Intraday Market Thoughts Archives

Displaying results for week of Jan 29, 2017FX Shrugs FOMC & NFP

Today's release of the US January jobs report was clearly positive on payrolls (227K vs exp 180K), negative on unemployment rate (rose to 4.8% from 4.7%) and negative on earnings (0.1% m/m vs exp 0.3% from downward revision to 0.2% from 0.4%). The figures reduced chances of a March Fed hike to 26% from 33% and propped stocks higher. Barring any more USD-related statements from Trump & Co, the main USD factor of the month will be Yellen's semi-annual testimony to Congress starting on February 15th, which is widely anticipated to reiterate the Fed's improved assessment in this week's FOMC Fed.

Instead of focusing on speculation about the number of this year's rate hikes (2 or 3), FX traders shift to Trump & Co's USD rhetoric and the shifting odds of a March Fed hike, which were as high as 33% three weeks ago, 32% prior to NFP and 26% now. The non-sustainability of any increase in earnings growth and the rise in unemployment could well be the focus of Yellen's testimony, indicating she requires more labour market tightness to see the inflation trend warranted for tightening ahead. Depending on where the dollar stands 2 weeks from now, FX could well be a mitigating factor in Yellen's testimony in revising down odds of March hike.

A new chart note was issued to our Premium subscribers regarding the existing USDJPY trade, which is the part of the existing 6 Premium trades (3 FX, 2 indices and 1 metal).

Whale Watching

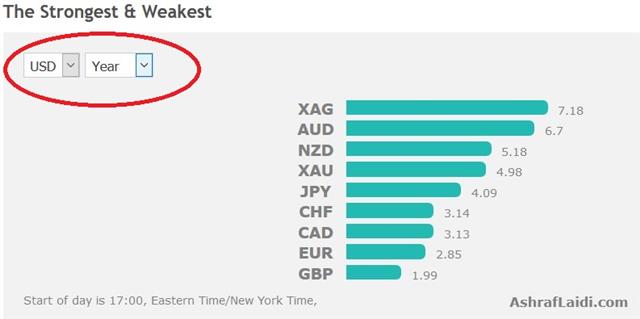

Trading daily is like fishing. You survey the scene and the weather, fish where it's best and catch a few pips. Sometimes they're large fish, sometimes they're small fish and sometimes there are no fish at all. There are 6 Premium trades currently in progress ahead of Friday's US jobs report: 3 in FX, 2 in indices and 1 in metals. The chart below shows the strongest and weakest vs the USD Year-to-Date.

Once in a while something completely different comes onto the fishing radar or nibbles at the hook. Something you might only see a few times in a lifetime – a whale. There is one circling now. Of course, there are always whales in the ocean and in the markets. They're huge trades that last years and the hauls are legendary. Identifying and catching them is a different game than the day-to-day trade but it's possible.

Trump himself isn't a whale but he is stirring up the entire ocean of trading and a whale of Moby Dick proportions might be surfacing. It's the official strong dollar policy of the United States. It's been the policy of the Treasury Department for a generation and markets are vastly underestimating the risk it will be eliminated and the potential rewards of trading it.

This week, Trump came within a stutter of saying he is going to weaken the dollar; or at least go to a currency war with others who have weakened their currencies.

A weak dollar would be a panacea. It could mean higher stock markets, higher inflation, higher nominal growth, higher wages and more competitiveness. Jawboning alone would do much of his work and it could be followed up with a Yellen replacement next year to do the heavy lifting. The FX winners in such a war would be the yen and euro. Both would struggle to find ammunition to fight back. An even bigger winner would be gold. It might be tomorrow, two months from now or two weeks from now but the weak-dollar whale is one we want to be ready to catch.

And as Ashraf reminds me, FX & politics will shift to the France elections and when/if Republican presidential candidate Francois Fillon officially drops out of the race. He was long considered as ideally euro-positive due to his stance on free market reforms.

Fed To Take It Slow

The FOMC decision gave a nod to better sentiment but offered no guidance on how soon it could hike. The US dollar slumped after the announcement with a March hike more in doubt. A new Premium trade has been added, backed by 6 reasons and 3 charts. Having broken a key moving average for the 1st time in 366 days, this trade is for medium and long term traders.

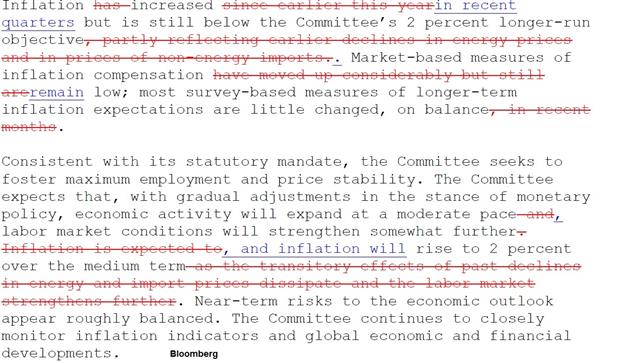

The Fed funds futures pricing for a March 15 hike is at 32.0%. That's rich given the FOMC statement was largely the same. There was a notable upgrade on consumer sentiment and it removed some caveats on inflation that had pointed to only a temporary bounce but the bulk of the message was the same. The Fed said the balance of risks was neutral and that hikes will be gradual.

The FOMC is clearly in wait-and-see mode on the economy and politics. About half the FOMC upgraded forecasts to include fiscal stimulus but that's as far as they will go. They want to see some hard evidence from Congress before they proceed and they would surely like a bit less uncertainty from the President as well.

It's a similar story on the economy. There has been good news but it's been in sentiment and that's something the Fed acknowledged. Those high hopes can be unwound quickly unless they're followed by growth and investment.

A good sign came from the ADP employment report with private jobs up 246K compared to 168K expected. The report has been correlating more closely with non-farm payrolls lately and adds some upside risks to the dollar for late in the week.

The other notable news was from the UK where the first reading on the Article 50 bill passed and the final reading was scheduled for next week. The tally was 498 votes to 114 so while the final vote is likely to be closer, it looks as if May will be able to invoke Article 50 before March 31.

From a trading perspective, we were impressed by the bid in the pound through the strong US data and the Brexit news. Some much negativity is priced in and shorts are crowded and taking every opportunity to lighten up. All eyes turn to Thursday's BoE inflation report & Carney's testimony.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 246K | 165K | 151K | Feb 01 13:15 |

| BoE Gov Carney Speaks | |||

| Feb 02 12:30 | |||

Ashraf on CNBC

Ashraf's interview on CNBC warning about protectionism. Video.

Open Currency Warfare

Donald Trump and his team singled out three countries for currency manipulation on Tuesday and came closer than ever to pledging to devalue in response. EUR was the top performer of the day; the US dollar lagged on both fronts. China's Jan manufacturing PMI edged up to a higher than expected 54.6 from 54.5 in Dec. A new Premium trade was posted earlier on Tuesday, with the details on the fundamental and technical rationale in the Premium video below. The existing trades ahead of the Fed & NFP are also covered.

A two-pronged salvo on currency manipulation Tuesday makes it likely the communication was planned and deliberate. It started with Trump trade adviser Peter Navarro who said Germany is using a grossly undervalued euro to exploit the US. That was followed a few hours later by Trump singling out Japan and China.

“Other countries take advantage of us with their money and their money supply and devaluation. Our country has been run so badly, we know nothing about devaluation; every other country lives on devaluation,” he said.

Trump says what he means and we're finding out that he's following it up with action. If he believes other countries are openly and deliberately devaluing, the risk of the US taking countermeasures rises exponentially and the consequences could be calamitous.

At this point we can't exclude anything but if the comments were coordinated then surely there will be more to come and the moves in the market will be much larger than the 100-pip rises in EUR and JPY on Tuesday.

What's more consequential than the size of the moves was the potential technical breaks. USD/JPY fell below the January lows to the worst since November. EUR/USD rose above the January highs to the best levels since early December. A third spot to watch is USD/CAD as the pair briefly broke key support at 1.30 and fell to the lowest since September.

In early Asia-Pacific trading, the BOC's Poloz has attempted to use some jawboning of his own to counteract the USD/CAD fall. In a rare direct comment on the currency, he said the recent rise in the currency was premature.

One spot that remains a wildcard is China and with Trump commenting on the yuan, we may get a chance to measure how assertive Beijing will be.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final PMI Manufacturing [F] | |||

| 52.7 | 52.8 | 52.8 | Feb 01 0:30 |

| Chicago PMI | |||

| 50.3 | 55.1 | 54.6 | Jan 31 14:45 |

| Final Manufacturing PMI [F] | |||

| 55.1 | 55.1 | Feb 01 14:45 | |

| ISM Manufacturing PMI | |||

| 55.0 | 54.7 | Feb 01 15:00 | |

| PMI | |||

| 51.3 | 51.2 | 51.4 | Feb 01 1:00 |

| Eurozone Spanish PMI Manufacturing | |||

| 55.1 | 55.3 | Feb 01 8:15 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 55.1 | 55.1 | Feb 01 9:00 | |

| Germany Final PMI Manufacturing | |||

| 56.5 | 56.5 | Feb 01 8:55 | |

The New BOJ Challenge

The BOJ has its head above water on inflation but it's still drowning in other questions and that will be reflected in today's decision. The yen was the top performer while the pound lagged. Japanese household spending and industrial production are the last two major releases before today's BOJ decision. There is 1 USDJPY trade already in progress

The BoJ finally got some good news last week with year-over-year inflation rising above zero. The market has taken that along with the sudden improvement in sentiment and extrapolated it to indicate a near-term change in policy.

Today's announcement – which will come at some time between 0230 GMT and 0330 GMT – is all about BOJ forecasts. If Kuroda bumps up the outlook or hints that he's going to do so then the yen will extend Monday's 150-pip jump.

But it would likely be a mistake. The BOJ has been fighting deflation forever and now that they finally have a glimpse of success, any tilt in policy would threaten to unwind it. As unnamed BOJ officials who spoke to the WSJ said in a weekend report, the ensuing yen strength would quickly unwind the inflation progress.

At the same time, the BOJ is wary of Trump. With a large US trade surplus and many competing industries, Japan is a likely target of the President. In addition, the market is trying to figure out administration.

As we have been warning, the inability to roll out policies smoothly and coherently is a main risk at the moment and it's beginning to materialize.

In the lead-up to the BOJ decision, watch for final signals from the data. The household spending report showed a 0.3% contraction in year-over-year spending compared to -0.9% expected and that adds a slight positive risk to the BOJ. The industrial production report is expected to show a 3.0% y/y improvement; it's due at 2350 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Overall Household Spending (y/y) | |||

| -0.3% | -0.8% | -1.5% | Jan 30 23:30 |

| Industrial Production (m/m) [P] | |||

| 0.5% | 0.4% | 1.5% | Jan 30 23:50 |

ندوة أشرف العايدي مساء الثلاثاء

Great Expectations, Shaky Delivery

Another mediocre quarter and year of US growth highlighted that the recent bout of optimism is based on hope and hardly any data. JPY is the top performer early in the week while the US dollar lags. CFTC positioning data showed waning enthusiasm for the US dollar with net speculative EUR longs charted below.

The world was abuzz on the weekend with immigration nightmares as Trump changes the rules on the fly. Aside from the politics of the move, the market is watching to see if Trump can implement policy smoothly and effectively. The impression from the latest moves was that they weren't well thought out and that isn't the kind of thing that will keep sentiment high for the longer term.

On Friday, the first look at fourth quarter US growth showed just a 1.9% q/q annualized rise compared to 2.2% expected. For the year, growth was just 1.6% to match the lowest since the crisis. There were some positive caveats in the data like solid consumer spending and the first rise in business investment in five quarters but the overall picture is much the same as it's been for the past decade.

Meanwhile, markets point to an economy that's in transition to higher growth and inflation. In terms of hard data, though, not much has changed. Sentiment indicators have risen since the election but that's just as likely to fade as the shine of the new administration wears off.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -52K vs -67K prior JPY -67K vs -78K prior GBP -66K vs -66K prior CHF -14K vs -14K prior AUD +10K vs +5K prior CAD +3K vs -5K prior NZD -10K vs -12K prior

For all the enthusiasm about US growth after the election, it hasn't translated into speculative buying. That's either because the market as a whole doesn't believe Trump will make America great again, or come classes of investors are holding out on buying until they see more solid evidence.