Intraday Market Thoughts Archives

Displaying results for week of Apr 14, 2019النفط و ثلاثة مدارس التحليل الفني

تحليل نفط الخام الأميركي عبر مؤشرالقوة النسبية و الزخم و النموذج السعري. الفيديو المفصل

Mueller, Retail Sales & China Deal

We'll find out today why US Special Counsel Mueller declined to make a decision on whether to charge Pres Trump with obstructing justice after a 2-year investigation. As for the China story, Trump said there will be a “very big spike” in markets when a China trade deal gets done. But as markets showed Wednesday, that's may not necessarily be the case. GBP ignores stronger than expected UK retail sales. Euro drops across the board on a series of a disappointing Eurozone PMIs. Canada and US retail sales are due at 1230 GMT/13:30 London. Ashraf sent me this chart suggesting that gold will need to stabilise then rally vs copper in order for indices to make any meaningful pullback.

In the past six weeks markets have grown increasingly desensitized to soft news about a China-US trade deal. Presidential leaks and tweets about progress, optimism and good feelings about a deal once stimulated sentiment, now they have almost zero impact.

True signs of progress are now falling flat as well. The WSJ reported Wednesday about plans for Lighthizer to fly to Beijing for talks later this month and counterpart Liu He to go to Washington a week later. They wrote that the aim is to get a deal signed in late May or early June. The report had almost no effect on markets.

The conclusion can only be that a trade deal is 95% priced in or more. The risk then is that there is a 'sell-the-fact' trade in light of the already astounding run-up in stocks since the start of the year. We also remind that Trump's spat with China ramped up almost immediately after finishing NAFTA negotiations. Trump may pivot to Europe after a China deal and create a fresh impetus to de-risk.

Canadian and US retail sales are due later today in what will be a sharp focus on the consumer globally. Beware of a drop off in liquidity and trading late in the day with most world markets heading out for the Good Friday holiday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.2% | 0.1% | Apr 18 12:30 | |

فحص الإسترليني بدون عامل البريكست

دعونا نفحص الجنيه الاسترليني دون ذكر موضوع البريكست ـ خروج بريطانيا من الاتحاد الأوروبي. يوضح الرسم البياني أدناه سبب كون الجنيه البريطاني أفضل العملات أداءً منذ بداية العام بين أكبر عشرة عملات في السوق من حيث حجم الاقتصاد . التحليل المفصل

Why GBP is Year's Best Performer

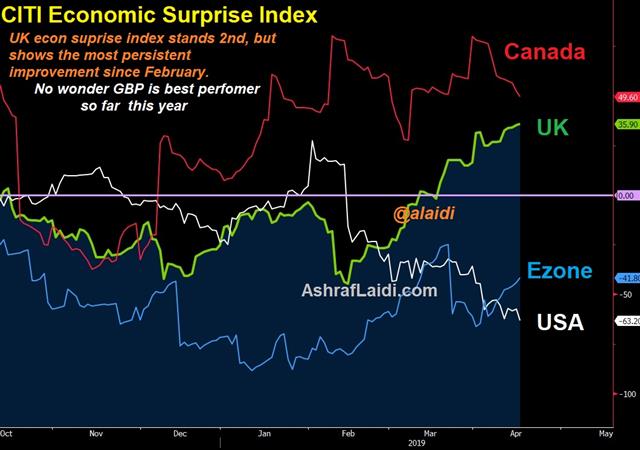

Commodity currencies finally breath sigh of relief after better than expected China Q1 GDP helping oil to new highs for the year. UK CPI held at 1.9% y/y in March, while Eurozone CPI held at 1.4% in the same month. Canada CPI follows next. Let's talk about the UK but not Brexit. And here's a chart of the UK's economic surprise index versus the rest of the major markets, helping to explain why GBP is the best performing currency year-to-date. Currencies focus on flow and expected rate of change.

Brexit has absolutely dominated headlines and trading in the pound for months but a possible respite in talks is an opportunity for the market to focus on the other part of the GBP-trade: The economy.

UK unemployment held steady on Tuesday in what was largely a non-event for the pound. UK earnings growth at 3.5% y/y matched the high from 2008. Later in the day, negative comments from Corbyn about negotiations with May sent cable to the lows of the day at 1.3045.

While Brexit headlines will continue to be market movers, we're likely stuck in a holding pattern in the big picture. That means their impact will ebb, flow and likely fade in the days and weeks ahead. Instead, the market will turn its attention to economic data.

Today's UK CPI was described to have missed the target, but remains the best of both worlds: The highest CPI in the G7, but remains below the BoE's target. Thursday's retail sales report excluding auto fuel, sales are forecast to fall 0.3% after a 0.2% rise in February.

Some Brexiters may say: "We told you UK economy would do well despite Brexit", a possible reply would be "Because hard Brexit has been avoided so far".

Overall, UK GDP forecasts for this year have slipped to 1.2% from 1.5% at the start of the year but that's in-line with much of the developed world. Some of that is a result of Brexit uncertainty, which has diminished after spiking in March. The Citi Economic Surprise index at +36 is one of the better global readings so there have been some beats, albeit against very low expectations.

Given the negativity in GBP and the uncertainty, risks are skewed towards the upside but none of that can materialize until the data starts to show a growth pickup.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product | |||

| 6.4% | 6.3% | 6.4% | Apr 17 2:00 |

| CPI (m/m) | |||

| 0.7% | 0.7% | Apr 17 12:30 | |

| CPI (y/y) | |||

| 1.9% | 2.0% | 1.9% | Apr 17 8:30 |

| Eurozone Final CPI (y/y) [F] | |||

| 1.4% | 1.4% | 1.4% | Apr 17 9:00 |

| Retail Sales (m/m) | |||

| -0.3% | 0.4% | Apr 18 8:30 | |

Loonie Drops on BoC, onto US IP

A key survey from the Bank of Canada showed a sharp slowdown in a downcast report for the Canadian economy. Euro briefly dropped below 1.13 on reports that some ECB officials disagree with the assessment for an H2 growth rebound. GBP little changed after UK earnings data met expectations at a solid 3.5% y/y. March US industrial production is up next, expected +0.2% from unchanged. The Silver long was stopped out. Global indices resume their upside, with DOW30 retesting the 26530/50 cyclical top.

إغلاق الشراء أو فتح البيع؟ (فيديو للمشتركين)

A big surprise in Q1 economic data has been the strength of Canadian economic data but that raises as many questions as it answers.

CAD Data vs Loonie Reality

The loonie is the second-best G10 performer this year (after GBP), but that requires some perspective. It's up about 2% year-to-date against the US dollar, while in Q4 alone it fell more than 6%. More importantly, just about everything has gone right for Canada to start the year. Oil prices are up 40%, the huge Canadian-oil discount is gone and economic data in Canada has been one of the very few bright spots globally. The jobs numbers, retail sales numbers and growth numbers have all been upside surprises.Yet the market has given the loonie little credit. Monday's survey showed why. The measure of sales has traded between +12% and +29% for the past seven quarters. It sank to -6%. Optimism about future sales fell to the lowest in three years. Capacity pressures had been at 10-year highs at 56%. They sank to 31%, which is the lowest since 2015. The measure of labour shortages had a similar plunge.

Despite the 70-pip fall in loonie Monday, the market is still tepid on the BOC's business outlook survey but the central bank itself embraces it. Expect it to be followed by more downcast comments from Poloz and his deputies.

Rest of the week

The rest of the week turns to China GDP tonight, UK, Eurozone and Canada and CPIs tomorrow, Eurozone PMIs after tomorrow and US retail sales on Friday, while most European markets will be shut for Good Friday.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product | |||

| 6.3% | 6.4% | Apr 17 2:00 | |

| CPI (y/y) | |||

| 2.0% | 1.9% | Apr 17 8:30 | |

| Eurozone Final CPI (y/y) [F] | |||

| 1.4% | 1.4% | Apr 17 9:00 | |

Equities Push into Earnings

It's been one of the best starts to a year ever for stock markets but it's not what it appears. The week ahead is all about the start of US earnings season, with important data from flash PMIs in the Eurozone, China Q1 GDP and US industrial production and retail sales. GBP currently leads currencies since the stat of a thinly traded Asian ession. The Video for Premium susbcribers is posted below, flagging signals as to whether to square some longs or open shorts.

The temptation is to chalk up the rally in equities this year to better growth but it's been just the opposite. Growth almost everywhere has disappointed.

Instead, this is a rally entirely predicated on the Fed going to the sidelines and China stimulating. No surprise that on Friday, indices in most developed world markets rallied to their best levels of the year after March new Chinese loans rose 1.69 trillion yuan compared to 1.2 trillion expected.

Markets are increasingly betting on two things: 1) An end to the US-China trade war, and 2) PBOC, Fed and other central bank efforts working to spur growth in the second half. The looming problem is that their actions will help in Q3 or Q4, but we're facing Q1 earnings season.

Gauging Earnings Season

There is considerable risk for disappointment for revenues and earnings, but guidance will hold more sway. The week ahead is focused on financials, which do not reflect an accurate view at consumers or underlying economic conditions. But there could be clues from Netflix, Pepsi, Alcoa and Las Vegas Sands this week. Make sure to distinguish beteween forecasts for revenues, profits and profit margins. And when you read the term "earnings recession", that means overall forecasts for profit growth will be negative for two quarters in a row.One spot we've been following closely is signaling a positive outcome. On Friday, AUD/JPY rose to the highest levels of the year. It had been trading in a tight, well-defined 3% range since the flash crash at the start of the year. The rally on Friday argues that central banks may have done enough to keep risk trades rising. On the same token, check out Ashraf's take on the topic in Friday's IMT here.

CFTC Commitments of Traders

Speculative net futures trader positions as of last Tuesday's close. Net short denoted by - long by +. This week's report was delayed because of the US holiday.EUR -102K vs -99K prior GBP -7K vs -10K prior JPY -72K vs -63K prior CHF -28K vs -26K prior CAD -43K vs -44K prior AUD -54K vs -56K prior NZD -1K vs 0K prior

The euro rallied last week despite Draghi's decidedly dovish press conference. The net short is the largest since late-2016 and the pair is basing from a double bottom at 1.1180. If EUR/USD can keep the momentum going, shorts will start to get nervous.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Evans Speaks | |||

| Apr 15 12:30 | |||

| FOMC's Rosengren Speaks | |||

| Apr 16 0:00 | |||