Intraday Market Thoughts Archives

Displaying results for week of Sep 13, 2015VIX Golden Cross not seen since 2007

The VIX may be 60% below the six-year highs reached last month, but the confluence of medium-trend measures shows a technical development seen only in three occasions over the last 14 years; August 2001, August 2007 and July 2002. This development is the Golden Cross via the 55-week moving average crossing above the 200-week moving average. It is happening again today.

The relative infrequency of such occurrence highlights its importance. Unlike moving average cross-overs in hourly and daily charts, weekly crossovers carry particular significance as they reflect a more established build-up in the trend.

One potential weakness of medium-term crossovers is the possibility of being behind the trend. Many a times, a Death Cross coincided with a price bottom and vice versa for a Golden Cross. In comes the importance of momentum indicators in gauging the likelihood of a continuation/escalation in the price trend. A positive cross-over in a selected momentum oscillator is in fact developing, as was shared with Premium subscribers in today's video charts analysis.

Worthy of note is the time lag in weekly MA crossovers. Note that in 2007 and 2002, a considerable ascent in stochastics has taken place, which is not the case for long-term oscillators prevailing today. Whether this implies it is too early to expect a follow-up in volatility escalation remains to be seen.

A striking difference from 2007 and 2002 is the soaring volume of VIX and VIX-related products (VIX ETFs and leveraged ETFs), combined with high-frequency trading of these products by banks and algo firms. We've already argued on here that further volatility lies ahead.

Back to the Fed

Many were surprised by the Fed's rate decision to have failed in supressing volatility. Stocks dropped despite the Fed not raising rates. Late session selloffs in equities from dovish (or less hawkish than expected) Fed outcomes usually occur on the premise that traders reason the Fed knows something we don't. Intermeeting rate cuts are one example, such as the August 2007 discount rate cut.In this case, the Fed's assessment of “recent global economic and financial developments” i.e. China's transmission mechanism of global deflationary risks and emerging markets fallout from renewed USD is a new revelation to players, who were too occupied with falling US unemployment and stabilizing hourly earnings. There's more to this world, especially as advanced trading structures serve as a rapid conduit for market volatility.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Rate Decision (SEP) | |||

| 0.25% | 0.25% | 0.25% | Sep 17 18:00 |

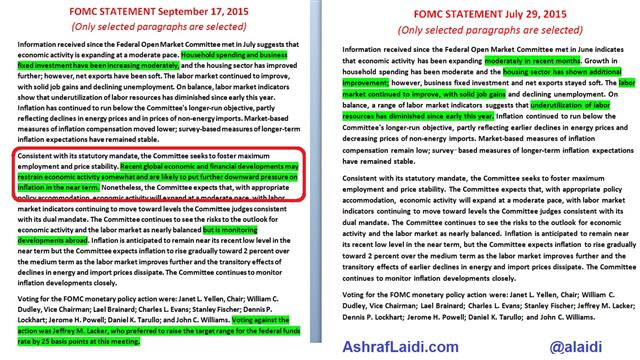

Fed Holds & Worries about the World

The Fed kept rates unchanged with an unambiguously dovish statement, focusing on weakening inflation, rising market turbulence and a new reference to foreign developments. The dot forecasts pointed to slower growth and lower core inflation and lower fed funds projections. The only hawkish dissent to the decision was from Richmond Fed's Lacker, but this point was made moot by not only due to Lacker's well documented hawkish stance, but also by the fact that the dot plot showed one Fed member expecting negative rates, even if this member is the widely dovish Minneapolis Fed's Kocherlakota.

New way to worry about the world

The most important part of the Fed statement is the following: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Still, we expect the Fed to tighten by year-end; we continue to look for the initial rate hike to come in December."We made the case against a Fed hike since the start of the year and our latest argument was clarified today on here (see final 3 paragraphs): Subscribers to our Premium trades are sitting on a long EURUSD trade at 1.1210 and long EURCAD.

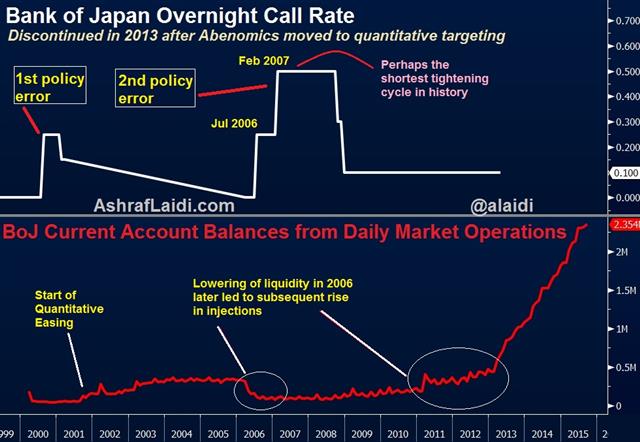

Fed must avoid Bank of Japan Errors

No, the US is not Japan and the Federal Reserve is not the Bank of Japan. But when we assess the implications of what could be the first Fed rate after 7 years of zero interest rate policy in the US, there's no better reference than the BoJ.

When Japan's asset bubble finally burst in 1990 and the nation was gripped in a deflationary spiral, the BoJ's easing policy took interest rates from 6.0% in 1991 to 0.50% in 1995. The central bank paused for three years as the global economy picked up and US demand powered ahead, until the Asian currency crisis hit the continent, forcing the BoJ to further slash rates, dragging the overnight rate to 0.25% in 1998 and 0% in 1999. Quantitative easing followed in 2001.

1st policy mistake

In August 2000, satisfied with a modest recovery in inflation and prompted by the need to respond the global economic rebound as well as a series of Fed tightening, BoJ governor Masaru Hayami (known for his hawkishness and combative decisions against the cabinet) decided to raise rates by 25 bps. That proved to be the first policy error as the fallout from the dotcom bubble and the resulting recession in the US and in most of Europe accelerated Japan's deflationary crisis. Hayami was forced to ease again, slashing rates until they returned to 0.0% in early 2006.2nd policy mistake

The 2nd and more publicized policy mistake occurred in late Q1 2006 as the BoJ, under governor Toshihiko Fukui, began withdrawing liquidity, which was created by raising excess reserves under the 5-year old quantitative easing policy. There were good reasons for reducing the extent of easing: Japan inflation was at 2-year highs, yen was at 3-year lows, the global economic recovery has entered its 2nd year, Fed had been raising rates for two years and even the European Central Bank had started tightening.But Fukui got carried away as the reduction of QE turned into higher rates. The overnight rate was raised back to 0.25% in July 2006 and to 0.50% in February 2007, then a nine-year high. As the global crisis imploded, the BoJ was forced to join all other central banks, dragging rates back to 0.1%.

It may be disingenuous to call the BoJ's 2006 tightening a policy mistake as the dynamics prevailing at the time did justify such action. But the fact that the central bank not only quickly returned to zero rates, but also remained stuck in that phase well after other central banks partly withdrew their easing does highlight the structural deficiencies of Japan's savings/deflation dynamics, which were only worsened by the 2006-7 rate hikes.

PM Abe's 2012 decision to go for shock-&-awe policy and currency easing reflects the structural complexities of Japan's savings-deflationary deficiency. And still not much progress, with the exception of a weaker yen.

Fed Hike would be another Mistake

Despite notable tightening in the US jobs market and improved state of most US balance sheets, a Fed rate hike today will be a policy mistake. Inflation continues to deviate away from the Fed's 2.0% target, lingering at a four-year low of 1.2%, from 1.4% in March and 1.7% in July 2014. This will be exacerbated by the disinflationary impact of USD strength, while inevitable depreciation of the Chinese yuan will continue to supress US inflation to the extent of shadowing declines in US jobless rate.The liquidity gaps in the US treasury market and the threat of further yields spikes at a time when the Federal government is nearing another debt ceiling deadline implies a potential break in the bond market and a blow for equity valuations, long dependent on low discount rates. Aside from China, Saudi Arabia, a key strategic partner of the US is already suffering from the combination of plunging oil prices, rising budget deficit and having its currency –riyal-tied to a strong USD.

The minutes of the July FOMC meeting have already revealed an admission of lower inflation and downside risks from China. Since that meeting, China devalued, oil fell further and inflation weakened (core PCE slowed to 1.24% from 1.30%). Raising rates now would be a grave error and the process of reversing it will trigger panic.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoJ Monetary Policy Meeting Minutes | |||

| Sep 17 23:50 | |||

After The Fed

A slide in the US dollar and rally in stocks Wednesday underscored the minimal expectations for a Fed hike on Thursday but we will examine what happens next whether Yellen launches liftoff or not. The pound was the top performer on the day while the yen lagged. 4 hours before the Fed, watch the release of the Sep Philly Fed following the dismal Empire Fed survey. A video of key equity indices and major FX pairs is featured today for Premium subscribers.

The game of 'will they or won't they hike' will come to a conclusion at 2 pm ET on Thursday. For weeks analysts have written exhaustingly on that question but there are other Fed-related puzzles to be solved.

If they don't hike, the next question is: when? Better market sentiment and good retail sales numbers on Tuesday may have tiled the Fed towards offering a signal about an Oct or Dec hike. The most-obvious sign would be if Yellen pre-announces a press conference following the October meeting. She is sure to follow this with many caveats that nothing is pre-ordained but markets will interpret it as a de-facto hike.

The extent of dissent against the decision will also be instrumental in hinting about prospects for a December action on rates.

Other signals about a hike could come in the Fed statement guidance dot plot or Yellen's press conference. We think that any hike this year would prove to be a mistake because of disinflationary forces from the strong US dollar and softening global demand. But there is some virtue in giving markets clearer guidance heading into future meetings rather than leaving speculators to guess.

Such an approach would allow market participants to better focus on what happens next. Namely, when will the Fed think about hiking again and what will happen with the $2.5 trillion in cash parked at the Fed. Keeping the effective Fed funds rate in the 0.25% to 0.50% range will be a challenge and they're hoping to use reverse repos to hold the floor. In the aftermath of the decision, markets will be closely watching the 0930 GMT daily release of effective Fed funds. That watch could start as soon as Friday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Monetary Policy Statement and press conference | |||

| Sep 17 18:30 | |||

| Philadelphia Fed Manufacturing Survey (AUG) | |||

| 6.0 | 8.3 | Sep 17 14:00 | |

تحليلات الأسواق قبل قرار الاحتياطي الفدرالي

Bonds Skittish ahead of Fed

US 2-year yields rose to the highest level since 2011 on Tuesday as a solid retail sales report caused speculation about hawkish talk from the Fed. The kiwi was the top performer in a late rally while the Swiss franc lagged ahead of Thursday's SNB decision. The BOJ monthly economic report is due later but the Asia-Pacific schedule is light. A new note and set of charts has been issued for the existing DAX Premium trades.

US retail sales have improved at an impressive clip over the past few months and it continued with a good report for August. Sales excluding autos, gas and building supplies were up 0.4% compared to 0.3% but the better news was in the July data where that metric was raised to +0.6% from 0.3%. It was part of a larger set of upward revisions that has pushed the annualized pace of retail sales growth over the past 3 months to more than 5%.

The US dollar was slow to react at first but eventually pushed to substantial gains, especially against the yen and pound. USD/JPY rose to 120.50 from 119.50 while the pound sank to 1.5340 from 1.5400.

A big part of the dollar climb was due to a major push higher in yields. Across the curve, they were up 8-11 basis points. Short-dated Treasuries are the most sensitive to interest rates so it was particularly interesting that 2-year yields rose to the highest in 4 years.

We're not sure it argues for a higher chance of a Fed hike on Thursday but it definitely raises the risk of some hawkish talk from the central bank. US inflation is seen emerging via: 1) job market tightening, something that's largely been played out; 2) workers feel more confident in jobs and economic prospects so they spend more 3) rise in wages; 4) rise in prices.

If the Fed believes the second stage has been reachedm then it will gain confidence that the US economy is firmly on the path to #4.

The danger for the US economy is that the strong dollar snuffs out exports, inflation and manufacturing jobs to undercut the recovery. The Empire Fed and industrial production numbers both missed estimates Tuesday in a sign that will encourage Yellen to wait and see.

Looking towards Asia-Pacific trading, the calendar is light. The highlight is the BOJ monthly report for September at 0500 GMT followed by final revisions to the Japanese machine tool orders report an hour later.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.1% | 0.2% | 0.6% | Sep 15 12:30 |

| Industrial Production (AUG) (m/m) | |||

| -0.4% | -0.2% | 0.9% | Sep 15 13:15 |

| BoJ Monthly Economic Survey | |||

| Sep 16 5:00 | |||

Empire Fed, Retail Sales, Industrial Production all miss

A trifecta of misses in today's US economic releases may not be a game-changer in Thursday's Fed decision because the game is already “unchanged”. The September Empire Fed survey posted another double digit decline to remain at 6-year lows, August retail sales rose 0.3% to miss expectations for the sixth consecutive month and industrial production fell 0.4% in August to post seven declines over the past eight months—the worst pattern since 2008-9.

On the bright side, core retail sales (excluding autos, gas and building materials), rose along upward revisions to the prior two months. In the Fed's Empire survey, the employment component turned negative to 6.2 from 1.8, as did the average workweek plunging 10.3 from -1.8. US industrial production was battered by the usual strong US dollar story and weak exports. Manufacturing dropped 0.5%, mining fell 0.6% and utilities were up 0.6%.

Bearish Argument

The bearish side may argue against the robust retail sales by indicating the report was too early to take into consideration the slump in equities, materializing in the 2nd half of the month. The argument becomes especially potent following Friday's release of the preliminary report of the September University of Michigan Sentiment Survey, showing the biggest one-month plunge since late 2012. Thus, the release of US September retail sales, due in mid-October (2 weeks before the FOMC) could potentially disappoint.Bullish Argument

A more optimistic interpretation of the figures could point to the fact that the gloomy surveys in the chart above focus on manufacturing, which has been pummelled by the disinflationary challenges of a strengthening US dollar and the eroding global supply change. Not only manufacturing accounts for shrinking part of the overall US economy, but also inflation is more positive in the services sector.This leaves us with tomorrow's release of US August CPI for and Thursday's September Philly Fed survey as the remaining last figures prior to the Fed decision. Fed watchers are already hedging themselves in their prediction for the big event, indicating a hawkish statement/forecasts accompanying an unchanged announcement on rates, while others predict a dovish statement/forecasts to accompany a rate hike. While we lean towards expecting no change this week, markets have already made up their mind in pursuing further downside for the month.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.1% | 0.2% | 0.6% | Sep 15 12:30 |

| Industrial Production (AUG) (m/m) | |||

| -0.4% | -0.2% | 0.9% | Sep 15 13:15 |

AUD Downed by RBA Minutes, BoJ Next

One of the most powerful signals in markets is when a something rallies despite bad news. The latest example is the Australian dollar, which was the top performer on Monday while the euro lagged. The Bank of Japan decision is next. But it appears the Aussie is finally pulling back in reaction to the RBA minutes.

Aussie Reacts to RBA Minutes

Aussie oulling lower after the minutes of this month's RBA meeting restated that very low interest rates would continue to support growth in dwelling investment and household consumption. The RBA added that Aussie depreciation in response to significant declines in commodity prices was expected to support growth, particularly through larger contribution from net service exports. inflation forecast to remain consistent with target over next 1-2 years. Labour markets were described as mixed. The central bank added that the first US federal funds rate in around nine years could have significant effects on financial markets despite fact it had been well telegraphed.A normal recipe for Australian dollar weakness could include: A commodity slide, including energy and metals; a more than 2.5% decline in the Shanghai Composite; and a mild round of broader risk aversion. All those things combined Monday with a political coup that saw Australian Prime Minister Tony Abbott ousted by his own political party and replaced by Malcolm Turnbull.

Throughout it all, the Australian dollar climbed higher. It reached 0.7151, which is the best level since Aug 31. In a little over a week, AUD/USD has made a strong case for a bounce.

First came a three candle reversal to begin last week, that was followed by a bullish outside day on Thursday and now there is this. Many clouds remain in the overall Australian dollar picture but a retracement from the three-month rout to 0.69 from 0.81 is a better short term bet than continued declines.

AUD/USD will stay in focus later with the 0130 GMT release of the Sept 1 RBA meeting minutes. There were no surprises in the announcement and the RBA has a slight easing bias. A release like this can often be interpreted however a market likes and if it leads to more AUD gains, it's another reason for conviction.

The major event on the schedule is the BOJ decision. A good reason for JPY longs to pay special are ahead of the BoJ meeting is that only 2 of 35 economists surveyed by Bloomberg are calling for surprise easing so it's a live decision but newswire 'sources' have said the BOJ won't ease. We're looking for signals about a potential cut later this year and that could come via downgrades to the inflation forecast. Still, there are rumors that the BOJ doesn't believe there is much more it can do and is worried about eating up too much JGB liquidity.

China, Yen Shorts and the Left

Weekend data included solid data from China and a swing left in UK politics. Markets opened the week largely unchanged with the Fed in focus. Weekly CFTC positioning data showed yet another fall in yen shorts. The EURUSD Premium long at 1.1210 is currently in progress, along 4 other trades.

Fear about China is continuing to fade and the latest economic data should continue to sooth nerves. Retail sales and industrial production numbers released on the weekend were solid. Retail sales rose 10.8% y/y compared to 10.6% expected while industrial production climbed 6.1% y/y versus the 6.3% consensus forecast.

The volatility in Chinese stocks is slowly diminishing and that's good for risk assets globally and commodity currencies. The Australian dollar was the top performer last week while the yen lagged.

In the longer-term picture, a shift to the left is increasingly evident in major developed countries. The latest evidence was a landslide victory for Jeremy Corbyn for the leadership of the Labor Party. Britain isn't scheduled to hold an election until 2020 and but he's miles to the left from one-time leader Tony Blair. We note that the UK isn't the only place where anti-austerity and public investment politicians are gaining ground.

Canada holds elections in October and the two parties leading in the polls are both to the left of Prime Minister Harper. In the US, Bernie Sanders has narrowed Hillary Clinton's lead to 10 points and holds leads in Iowa and New Hampshire primary polls.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -81K vs -68K prior JPY -7K vs -16K prior GBP -18K vs -11K prior AUD -53K vs -56K prior CAD -49K vs -56K prior CHF -7K vs -8K prior

Once again, the US dollar is in a net-long position right across the board, highlighting its vulnerability ahead of the Fed decision. The first currency to switch might be the yen, which was nearly unthinkable three weeks ago when it was held at a net -90K.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (AUG) (y/y) | |||

| 10.8% | 10.5% | 10.5% | Sep 13 5:30 |

| Industrial Production (AUG) (y/y) | |||

| 6.1% | 6.4% | 6.0% | Sep 13 5:30 |