Intraday Market Thoughts Archives

Displaying results for week of Oct 26, 2014BoJ Expands Q, Fed Exits QE, ECB Expected to Enter QE

2 after the Fed exited quantitative easing, the Bank of Japan surprises the markets by expanded its own QE and unleashing a fierce wave of buying in global equities. What happens next? Full charts & analysis.

Inflation Could be the Dollar’s Worst Enemy

US GDP rose at a 3.5% pace in the preliminary Q3 report, beating the 3.0% consensus. The dollar jumped 30 pips across the board but the gains were almost immediately erased and the dollar continued to fall throughout the day.

What happened? Most economists pointed to the large boost in GDP because of US defense spending. That added about 0.6 pp. Others pointed to trade but that could continue to be a boost because of rising oil production. Consumer spending was also slower at +1.8% but it's a challenge to separate the effects of lower gasoline prices at the moment.

What was largely overlooked was the slowdown in inflation to 1.4% y/y compared to 1.5% expected and 2.1% in Q2. With commodity prices down, it's a challenge to envision any type of US inflation in the next six months.

The Fed flagged falling breakevens in the FOMC statement and 5-years are holding at 1.53% and 10 years have slipped to 1.90%.

Bank of England officials have been discovering that better growth and employment don't necessarily mean inflation as slack is slowly taken up and the Fed could soon be learning the same lesson. In Friday's PCE report, keep a close eye on the deflator.

But first, the focus will be on the BOJ. USD/JPY rose to a three-week high of 109.48 on Friday. The catalyst was a rehashed report that the GPIF will increase its domestic stock allocation to 25% in an announcement that will be formalized today.

But the larger announcement will be the BOJ at around 0200 GMT. But first at 2330 GMT it's the September CPI report. The national CPI is expected up 3.3% y/y with Tokyo up only 2.7% y/y for October. Stripping out the effects of the consumption tax hike, that's far below the BOJ's target.

And that's why 3 of 35 economists surveyed by Bloomberg are predicting the BOJ increases asset purchases Friday. Such a move or a strong hint at a future move would easily send USD/JPY through 110. If those headlines hit, jump on them and ride them for as long as you can.| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Annualized) (Q3) [P] | |||

| 3.5% | 3.0% | 4.6% | Oct 30 12:30 |

| GDP Price Index (Q3) [P] | |||

| 1.3% | 1.4% | 2.1% | Oct 30 12:30 |

| Tokyo CPI (OCT) (y/y) | |||

| 2.9% | Oct 30 23:30 | ||

| Tokyo CPI ex Food, Energy (OCT) (y/y) | |||

| 2% | Oct 30 23:30 | ||

| Tokyo CPI ex Fresh Food (OCT) (y/y) | |||

| 2.5% | 2.6% | Oct 30 23:30 | |

| National CPI (SEP) (y/y) | |||

| 3.3% | Oct 30 23:30 | ||

| National CPI Ex Food, Energy (SEP) (y/y) | |||

| 2.3% | Oct 30 23:30 | ||

| National CPI Ex-Fresh Food (SEP) (y/y) | |||

| 3.0% | 3.1% | Oct 30 23:30 | |

| Producer Price Index (Q3) (q/q) | |||

| -0.1% | Oct 31 0:30 | ||

| Producer Price Index (Q3) (y/y) | |||

| 2.3% | Oct 31 0:30 | ||

5 Reasons for the USD Rally (and Why it May Continue)

1. A 'significant' change

The Fed altered the assessment of “significant underutilization of labor resources” and instead said the underutilization is “gradually diminishing”. It's a nod to the fall in the unemployment rate falling below 6%.

The statement was only put in a few meetings ago and Yellen has championed the plight of workers so this is a meaningful change and so long as job growth continues at around these levels, the decision about when to tighten will be solely focused on inflation.

2. The Fed didn't just end QE

There was a small chance the Fed could continue QE so ending it gave the dollar a slight boost but it wasn't just that the Fed ended it. It's slammed the door

3. Better signs on the economy

When the Fed announced it was ending QE, the statement also said officials “see sufficient underlying strength in the broader economy” to support more improvements in unemployment

4. “Market-based measures of inflation compensation have declined somewhat”

This is a negative sign for markets and this refers to things like 5-year breakevens and that's something Bullard highlighted. They've come down to 1.53% from above 2% three months ago. That's an ominous sign and the Fed is surely hoping for a quick recovery.

The takeaway is that inflation data will grow more important that jobs data in the months ahead.

5. Sometimes nothing needs to be said

A large part of the US dollar rally, we suspect, would have come so long as the Fed didn't do anything extraordinarily dovish. The US dollar trade was crowded in the days leading up to the FOMC and the traders were jittery and pulled out on soft pending home sales and durable goods orders. Other trades that got shaken out in the risk rout were also probably simply waiting for the event to pass so they could get back into longer-term positions.

The last point (and the dearth of good reasons to buy other currencies) is the best reason why the US dollar rally will likely continue.Dollar Soars as Fed Shuts QE3 Door

As the Fed slammed the door on QE3, the upgraded view on labour markets and diminishing worries of disinflation boosted the greenback, while the maintaining of “considerable time” guidance on low interest rates avoided any bringing forward of rate hike expectations, thus, weighing on bond yields and helping stocks pare their earlier pullback. There was a reason why yesterday we re-confirmed our Premium shorts in GBPUSD, AUDUSD, NZDJPY and longs in USDCHF. Full analysis here

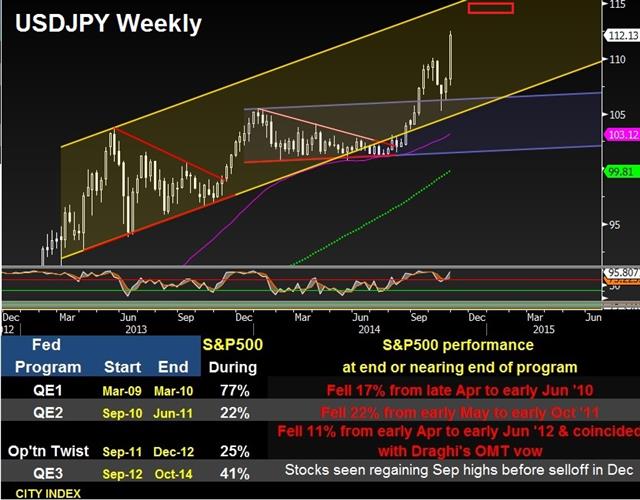

Charting S&P500 vs Fed Policies

As we approach the Fed decision, the chart analysis below reminds us that stocks market consistently fell by more than 15% between the conclusion of the Fed stimulus programs; between the end of QE1 and start of QE2; and between the end of QE2 & start of Operation Twist. Full analysis

Fed to Sort out Mixed Data

As the clock winds down to the FOMC decision, data on Tuesday showed dramatically different views on the US economy. The market is waiting for signals The Canadian dollar was the top performer while the yen lagged on buoyant risk appetite once again. Japanese industrial production is due later. A new set of Premium Insights will be issued later tonight.

The US dollar dropped 30-60 pips across the board on a soft durable goods report early in US trading. That sent EUR/USD to 1.2765 from 1.2710. Capital goods orders non-defense ex-air fell 1.7% compared to a 0.7% rise expected. Over the past three months, the metric has averaged -0.5% in a statistic that's often seen as the best proxy for business investment. It's certainly something that will have gotten the Fed's attention and could temp their assessment of the economy.

Just 90 minutes later the US dollar bounced back as consumer confidence rose to the highest since the crisis and the Richmond Fed climbed to the best levels since 2010. That erased all of the decline in USD/JPY and about half the EUR/USD move.

Consumer confidence was the bigger driver but it's a dubious indicator and correlates to gasoline prices and little else. Moreover, it was entirely driven by the 'expectations' component rather than 'present situation.'

Overall trading was surprisingly robust with the Fed looming. The market is divided on the removal of “considerable time” from the FOMC statement. Betting on a dovish Fed has been the trade for years and after this meeting it could grow clear that inflation is a larger concern for the Fed than employment and growth.

The other headline that caught our attention was from the Bank of England's Cunliffe who sounded a strongly dovish tone. He doesn't speak often and when combined with similar rhetoric from Shafik yesterday it could mean the BOE is on the sidelines for longer than markets anticipate. Cable stalled out just ahead of the Oct 20 high of 1.6184 after durable goods and then stumbled to 1.6133 after the comments.

Markets may continue to consolidate ahead of the Fed in the hours ahead but Japanese data could also deliver some intrigue ahead of Thursday's equally important BOJ meeting. Sept industrial production is due at 2350 GMT and expected down 0.1% y/y. NOTE THAT GMT IS NOW EQUAL TO LONDON until late March 2015. NEW YORK, or EASTERN TIME this week is 4 hrs behind London/GMT, but changes to 5 hrs behind London/GMT starting next week.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (SEP) (m/m) [P] | |||

| 2.2% | -1.9% | Oct 28 23:50 | |

| Industrial Production (SEP) (y/y) [P] | |||

| -3.3% | Oct 28 23:50 | ||

| Durable Goods Orders (SEP) | |||

| -1.3% | 0.5% | -18.3% | Oct 28 12:30 |

| Durable Goods Orders ex Transportation (SEP) | |||

| -0.2% | 0.5% | 0.4% | Oct 28 12:30 |

| BoC Governor Poloz Speech | |||

| Oct 29 20:15 | |||

| Cap Goods Orders Nondef Ex Air (SEP) | |||

| -1.7% | 0.7% | 0.3% | Oct 28 12:30 |

| Cap Goods Ship Nondef Ex Air (SEP) | |||

| -0.2% | 0.7% | 0.1% | Oct 28 12:30 |

| CB Consumer Confidence (OCT) | |||

| 94.5 | 87.0 | 89.0 | Oct 28 14:00 |

| Richmond Fed Manufacturing Index (OCT) | |||

| 20 | 11 | 14 | Oct 28 14:00 |

US Dollar Longs Look For The Exit

US pending home sales rose 1.0% year-over-year compared to 2.2% expected, which is hardly a dramatic miss but the market was clearly rattled as the euro immediately rose to 1.2722 from 1.2680 against the dollar. Similar, albeit smaller, moves came across the board.

We're highly skeptical that the market has a newfound fear about US housing. Rather, the market looks skittish about the Fed staying dovish and US dollar longs may have been looking for a reason to head to the exits.

The Fed focus is on guidance but inflation is a growing concern. 5-year breakevens indicate inflation at just 1.50% through the end of the decade and that's hardly something Yellen can ignore.

In the UK, the market finally got a taste of where the BOE's Shafik stands as she released a dovish interview with the FT. She sees “no significant evidence” of inflation and didn't sound like an MPC member in any hurry to hike.

Looking ahead, the focus shifts to retail sales at 2350 GMT. The consensus is for a 0.8% y/y improvement and the BOJ could be watching closely ahead of the meeting on Oct 31. There is some talk of fresh dovish indications at that meeting and it shouldn't be overshadowed by the Fed.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Pending Home Sales (SEP) (m/m) | |||

| 0.3% | 1.0% | -1.0% | Oct 27 14:00 |

| Pending Home Sales (SEP) (y/y) | |||

| 3.0% | 2.2% | -4.1% | Oct 27 14:00 |

| Retail Trade s.a (SEP) (m/m) | |||

| 1.9% | Oct 27 23:50 | ||

| Retail Trade (SEP) (y/y) | |||

| 0.6% | 1.2% | Oct 27 23:50 | |

Euro Calm on Stress Test, Rousseff to Win

The Australian dollar is the early leader while the yen lags but overall moves have been limited to 15 pips. The euro is barely changed from opening levels near 1.2675.

The ECB stress tests were encouraging. 25 banks failed as of the Dec 2013 test date but including actions taken since then or planned for the immediate future, just 11 banks failed and the total capital shortfall is a miniscule 7 billion euros.

There are some caveats as the methodology faces criticisms like including goodwill and deferred tax assets – two things that would be little help if a crisis hit. Overall, however, we think that European bank stocks will react positively to the news.

It's also good news for the euro but it still leaves many questions about whether bank loan availability and demand, nevermind the endless questions about the strength of the economy. Traders still overwhelmingly want to sell bounces in the euro.

In emerging market news, Brazilian President Rousseff appears headed to re-election with a 51-49% win over Neves. The domestic market won't like a Rousseff win or the narrow margin of victory and that could have some minor spillovers to the risk trade.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -159K vs -155K prior

JPY -72K vs -101K prior

GBP -4K vs -3K prior

AUD -32K vs -30K prior

CAD -22K vs -16K prior

CHF -18K vs -17K prior

NZD -2K vs -2K prior

The only notable move was in the yen and it showed a very skittish market. As shorts begin to pile back in that could be the basis for a fresh challenge of 1.10 in USD/JPY.