Market Waits on Yellen

Cascading downgrades in energy and financials persist but the Fed continues to point to China as the source of unease in markets. Yellen needs to demonstrate Wednesday that officials understand then potential economic downside to the commodity collapse. The yen stabilized in US trading Tuesday but may become unhinged again if the Fed plows forward. In the Premium Insights, the gold long hit its final target, EURAUD short was stopped out and last night's trade is filled & in progress. There are 3 trades currently open and are all in the green.

The December JOLTS report beat expectations at 5607K job openings compared to 5413K expected. That may give Yellen a false sense of economic security heading into her testimony.

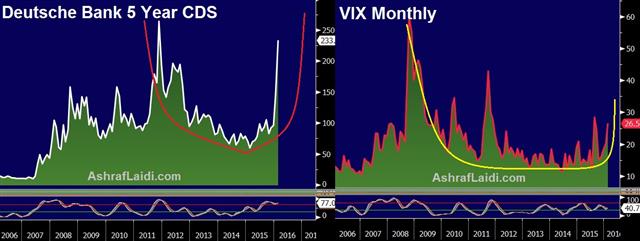

Markets and especially financials are sending a different signal. The market is convinced that energy and commodity companies will go bust and the focus is now on where the losses lie. The swift declines in financials, including Citi, BAML and Deutsche Bank, argue that traders are pricing in hefty losses.

If Yellen focuses on messages from lagging economic data rather than real-time market pricing it will underscore a lack of confidence in central bankers. At the moment, the S&P 500 is clinging to support form the Aug/Jan lows. If she doesn't address commodities, banking and disinflationary risks and instead highlights an upbeat hawkish outlook based on domestic data, then expect a breakdown.

USD/JPY has already faltered below 115.50 support and closed below it for a second day. Other key headlines from the IEA and EIA underscored the challenges to the oil market. Both cut demand forecasts and the IEA warned that production will continue to exceed demand by 1.75 million barrels per day for the first half of the year. Oil had been higher but finished 7% lower on the day.

Despite the drop in crude, USD/CAD finished lower on the day. The resilience of the Canadian dollar in February has been astounding and telling. A large portion can be explained by general USD weakness but the market is also having second thoughts about the idea of Canada heading towards a recession.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings (DEC) | |||

| 5.600M | 5.400M | 5.431M | Feb 09 15:00 |

| Fed's Yellen testifies | |||

| Feb 10 15:00 | |||

| FOMC's Williams speech | |||

| Feb 10 18:30 | |||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40