Intraday Market Thoughts Archives

Displaying results for week of Apr 02, 2017Missiles, Jobs & Breakouts

In what was perhaps the least important US jobs report of the year (due to its lack of proximity from Fed meeting and importance relative to mounting geopolitical events), the reports were neutral to positive. The 98K in payrolls in March undershot expectations for a 180K rise and followed a 219K April increase with a 2-month net revision of -38K. With the figures blamed on the snow storms, the unemployment rate fell to 4.5% from 4.7% and wages growth slowed to 2.7% y/y from 2.8% y/y. The participation rate held unchanged at 63%.

On the positive side for the US dollar and stock indices, the situation is holding steady despite the escalation of worries and/negative events (Fed concerned about equity valuations being too elevated, US strikes on Assad Regime, Paul Ryan expressing frustration at tax reforms obstacles). But the resistance turns increasingly apparent as stocks struggle near the key 2373 (SPX500) and 20800 (DOW30).

As US 10-year yields find consolidated support at 2.30% and USDX remains capped at 101.50s, gold is set to break above its 200-DMA for the first time since the pre-US election swings. The decision to close our Premium short USDJPY moments before the US jobs figures was largely technical in and partly related to the other Premium trades outstanding. Yen strength may dissipate somewhat, while USD strength will edge likely edge higher against European FX for the rest of what will likely be a slow trading week ahead of the Easter Holidays.

تسجيل ندوة امس مع اشرف العايدي

Price Levels & Exuberance

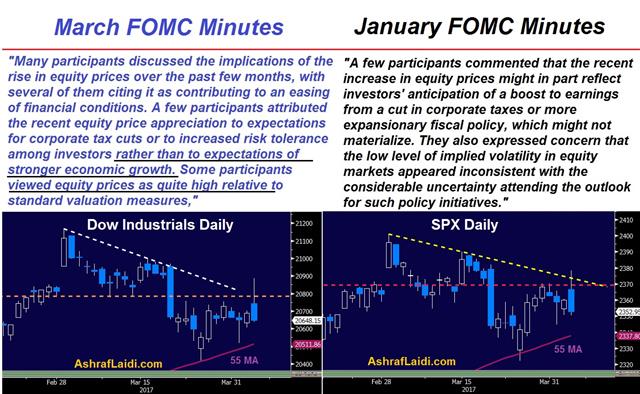

The final 30 minutes of Wednesday's S&P500 cash session saw the biggest decline in the index since September. The sell-off across US indices (and global futures) was largely attributed to the release of the March FOMC minutes and House Speaker Paul Ryan's comments on the remaining obstacles facing Trump's tax stimulus. The quotes below indicate FOMC officials have grown bolder in expressing their doubts with equity valuations, something similar to Greenspan's irrational exuberance speech 21 years ago.

Technical analysts will tell you the above explanations are fundamental triggers for developments largely apparent in the charts. The 20,800 and 2370 territories in the Dow30 and SP500 acted as previous support, now resistance levels, while the USD index faces rising pressure at 100.80s. We could elaborate further on the relevant pressure points in US 10-year yields and individual USD pairs, but… you get the picture.

As we approach tomorrow's US jobs report, some decisions may have to be made with regards to our existing USD and cross pair Premium trades. Some may say Friday's report is least important of the year as there is no Fed meeting scheduled for this month. The upside surprise in this week's ADP release may suggest the figures could come in above the 180K expected, following the 235K in February. But as we saw in the last report, USD and yields are increasingly to the mercy of the earnings figures. 4 Premium trades remain in FX and 2 in indices. The 2 trades in commodities have not and will not be touched for quite some time.

ندوة مساء اليوم مع اشرف العايدي

هل ودعت الأسواق بيانات الوظائف الأميركية فوق ال 300 الف؟ أم تحول تركيز الفدرالي نحو الأجور خاصة بعد هدوء بيانات التضخم؟ - كيف ستتأثر معادلة الدولار، الين، والذهب من الوظائف الأميركية سيركز الاستاذ اشرف العايدي على بيانات الوظائف، البطالة والأجور الاميركية التي ستصدر يوما بعد الندوة احجز مقعدك

Ashraf on BNN about the Euro

Discussing euro's cross currents ahead of the French elections and the key levels for the France-German spread. Full interview.

After the Nikkei's 20K Failure

Plenty of noise was made about the great comeback of stocks: How Japan's Nikkei-225 rocketed 28% in the last 6 months of 2016, erasing a 25% decline of Q1 2016, largely thanks to a 15% jump in November alone, courtesy of the “Trump-reflation-Fed-raises-rates-US-pumps-infrastructure-yields-soar-yen dives trade”. The trade worked wonders for the BoJ who had run out of tricks and out of bonds to buy to weaken the yen.

But Japanese traders cared little for round numbers as the 20,000 level was attempted and failed for the last four months (N2). Interestingly, the 20,000 also failed in Nov and Dec 2015 when global indices recovered from the August 2015 China sell-off, but again failed (N1). As markets recovered in spring 2016 with the help of oil stabilisation, Nikkei bulls were propelled by the perfect storm: falling yen, rising yields and recovering USD. But it was still not not enough. Both the Nikkei and Topix are at 4-month lows as yen pain escalates.

Does the above Nikkei chart suggest a double top, or a partial pullback retesting the 100-WMA of 18108? Will 18780 suffice? There is no Fed meeting this month and Trump will be busy talking trade with China, before going to lawmakers to try out a few executive orders favouring US manufacturing. Nikkei bulls will be encouraged by 10-year yield's recurring stabilisation above 2.30%

Our short USDJPY trade opened near 112 on Friday remains in progress alongside 7 other trades. The 2 opposing CAD trade remains a synthetic hedge for an outright USD short. A new video for the Premium subscribers has been sent and be watched here.

سجل لندوة الخميس مع اشرف العايدي

سيركز الاستاذ اشرف العايدي على بيانات الوظائف، البطالة والأجور الاميركية التي ستصدر يوما بعد الندوة - هل ودعت الأسواق بيانات الوظائف الأميركية فوق ال 300 الف؟ أم تحول تركيز الفدرالي نحو الأجور خاصة بعد هدوء بيانات التضخم؟ - كيف ستتأثر معادلة الدولار، الين، والذهب من الوظائف الأميركية؟ احجز مقعدك