Three Things to Watch in January Seasonals

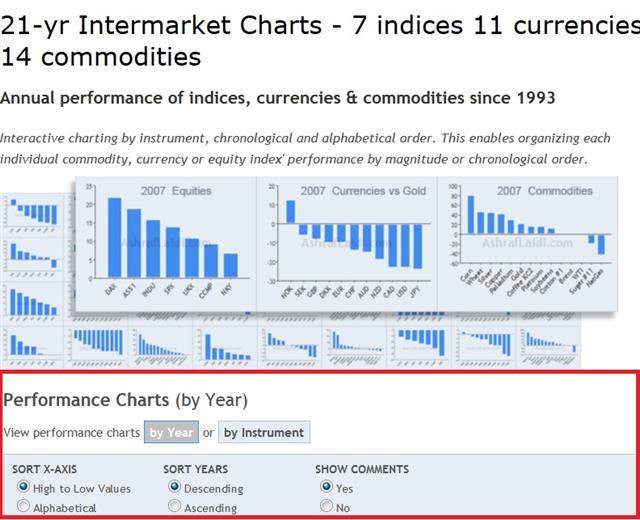

The year is winding down and we are continuing to focus on the incoming economic data but it's certainly not too soon to look forward to January and some strong seasonal skews. In 2015, the top performer was the Swiss franc after the SNB floor collapsed but it was almost surpassed by the US dollar. The commodity bloc, led by CAD, lagged. In the upcoming Asia-Pacific session, Japanese industrial production and retail sales are due. Ashraf's analytics team has devised an interactive peformance database for equity indices, commodities and currencies from 1993 to 2015, illustrating several intermarket relationships, including the January Effect in FX (see below).

Seasonals are certainly not the only basis for a trade and they can be skewed by one-off events or coincidences in timing of central bank moves. Overall, they're one small tool in the toolbox and are something to keep in mind every time the calendar turns.

For January, the first strong seasonal is gold. It fell more than 9% in 2015 but it started last year with a 10% rally. That may have been partly due to a strong seasonal bias. January is the best month for gold with an average gain of more than 4% over the past decade.

Another one to watch is sterling. January is the worst month for cable over the past 30 years and with a hawk like Weale backing away from a rate hike, there is certainly reason for concern. The weakness may have come early this year with no BOE rate hikes fully priced into the rates market in the year ahead.

The underlying seasonal theme in FX markets in January is US dollar strength. It's the strongest month for the Dollar Index over the past 30 years. The bull market in the dollar is already well-entrenched and foreign asset managers or those frightened about emerging markets in 2016 may cycle into USD early in the year.

For the immediate term, the focus is on incoming Japanese economic data with retail sales and industrial production due at 2350 GMT. November IP is expected to slide 0.5% m/m but rise 1.6% y/y. The soft yen has been a disappointment on the economic growth and inflation fronts and what Abe does next is a major theme of 2016. At the same time, the retail sales report is expected to show a 1.4% m/m decline in November. Don't expect a big JPY reaction to the data.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33