Intraday Market Thoughts Archives

Displaying results for week of Jul 10, 2016Ashraf on BNN Earlier Today

Ashraf's take on the Bank of England, GBP and differentiating capital flows. Full interview.

GBP up, China GDP Next

Cable jumped after the BOE opted to leave interest rates unchanged and it was top performer on the day while the New Zealand dollar lagged. To see the daily, weekly and monthly top performers, check out our new widget. Chinese GDP is due up next. A truck in French city of Nice ran into crowds, killing over 60 persons and injuring over 100 during the Bastille Day celebrations. ISIS has reportedly claimed responsibility. 5 Premium trades are currently in progress, 2 of which are commodities and 3 in currencies.

The market was pricing in an 80% chance of a BoE rate cut on Thursday but Carney disappointed. In response, cable jumped 240 pips immediately. Those gains were tempered somewhat by a virtual pre-commitment to easing in August but the pound still gained 2 cents on the day.

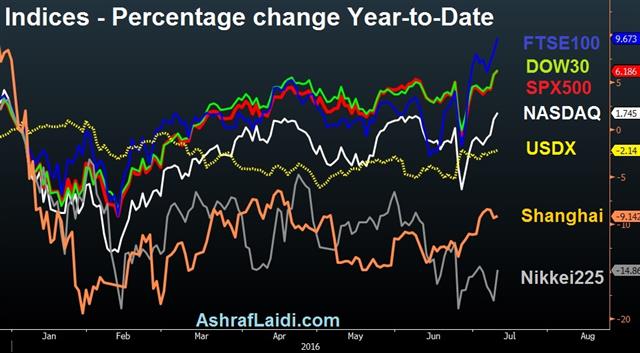

Outside of GBP trading, the underlying bond selloff and stock rally continued. The S&P 500 hit a record intraday high for the fourth consecutive day. US 10-year Treasury yields rose a further 6 bps.

The market is having a re-think on the consequences of the Brexit vote. May has been firm that the UK will leave the EU but traders are taking more of a wait-and-see approach before pricing in problems.

What's increasingly clear is that central banks may not be as dovish as markets were anticipating. The Fed funds market pricing in no move until Feb 2019 is aggressive and while Lockhart said a patient approach is prudent, he also said that a near-term hike wasn't out of the question.

At the same time, US initial jobless claims beat estimates at 254K compared to the 265K consensus. The PPI at 0.3% y/y compared to 0.0% expected also showed some minor price momentum.

USD/JPY rose for the third time in four days and is now above to pre-Brexit levels. That's largely a function of what the BOJ might do next but it also reflects the positive sentiment in stocks. One stat that worries us is the VIX. It's at the lowest level in 11 months. Few would argue that risks are lower now than at any time in that period so, instead, that argues that a squeeze has partly fuelled the latest moves.

One of the risks in the background remains China. It's a big day for economic data with industrial production, retail sales and GDP for Q2 all due at 0200 GMT. Growth is expected at 1.6% q/q and 6.6% YTD y/y. Those numbers aren't likely to be trustworthy so any misses in retail sales or industrial production might hold more weight.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Continuing Jobless Claims (AUG 02) | |||

| 2149K | 2117K | Jul 14 12:30 | |

| Initial Jobless Claims (AUG 09) | |||

| 254K | 265K | 254K | Jul 14 12:30 |

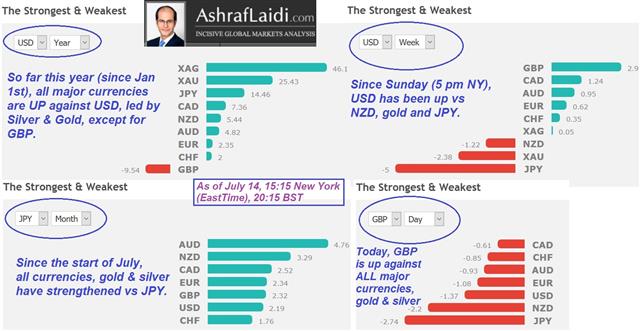

Strongest & Weakest Currency

You can now find out the strongest/weakest currency among 7 leading currencies, gold and silver on the day, the week, the month or year. No need for expensive software, no need for gazing at the screen for hours. Just choose your base currency and click. GET STARTED HERE

BoC Won’t Budge, Cable Slips

The Bank of Canada may have offered an early preview of the upcoming Federal Reserve decision as policymakers refused to budge until more data arrives. The loonie was the top performer while GBP lagged. The Australian jobs report is due later. A new Premium trade was issued today. The chart below is among the 3 charts used to support the case for re-entering the long.

There was speculation the BoC could respond to the volatility in markets due to the Brexit with a surprise cut or an explicit dovish bias. Instead, Poloz held rates unchanged and maintained a neutral bias. Growth forecasts were lowered and the BOC pushed back the timeline for closing the output gap but there was no signal on rates.

Poloz was grilled about housing and weak non-commodity exports and he continued to express confidence that manufacturing exports and investment will soon pick up. The Canadian dollar rallied across the board despite a 4% slump in oil prices but Poloz may face a crisis of credibility in the coming year.

The continuing crisis in UK politics gained some stability as May took over as PM but new questions were raised about her cabinet and GBP slid. Philip Hammond was named as Chancellor of the Exchequer but his reputation as a fiscal hawk dampened hopes for fiscal stimulus. The undiplomatic Boris Johnson also raised eyebrows as Foreign Secretary.

In her first speech as Prime Minister, May reaffirmed her commitment to a Brexit and she named two pro-Brexit cabinet ministers to lead the efforts to Leave and negotiation new trade deals.

The main factor for GBP in the day ahead is the BoE decision. Surely some signs of political stability will be welcomed by Carney but he's sent plenty of signals about easing and, just in the past two days, the majority of economists has now shifted to expecting easing.

Before that decision is the Australian employment report at 0130 GMT. The consensus is for a 10.0K rise with unemployment ticking to 5.8% from 5.7%. The August 2 RBA decision remains at nearly a 50/50 split in the market and this number will go a long ways towards adding a bias and sparking a sizeable AUD move.

The Land of the Rising USD/JPY

Indications from Japan and the huge moves in yen crosses suggest the Japanese government is preparing a new foray into experimental monetary policy. The pound was the top performer on Tuesday while the yen lagged as big FX moves continued. A speech from the RBNZ's McDermott is due later. GBPJPY and AUDPJPY trades were both stopped out. A new Premium video will be posted and sent at the start of the Wednesday session to share which trading ideas will be reviewed and confirmed. The link to the latest video is now ready. Please see below.

The two day rally in GBP/JPY was the largest since 2014. The pound is taking advantage of the improved stability as Theresa May takes over but the yen side of the equation is what we look at today.

Abe has been the strongest Japanese PM in a generation and he's done it with bold actions. In Kuroda he's found a central banker who is equally undaunted by the consequences down the road.

Japanese government debt has been de facto monetized already and they're clearly the most eager central bank to fight a currency war. With the Abe strengthening his mandate in upper house elections, the murmurs suggest he's planning yet another effort to decisively restart the Japanese economy.

Sankei reports that officials around Abe are considering 'helicopter money' and Ben Bernanke paid a visit to top Japanese leaders. The mechanics would include a BOJ pledge to hold its inventory of JGB's semi-permanently, likely for 100 years. It would be combined with fresh government debt issuance and spending.

There have long been rumours of another fiscal/monetary dual effort to shock the economy. What better time than now?

The risk is that the market flouts scoffs at the actions once again but with the BOJ/MOF coming as close to printing as possible, the better bet might be that they succeed.

The economic calendar is light in Asia-Pacific trading so we will watch for other hints. Such a massive policy move – especially if it's combined with government spending – will be a tough secret to keep until the BOJ meeting. Expectations are certainly rising.

The main event to watch on the economic calendar in Asia-Pacific trading is a speech from RBNZ assistant governor McDermott. His colleague Grant Spencer hurt easing expectations by warning about the effects of loose policy on housing last week and that helped to boost NZD. In comments at 0030 GMT, McDermott may try to keep the options open.

The Fed's Mester also speaks at 0230 GMT but her likely-hawkish comments will assuredly be ignored.

Change the CB Channel

A surprise quick ascension to the UK PM job for Theresa May helps to sharpen the focus on a trio of central banks this week. The pound sterling was the top performer while the Japanese yen lagged. The RBA's Ellis and Japanese data are due later. Our Premium Video will be released tonight at the start of the Asian Tuesday session.

We look at the three central bank decision coming up:

Bank of England (Thursday)

The OIS market is pricing in a 79% chance of a cut but that might tick lower as May fills the political vacuum that was expected for the July-Sept period. In surprise announcements, Leadsom dropped out of the race and Cameron said he will step down late Wednesday. Carney has tipped his hand towards easing but the market has very little idea of how much is coming, what other tools will be used and when. GBP trading was choppy Thursday and that will continue through the decision but shorts may start to get cold feet.Bank of Canada (Wednesday)

Poloz staked his economic forecasting reputation on the idea that non-commodity exports and investment would be boosted by the weak CAD but record trade deficits the past two months and a sluggish economy has jeopardized that outlook. The weak Canadian jobs report and latest downtick on oil has pushed USD/CAD to the top end of its recent range. Poloz has plenty of reasons to tilt more dovish but don't expect a clear guide towards a cut. The market is pricing just a 9% chance of a move this week.Bank of Japan (July 29)

Abe and his partners won a surprise two-thirds majority in Sunday's upper house election. That strengthens a mandate that's had a core principle of easing and printing. It was no surprise then that the yen sagged badly to start the week. The first sign of action came early Tuesday on a report in the Japanese press that the government will cut its 2016 real GDP forecast to +0.9% from +1.7%. That will help pave the way for action. In the weeks ahead, we'll look for further clues about what Kuroda is planning.The BOJ will also be gauging what needs to be done and data at 0430 GMT could offer guidance. The May tertiary industry index is expected down 0.7% after a 1.4% rise in April. The BOJ's household sentiment survey is due at the same time.

The other event to watch is the 0330 GMT speech from the RBA's Ellis. The market is nearly 50/50 on a rate cut for Aug 2 after the latest statement steered clear of guidance. Perhaps Ellis will offer some clues.

Ashraf on Bloomberg TV

Ashraf discusses the GBP similarity to USD in 2003-4 as well as gold, oil, silver.

Complicated and Grim

China's trade minister called the global economic situation “complicated and grim” at the start of the G20. The yen was the top performer last week while the pound sterling lagged once again. CFTC positioning data showed increasing euro shorts and yen longs. Our Dow30 Premium trade was stopped out on Friday, raising questions as to whether a new bull market is underway. Will cover these points in this week's Premium video. 7 Premium trades remain in progress.

“Complicated” is the set of tools central bankers are increasingly reliant upon to stimulate any kind of inflation. Hopes for pre-crisis style growth are increasing “grim” as politicians fail to reform economies and stimulate growth.

Stepping back from the day-to-day FX moves, we see sluggish-at-best economic growth on the foreseeable horizon that's complicated by growing unrest and a near-total lack of global leadership. The type of volatility this year promises to be the baseline for years to come.

Weekend data showed China CPI at +1.9% y/y in June compared to 1.8% expected. Those numbers leave Chinese officials with plenty of ammunition to stimulate but their still waiting and watching how the latest rounds of easing filter through the economy.

In Australia, Malcolm Turnball has finally claimed victor in the election. The final tally still isn't complete but he will have the narrowest majority in parliament. The news was largely priced in late in the week but it may still give the Aussie an early bump.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -75K vs -62K prior JPY +64K vs +60K prior GBP -49K vs -43K prior CHF +9K vs +11K prior AUD +5K vs -2K prior CAD +9K vs +11K prior NZD -1.4K vs -2.8K prior

Yen longs have been creeping higher for the past six week and are nearing the all-time high of +72K which was set in April. The market is also increasingly comfortable with the idea of euro shorts with European sovereign yields continuing to fall. On Friday, Dutch 10-years traded below zero for the first time.