Iran Worries and US-China Progress

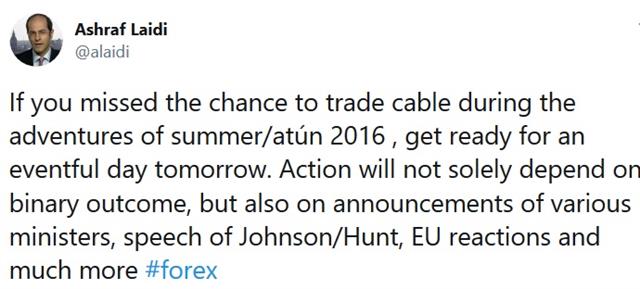

All eyes are on tomorrow's announcement of the new British PM. See Ashraf's tweet below. Two headlines from late on Friday set the stage for oil market jitters and trade optimism. DOW30 and SPX continue to test and fail 27300 and 2993 respectively. CFTC positioning data continued to show a sharp turn on CAD.

Iran seized a UK-flagged tanker on Friday in an escalation of a dispute that started in May with the UK seizure of a ship carrying Iranian oil. Crude climbed nearly $1 on the report and earlier scattered reports that a second vessel was held (it was later released). The move shows some brinksmanship from Iran as it fights to get oil to market and avoid US sanctions.

At almost the same time, reports on Friday suggested that the US and China had found some common ground on the Huawei blockade and agricultural orders. Reports last week suggested both sides were reluctant to follow-through on G20 promises but this critical step now appears to have been taken.

Now that the 2-week silence period from Fed speakers is active (no speeches before the Jul 31 decision), we revert to data watch. This week begins with the Richmond Fed and existing home sales for June. The manufacturing numbers have been tough to pin down lately. Most of the regional numbers plunged in June but the already-released Philly Fed rebounded strongly this month.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -31K vs -36K prior GBP -76K vs -73K prior JPY -11K vs -4K prior CHF -12K vs -10K prior CAD +21K vs +9K prior AUD -53K vs -54K prior NZD -17K vs -22K prior

CAD longs are now the most-stretched since March 2018 in what's been a quick shift from -38K just five weeks ago. The numbers track the period before Friday's soft retail sales report. Sales ex-autos were down 0.3% compared to +0.3% expected but an unusual 2.0% decline in supermarket sales skewed the numbers lower. That's a sector that's rarely economically sensitive and that was the message from the market as CAD bottomed quickly after the numbers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Kent Speaks | |||

| Jul 22 22:30 | |||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40