Intraday Market Thoughts Archives

Displaying results for week of Oct 05, 2014FTSE-100, Dax-30: How much more?

Is this the sell-off “everyone” has been waiting for? The month is October, the reason is Europe (partly) and inflation is at risk of becoming deflation. 13% and 8% declines in the DAX-30 and the FTSE-100 so far this year are categorised as corrections, while the 4%, 5% and 6% falls in the S&P500, Dow-30 and Nasdaq composite YTD suggest more to come. Full charts & analysis.

#AskAshraf starts on Twitter in 90 minutes

I will be taking questions on Twitter today live between 1 pm and 3 pm BST (2-4 pm CET) about trading, risk management, spread-betting, the latest currency ideas and the ongoing breakdown in technicals of equity indices. Please make sure to address your questions to @CityIndex (not @alaidi) and use #AskAshraf for your questions to be seen and answered. If the #AskAshraf is not used, your questions will not be picked up.

When the Correlations Crack

Volatility rose to the highest in 8 months in stocks as a 40 point intraday rally Wednesday was followed by a 40 point decline today. The yen was naturally the best performer but it failed to gain 100 pips on any cross.

A major talking point in the stock market was fear about slowing global growth and/or the end of QE3 but that's tough to square with Treasury yields that rose throughout the course of US trading. If anything, the Fed is beginning to signal lower rates for longer and that should be supportive for stocks, like we saw in Wednesday's rally.

Meanwhile, US oil prices have now fallen 21% since June and that's a powerful stimulant for stock markets.

What we've seen increasingly in markets since the start of September is these kinds of disconnects. Periods like this are rare but not unprecedented and they tend to precede larger turns in the market. This type of volatility is the kind of thing that sends stock market bulls to the sidelines even if declines haven't been substantial.

What's crystal clear is that every data point and central bank utterance is magnified at the moment. Comments from 8 major central bank members crossed Thursday and the most notable was Draghi underscoring lower rates for longer but that just served to underline the poor economic forecasts from Germany earlier in the day.

US traders are likely to be suffering a bout of indigestion in the day ahead. Asia-Pacific traders might get some guidance from the BOJ minutes from Sept 4 and the tertiary industry index at 2350 GMT. Later it's the RBA's Edey at 0145 GMT.About Those Fed Hikes

The Fed is putting on the brakes on rate hike expectations and that has put the brakes on the USD rally. The dollar was near session highs ahead of FOMC minutes as traders prepared from some indication the Fed would remove 'considerable time' in Oct but instead the minutes lamented slow overseas growth and dollar strength.

The response was dramatic with the dollar falling 140 pips against the pound, more than 100 pips against the commodity block and slightly less against the euro and yen. The stock market touched the lowest since Aug 8 in the early going then blasted 42 points higher to close with the largest gain this year.

The question traders are asking themselves now: Is this the start of a larger dollar retracement. Technically, it's tempting to say yes because the dollar index has gained for 12 weeks in a row. The Fed rhetoric might add a fundamental factor into the equation but we caution that the Fed minutes are from a meeting weeks ago.

For the next signal, we'll look to the full slate of Fed speakers in the week ahead but we warn that hawks like Bullard, Plosser, Fisher and George can safely be ignored.

The market has plenty to digest in the hours ahead. At the same time, Japan releases machine orders at 2350 GMT with a 4.9% y/y decline expected.Dollar hit by Fed Concerns ahead of WB/IMF Meetings

As the Fed reveals concerned about USD strength, we turn to tomorrow's showdown between ECB president & & Fed Vice chair Fischer. Full charts & analysis

When doves cry at the US dollar

A report showing US job openings at the highest since 2001 barely boosted the dollar before it slumped to the lows of the day on signs the Fed is more focused on inflation. The yen was the best performer and CAD lagged as stocks were hit hard. China finally returns from holiday and the services PMI is due. We have just issued 4 new Premium trades with four new charts, bringing back EURUSD and introducing USDMXN.

Influential Fed members are shifting their focus away from jobs and toward inflation in a sign that rates will stay low longer and that could mean a correction in the dollar.

Dudley andKocherlakota didn't sound like FOMC members who have been swayed by lower unemployment. Bernanke liked the JOLTS report on job openings but even a surge to a 13-year high of 4835K compared to 4700K expected hardly impressed the market.

That Kocherlakota was dovish isn't a surprise but that he remained so steadfast shows that the will of the doves to hold rates low is telling. Dudley is a more-influential Fed member and although he said it was a reasonable view to hike in mid-2015 he didn't sound like it was his view. Both men expressed fears about low, long-term inflation.

Those fears were underscored by softer IMF forecasts. Aside from slashing European and Japanese near-term forecasts, they cut longer-term potential growth rates for the US and UK.

The market has piled headlong into US dollars but the Fed is showing signs that it wants to hit the breaks. The market began to break as well, most notably the fall in USD/JPY below 108.00. That marks the first 'lower high' in the pair since July.

In the short-term, the market will be carefully watching China today as it reopens following a week of holidays that saw upheaval in Hong Kong. That could mean more stimulus and that would re-invigorate risk assets.

In terms of data, Japans current account balance is due at 2350 and China's HSBC services PMI is out at 0145 GMT. Neither are noted market movers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI (SEP) | |||

| 54.1 | Oct 08 1:45 | ||

| JOLTS Job Openings (AUG) | |||

| 4.835M | 4.710M | 4.605M | Oct 07 14:00 |

| Current Account n.s.a. (AUG) | |||

| ¥198.0B | ¥416.7B | Oct 07 23:50 | |

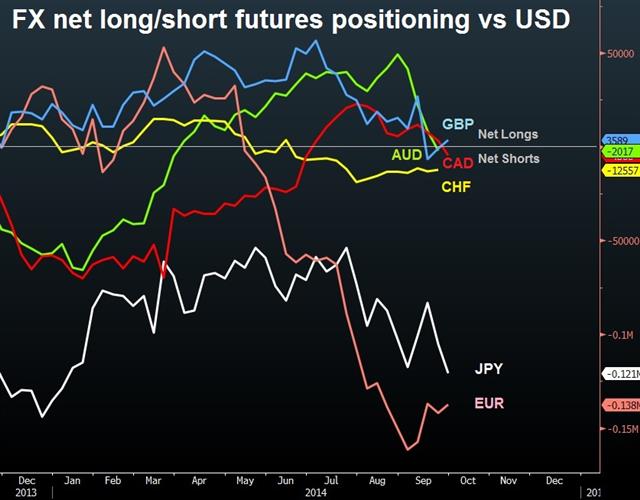

Charting USD positioning vs 6 major currencies

A currency by currency analysis of the emerging flows in FX futures in USD vs the 6 major currencies. Full charts & analysis.

Dollar Dumped, BoJ and RBA Next

The US dollar gave back almost all of Friday's gains in waves of selling to start the week that weren't triggered by any particular headlines. The Canadian dollar was the top performer on a strong Ivey PMI. Up next, the central bank decisions from Australian and Japan are due. A new set of Premium trades is issued on Tuesday, with the return of EURUSD and GBPUSD trades.

Volatility is definitely back in the FX market and that argues for closely monitoring trades and trends. The dollar fell by more than 100 pips right across the board on Monday but – importantly – the losses were smaller than the gains on Friday. That meant there were no 'outside days' on the charts and argues for further US dollar strength.

The exception was in USD/CAD as the pair retreated 150 pips from Friday's high of 1.1271. That high fell just short of the 2014 high and makes a potential double top. USD/CAD fell after the Ivey PMI rose to 58.6 compared to 53.0 expected.

Other pairs didn't have an impetus but still made solid gains against the dollar as a round of profit-taking in dollar longs hit.

The focus now shifts to central bank decisions in Japan and Australia.

Up first is the RBA announcement at 0330 GMT. The Australian dollar has fallen 5% since the previous RBA decision but that's unlikely to change the line calling for a “period of stability” in rates. It could mean less AUD jawboning and that could aid and AUD relief rally.

Perhaps the more-interesting decision is the BOJ, which is usually between 0230-0400 GMT. Officials have been backing away from yen-weakening rhetoric and Kuroda could lengthen the timeline to achieve 2% inflation. Either factor would be USD/JPY negative and underscore a potential double top on the chart.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Ivey PMI n.s.a | |||

| 65.2 | 49.1 | Oct 06 14:00 | |

It’s all about the dollar as bets rise

In a trending market like the US dollar, it's all about knowing when to take profits and when to buy a dip. The US dollar dip came ahead of non-farm payrolls on Friday as a strong report led to a huge day for the dollar. Despite the momentum, the weekly CFTC data doesn't yet show an overcrowded dollar trade. 1 of 2 USDCAD Premium longs issued on Tuesday hit the final target, while 1 of the 2 pre-NFP USDCHF Premium long nears its final target. All trades are found in the Premium Insights.

Non-farm payrolls rose 248K compared to 215K expected but that wasn't all. Revisions were higher and unemployment fell to 5.9% from 6.1%. The lone negative was in avg hourly earnings but better wages generally lag employment growth.

The US dollar jumped initially and then continued to rally throughout the day. On the week, the pound was the laggard as it plunged below 1.6000. The best sign for the dollar might have been that it closed near the weekly highs right across the board.

The Fed meeting isn't until the end of the month but traders begin to price in more-hawkish commentary once again and we'll be closely watching the Fedspeak in the week ahead.

The other area to watch is the commodities market. Oil and gold are teetering and US dollar strength could be the tipping point that shakes out long-term commodity bulls. Watch $1175 in gold.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -137K vs -142K prior JPY -121K vs -105K prior GBP +3.5K vs -1K prior AUD -2K vs +8K prior CAD -3K vs +3K prior CHF -12.5K vs -14K prior NZD 0K vs +2K prior

The euro and yen are definitely the favored spots for dollar longs but even though dollar bullishness is high, it's not extreme. We'll be watching closely in the weeks ahead.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ANZ Job Advertisements (SEP) | |||

| 1.5% | Oct 06 0:30 | ||