Yen: Conventional vs Unusual

As the yen resumes its rally, many FX experts appear bemused by the yen's insistence to rally despite reported heavy foreign-bound investing by Japanese institutional players, persistent retreat in the road to 2.0% CPI by Abenomics and broad-weakness in last week's release of the BoJ's tankan corporate sentiment survey. Retail investors have got caught up in blindly following “major bank” FX strategists who had been conveniently telling clients USDJPY will return to 117-120 at a point when it was close to 114.50. Many are throwing the towel, calling FX markets illogical, a crapshoot and a universal conspiracy.

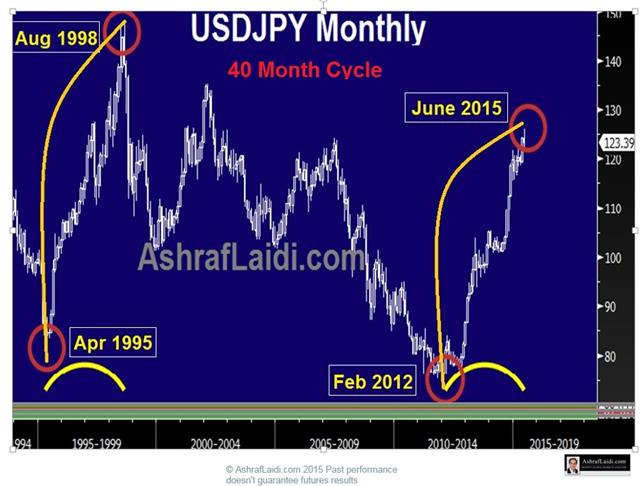

Slide from the Madrid Expo - June 13, 2015

It was at last year's Madrid Expo when I first shared the 40-month cycle in USDJPY. The expo was on June 13th, 8 days after the USDJPY peak of 125.86. The last long Premium trade in USDJPY issued to subscribers was in July 29th before exiting on Aug 23rd at 125.20. All subsequent USDJPY trades issued thereafter, were shorts, up to the current one.

Aside from the cyclical nature of the peaks in USDJPY, subscribers and attendees to my webinars/seminars are familiar with the many fundamental factors I cited for further decline the pair. From lack of sufficient JGBs, to falling oil to structural obstacles to effective salary hikes in Japan. As for the billions of yen in foreign-bound Japanese outflows, many of these are hedged against yen strength. Meanwhile, Japan's swelling debt is offset by its current account surplus, which continues to command the order of risk-aversion flows –something I explained in detail in my book written 9 years ago (yes, that long).

This has been a reminder for all of you to question conventional/repetitive analysis from the ever abundant ocean of pundits. We neither encourage blind contrarianism nor back up cozy herd-following. Do your homework, question what work and what doesn't. Or you can ask our subscribers what we did with yen pairs these past 6 months.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46