0.6% | 0.2% | -0.4% | Nov 27 13:30 |

Tonight's Crucial UK Poll

GBP is once again the only gainer vs USD, while the yen is the weakest as sterling traders shift attention to tonight's crucial MRP UK poll--the only poll of its kind to have correctly predicted a Hung Parliament at the 2017 elections (more below). US economic data came in mostly better than expected in Q3 GDP, jobless claims and durable goods, but the Fed's inflation measure slipped below expectations. The latest Premium video updates on the latest forward indicator regarding indices as well as on how to play GBPUSD ahead of tonight's poll.

Onto the Big Poll at 17:00 Eastern (22:00 London/GMT)

Uk polling agency YouGov will release seat-by-seat details of its highly anticipated poll of next month's UK elections. The Multilevel Regression and Post-stratification is known for being the only poll to have correctly predicted Conservatives' loss of parliamentary majority in 2017, while all other polls predicted a large majority win. The poll uses a sample of 50,000 instead of the 1,000 used by others, breaking down voters by socioeconomic and geographical traits.GBP bulls are looking for a Conservatives majority percentage margin of at least 8 points, while other details such as the extent of LibDems gains will also help boost the currency. One potentially misleading factor is that of Brexit, which could supersede issues tracked by the model, such as taxes, healthcare and housing.

US Data Bump

The latest US economic data reduce odds of the economy slipping towards a recession, while the Fed should be more deserving of some of the credit for easing pre-emptively. Time will tell if they spent their ammunition too quickly.One area that's undoubtedly been aided by the central bank is housing and that was clear in a jump in new home sales to a 733K pace in October compared to 705K expected. An upward revision to September data put that month at the highest since 2007.

On the flipside, the manufacturing sector continues to struggle with the Richmond Fed at -1 versus +5 expected. Consumer confidence was also a touch soft at 125.5 compared to 127.0.

Even with those modest misses, the conversation about the economy has changed away from talk about recession and an inverted yield curve to a potential upside swing in 2020 and the climb in housing prices underscores the potential.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| 0.6% | 0.2% | -0.4% | Nov 27 13:30 |

| Chicago PMI | |||

| 47.2 | 43.2 | Nov 27 14:45 | |

| CB Consumer Confidence | |||

| 125.5 | 126.9 | 126.1 | Nov 26 15:00 |

| Fed's Beige Book | |||

| Nov 27 19:00 | |||

إنتظار إستطلاع الرأي الحاسم

تلتفت أنظار متداولين الإسترليني نحو إستطلاع الليلة. لماذا يتلقى هذا الإستطلاع أكثر أهمية من باقي إستطلاعات الرأي؟ الإجابة في الفيديوالكامل

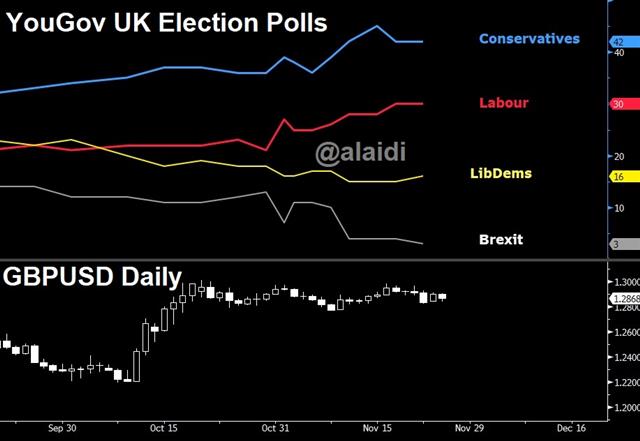

NZD, Impeachment Show Sign of Life

A strong Q3 retail sales report underpinned the RBNZ's shift to the sidelines and the potential upside for the currency. The pound gives up half of Monday's gains as various polls show a slight shrinkage in Tories' lead (see chart below). US new home sales rose in Oct showing the best 2 months in over 12 years, while consumer confidence fell for the 4th straight month despite US indices hitting new highs on 3 straight monthly gains. US-China trade talks took a backseat to developments in the Trump impeachment investigation after a US federal judge ruled that White House staff can be made to testify before Congress, rejecting the Trump administration's claims of immunity.

ماذا حدث لإشارة بيع السوق؟ (فيديو المشتركين)

New Zealand Q3 retail sales rose 1.6% excluding inflation, a far faster pace than the 0.5% climb expected. In the bigger picture, the news underpins the modest rally in the kiwi since October and the potential for a major long-term double bottom at 0.62.

It's still early days, but the RBNZ has signaled that it's done cutting for now and if trade tensions cool, and the global economy turns higher, the kiwi is particularly well-positioned. Moreover, the risk-reward is tilted to the upside. There's even the possibility of an inverse H&S on NZDUZD.

In the bigger macro picture, the market continues to wait on US-China news. Risk trades rallied, yen crosses climbed and US stocks hit fresh records Monday after China moved to strengthen IP protection and a report suggested that the broad outline of a phase one deal is in place.

Monday's rally in the pound came after the release of the Conservative manifesto but there is some reason for caution. A poll Monday showed the Tory lead over Labour down to +7. It led to a wobble in the pound and could be a one-off but if a second or third poll shows the same thing, expect GBP weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (q/q) | |||

| 1.8% | 0.6% | 0.3% | Nov 25 21:45 |

GBP Rides on Uncertain Polls

China appears to be making an earnest effort to bridge trade deal gaps as Beijing moved to raise penalties for IP theft on Sunday. GBP is the only gainer vs USD since Asia's Monday open as opinion polls suggest the Conservatives could win with as much as a 48-pt majority in next week's elections. JPY and gold are the weakest over the last 17 hours of trading. CFTC positioning data showed a CAD-longs covering on murky messages from the central bank. The chart below shows the weekly performance of Invesco's high beta SPX ETF, which has the highest correlation with the S&P500 index. The recent rotation towards industrials and cyclical sectors was largely behind the 8-week run up in indices, but a holiday-shortened week may give reason for a protracted pullback.

While most GBP bulls appear to be anticipating a Tories majority victory, a Tories win without majority (hung parliament) would depend on the make-up of the possible coalition. An unlikely Labour-Conservatives coalition would be GBP-negative, while a Tories-LibDem coalition is seen the preferred coalition scenario for GBP. A Labour-LibDem outcome would be the worst of these ouctomes.

Risk trades are higher early in the week after China published guidelines for local governments to raise penalties for IP violations. The announcement was vague but points to genuine action from China, likely in the hope of completing a phase one trade deal.

On Friday, there was more evidence that the US economy is stabilizing. The Markit PMIs and the final U Mich consumer sentiment survey were all better than anticipated. In Canada, retail sales also beat the consensus.

The market has clearly voted that lower interest rates outweigh any trade uncertainty. The week ahead will feature the same hot-and-cold game on trade and tariffs. We hope for some kind of definitive news but with the US week effectively shortened to three days because of Thursday's Thanksgiving holiday, we could be facing a continued grind.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -63K vs -58K prior GBP -32K vs -28K prior JPY -35K vs -35K prior CHF -16K vs -15K prior CAD +29K vs +42K prior AUD -47K vs -41K prior NZD -35K vs -36K prior

The speculative market was whipsawed by the Bank of Canada in the past week. The market mis-read comments from Poloz and Wilkins who intended to convey that the central bank had room to ease in the next downturn as dovish. On Thursday, the loonie rebounded when Poloz said he was comfortable with rates where they are currently.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (q/q) | |||

| 0.6% | 0.3% | Nov 25 21:45 | |