USD Firms ahead of Big Week

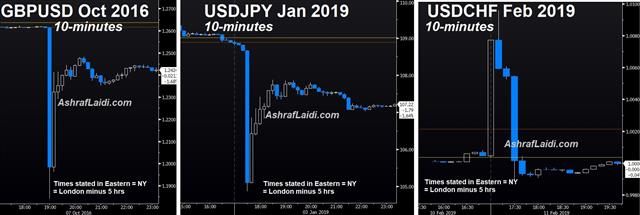

Most currencies are down against the US dollar since the start of Asia's Monday open with the exception of NZD and CAD as the latter holds on to gains after Friday's Canadian employment figures showed the best gain in 16 years. A big week of economic news and events awaits, with a statement from PM Theresa May tomorrow and US-China trade talks in focus later in the week. We took 230-pt profit in the DAX30 Premium Insights trade with a detailed note for subscribers citing the reason for exiting early. The franc was the latest victim of thin-liquidiy flash crash around midnight London, falling nearly 1%. A closed Tokyo session due to Japan Holiday helped propagate the move, but the charts below (GBP flash crash, JPY spike & CHF plunge) highlight the common denominator. US CPI is due next.

Canada's jobs market continues to defy signs of a slowing economy as it added 66,800 jobs in January compared to 5,000 expected. The economy averaged more than 47,000 jobs added for the past five months, in what's been the best five month period since 2002.

The numbers simply defy belief as the oil sector struggles and other economic data points point to trouble. At some point there will be a reversion to the mean but it wasn't on Friday. USD/CAD fell to 1.3230 from 1.3300 on the headlines but that was the low of the day and it bounced a half-cent. The rebound afterwards reflected skepticism of the report, including details that showed nearly all of the jobs were created in the service sector among those aged 15-24.

The overarching themes at the moment are global growth, central banks and US-China trade. In the week ahead they will all be in the spotlight. The main event will be meetings between Mnuchin, Lighthizer and top China officials on Thurs-Fri in Beijing. Recent signals have been mixed and a deal before month-end is increasingly unlikely but at the same time there have been signals about an extension of the March 1 tariff deadline.

This week's data calendar heats up as statisticians sort out the numbers after the US shutdown. Late in the week we get UK and US retail sales and CPI as well as China trade balance and Japanese GDP.

The UK data is likely to be overshadowed by Brexit politics once again as May brings her latest Brexit deal to parliament for a vote on Friday. But a Tuesday speech from here will be key. She will need to secure clear concessions from the EU by Thursday otherwise votes on Plan B become inevitable. Her best hope appears to be a deal with Corbyn for Labour support but that risks a Conservative civil war. At risk is the 1.2850 support on GBPUSD, which appears increasingly endangered amid the latest buying wave in USD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| -0.4% | 0.0% | 0.2% | Feb 11 9:30 |

| FOMC's Bowman Speaks | |||

| Feb 11 16:15 | |||

Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10