Intraday Market Thoughts Archives

Displaying results for week of Nov 16, 2014China cuts rates & drives lend-borrow spread to 16-year lows

China's decision to cut rates for the first time in two and a half years triggered a classic play of boosting global equities, commodities and their currencies, reinforcing investors' preferred play of shorting EUR and GBP vs the Canadian dollar. Full charts & analysis

A Warning Sign for the Dollar Bulls

The US dollar got the news it needed but the market wasn't impressed, that could be an early warning sign. The Canadian dollar was the top performer while the euro lagged. The Asia-Pacific calendar is quiet after a busy week. Our Premium trades include EURGBP, GBPCAD and USDCAD ahead of tomorrow's Canada CPI figures.

The shock of the day came with the Philly Fed rising to the highest since 1993. The index hit 40.8 compared to 18.5 expected – an 8.9 standard deviation miss.

Earlier, US CPI rose 1.7% y/y compared to 1.6% y/y expected. At the same time, existing home sales rose to 5.26m compared to the 5.15m consensus.

In every case, the US dollar kneejerked 20-50 pips higher but in every case the gains quickly evaporated. When an asset can't rally on good news, what will make it go higher?

The dollar has been hit by profit-taking on successive Fridays so some short-term caution is warranted but ultimately, the dollar bull market is showing no signs of slowing so dips will be buying opportunities at some point or another.

Another source of concern is in bonds as yields bleed lower. US 10-year yields hit 2.30% before recovering to 2.33%. A break of the 2.27% November low may cause some dollar concerns.

Technically, USD/JPY and EUR/JPY finished close to flat after hitting fresh cycle highs. The daily candlestick patterns may be an early signal of a falling star formation.

Focus remains on EUR/CHF after Zurbrugg affirmed the central bank will defend the floor with utmost determination. That led to another short-term bump but it's challenging to envision a more-lasting rally at least until after the Nov 30 referendum.

Looking ahead, there is very little on the Asia-Pacific (or US) calendar in the day ahead so watch out for some minor position squaring.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoC CPI Core (OCT) (m/m) | |||

| 0.2% | 0.2% | Nov 21 13:30 | |

| CPI (OCT) (m/m) | |||

| -0.2% | 0.1% | Nov 21 13:30 | |

| CPI - Core (OCT) (m/m) | |||

| 0.3% | Nov 21 13:30 | ||

| BoC CPI Core (OCT) (y/y) | |||

| 2.2% | 2.1% | Nov 21 13:30 | |

| CPI (OCT) (y/y) | |||

| 2.1% | 2.0% | Nov 21 13:30 | |

| Existing Home Sales (OCT) (m/m) | |||

| 1.5% | -0.4% | 2.6% | Nov 20 15:00 |

| Existing Home Sales (OCT) | |||

| 5.26M | 5.15M | 5.18M | Nov 20 15:00 |

| Philadelphia Fed. (NOV) | |||

| 40.8 | 18.5 | 20.7 | Nov 20 15:00 |

Manufacturing PMI confirm FX status quo

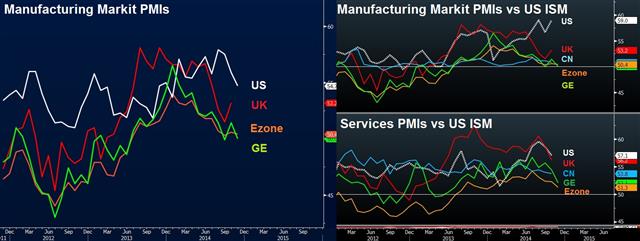

Today's flurry of manufacturing and services surveys from the US, China and Eurozone confirmed what the market had suspected; a cooling off in the pace of expansion in US manufacturing, despite remaining the highest rate in the G7 --, while both Germany and China eked out an expansion, albeit at a slower pace, as did the pan-Eurozone measure of both sectors. France remained in contraction territory. Full charts and analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit US Manufacturing PMI (NOV) [P] | |||

| 54.7 | 56.3 | 55.9 | Nov 20 14:45 |

| PMI (NOV) [P] | |||

| 50.0 | 50.3 | 50.4 | Nov 20 1:45 |

| Eurozone Markit PMI Manufacturing (NOV) [P] | |||

| 50.4 | 50.8 | 50.6 | Nov 20 9:00 |

| Eurozone Markit Services PMI (NOV) [P] | |||

| 51.3 | 52.4 | 52.3 | Nov 20 9:00 |

| Eurozone Markit PMI Composite (NOV) [P] | |||

| 51.4 | 52.3 | 52.1 | Nov 20 9:00 |

| France Markit PMI Manufacturing (NOV) [P] | |||

| 47.6 | 48.8 | 48.5 | Nov 20 8:00 |

| France Markit Services PMI (NOV) [P] | |||

| 48.8 | 48.5 | 48.3 | Nov 20 8:00 |

| Germany Flash PMI Manufacturing | |||

| 50.0 | 51.5 | 51.4 | Nov 20 8:30 |

AUD Nears Key Level Ahead of China PMI

0.8542 is the key level in AUD/USD. Not only is that the November low, it's also 50% of the 2008-2011 rally. With spot at 0.8618, that's a comfortable cushion but stops below Wednesday's session low of 0.8602 could cascade in a quick move lower.

If that happens in the day ahead, the catalyst would almost certainly be the HSBC China PMI due to be 0145 GMT. The consensus is for a slip to 50.2 from 50.4 but a fall below the 50 threshold would spark some worries.

The Fed mentioned fears of a Chinese slowdown in the FOMC minutes and that could become a mainstream fear. Concerns about China have been falsely raised so many times in the last 6 years that traders have tuned it out. The market may have grown complacent and often that's the time to be most on guard.

Xinhua reported on the weekend that Chinese electricity consumption was up just 3.1% y/y in October. There have been some efforts to save energy but it raises eyebrows in an economy that's supposedly growing close to 7.0%.

Other numbers to watch in the hours ahead include Japanese trade data at 2350 GMT. Exports are expected up 4.5% and imports up 3.4% but after the dismal forecasting effort from economists in the GDP data, the market will be skittish. Some estimates on imports are as low as -3.0%.

It will be interesting to see how the yen reacts to poor data. We're likely nearing the point where bad news also hurts the yen, at least domestic bad news.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (NOV) [P] | |||

| 56.4 | 55.9 | Nov 20 14:45 | |

| Nomura/ JMMA PMI Manufacturing (NOV) [P] | |||

| 52.4 | Nov 20 1:35 | ||

| PMI (NOV) [P] | |||

| 50.3 | 50.4 | Nov 20 1:45 | |

| Exports (OCT) (y/y) | |||

| 4.5% | 6.9% | Nov 19 23:50 | |

| Imports (OCT) (y/y) | |||

| 3.4% | 6.2% | Nov 19 23:50 | |

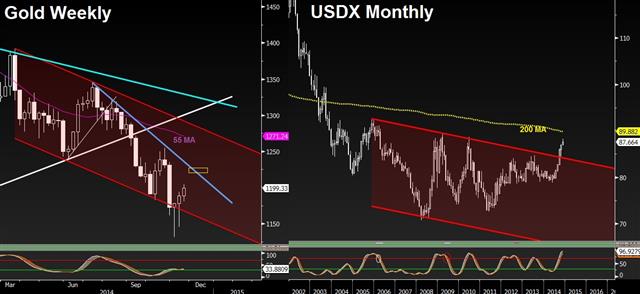

BoE & Fed Minutes FX & Gold Play

Sterling gets a boost after the BoE minutes surprisingly revealed a more hawkish view on inflation, despite the vote remaining a 7-2 split majority in favour of holding rates unchanged at 0.50%. But don't bet on today's release of the minutes from the Fed's October meeting doing the same for the greenback. Full charts & analysis here.

BoJ and Keystone XL Next

Better inflation and housing data helped the US dollar Tuesday. The euro showed some impressive resilience and was the best performer on the day while the yen lagged. The BOJ decision and the Keystone XL vote are next. A new round of GBPCAD trades had been open ahead of Tomorrow's BoE minutes and by elections in Rochester & Strood. The CAD portion the Senate vote on the Canadian pipleline. All details are in the Premium Insights.

Currencies generally traded independently on the day with no major theme taking hold.

The US dollar benefitted from PPI at +0.2% compared to -0.1% expected. The NAHB homebuilder sentiment index also climbed to 58 from 55. USD/JPY climbed back toward 117.00 after falling as low as 116.33. There is a minor double-top that has formed at 117.05.

EUR/USD found some bidders in the 1.2500 range and then sprang to 1.2540. A technical spot to watch is EUR/JPY. The euro is showing some resilience on the day, the pair gained 125 pips and made the first clear close above the 2013 high of 145.69. That's the best level since 2008 and there is very little major resistance until the 2008 high of 170.

Comments from BOE hawk McCafferty underscored some themes we will be hearing frequently in the year ahead. He said Eurozone growth was a risk, that inflation was tepid, the central bank will be patient and that the peak of the rate hike cycle will be lower than usual. His comments helped to pull back back to 1.5628 from 1.5679. Watch last week's low of 1.5595.

The kiwi took a hit on a 3.1% decline in milk prices at the latest Fonterra auction. Prices have been in near-freefall in what will be a consistent headline for a major NZ export.

The Canadian dollar was well supported despite another fall in oil prices (-$1.20 in WTI) but the Keystone XL vote in the Senate is in focus. It will take place just after 2315 GMT and will be within a vote or two of hitting 60. If it passes, look for CAD strength but it could reverse if/when Obama pledges to veto it.

Look for the BOJ meeting sometime between 0230 GMT and 0330 GMT and Kuroda's press conference at 0630 GMT. Despite the recession, it's highly unlikely the BOC will announce more easing after the surprise on Oct 31. There's also the matter of the 5-4 vote.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Producer Price Index - Output (Q3) (q/q) | |||

| 0.2% | -0.5% | Nov 19 21:45 | |

Abe-election 2.0 & UK inflation well below 2.0%

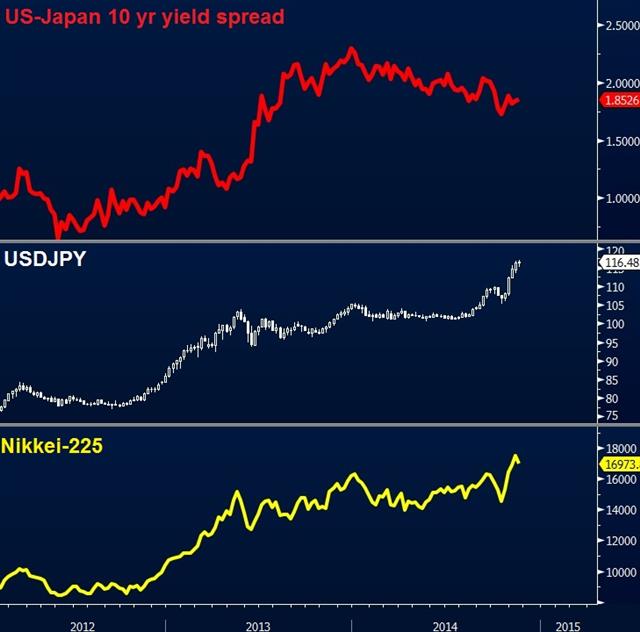

The yen fell across the board alongside a boost to the Nikkei as Japanese PM Abe confirmed the decision to delay the much feared hike in consumption taxes by 18 months and the announcement of snap elections. UK inflation edged up but remained well below the 2.0% target. Full charts & analysis

RBA Minutes and Abe-lection

The US dollar climbed once again on Monday, gaining a half-cent in New York trading against the yen and euro. The gains were despite soft economic data. The Empire Fed was at 10.16 compared to 12.0 expected. US industrial production also slipped 0.1% compared to the +0.2% consensus.

The shadow of the terrible Japanese GDP data hung over the session as the country fell into a quadruple dip recession. Local reports say Abe could call a press conference in the hours ahead to announce a mid-December election.

Chatter about an election started two weeks ago so it's not a surprise but it will add to USD/JPY volatility. Polls show Abe likely to refresh his mandate but those polls were taken before the GDP data. No leader likes to campaign on a recession.

The ideas from opposition candidates will make headlines early in the campaign and it will be interesting to hear opposing ideas to Abenomics but trading strategies in elections can be tricky to map out. We could see USD/JPY slide on the announcement as specs head to the sidelines but at this point an election is largely priced in.

The other event to watch for in the hours ahead are the minutes of the Nov RBA meeting. We will be looking for comments on intervention after Kent's comments in a speech last week. Overall, the minutes at 0030 should be largely in line with the quarterly statement on monetary policy.| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (OCT) (m/m) | |||

| 0.1% | 0.0% | Nov 18 9:30 | |

| Core CPI (OCT) (y/y) | |||

| 1.6% | 1.5% | Nov 18 9:30 | |

| CPI (OCT) (y/y) | |||

| 1.3% | 1.2% | Nov 18 9:30 | |

| Industrial Production (OCT) (m/m) | |||

| -0.1% | 0.2% | 0.8% | Nov 17 14:15 |

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Nov 18 18:30 | |||

Japan recession shifts focus on Abe from Kuroda

Japanese PM Abe needed a bad GDP report in order to justify calling off the tax hike, and he got more than he bargained for. Unconfirmed reports suggest December 14 or 21 as a preferred date for a snap election. But watch the rating agencies as they will likely downgrade Japan next month. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) [P] | |||

| -1.6% | 2.1% | -7.3% | Nov 16 23:50 |

| GDP (Q3) (q/q) [P] | |||

| -0.4% | 0.5% | -1.9% | Nov 16 23:50 |

| GDP Deflator (Q3) (y/y) [P] | |||

| 2.1% | 2.0% | Nov 16 23:50 | |

Fed View May Be Inflated

October CPI is due in the US on Thursday and that will be the main talking point after the dollar rally sputtered last week (it was the worst performer outside of GBP and JPY). On Friday, the ultra hawkish Philly Fed President Charles Plosser said inflation won't be a problem, at least in the near term.

Meanwhile, economists at Goldman Sachs and BofA cut core inflation forecasts for 2015 to 1.5% and 1.4%, respectively.

Plosser and fellow hawk Fisher will both retire in Q1 2015 and that leaves Esther George as the lead hawk and she's switching tactics away from worrying about price rises to a focus on asset bubbles and financial excesses. On Saturday, she cited that as the main reason to raise rates.

The argument may not gain traction but even if it does, it has much different implications than hiking to curb inflation. If the Fed wants to encourage a bit of lending and bubble discipline it will likely end a hiking cycle at 1.00% but could go as high as 2.00%. In the event of inflation, the top could be 200-300 basis points higher.

As the argument shifts, it may cap longer-term US yields and that may stall the USD advance.

In the near-term, Japanese GDP data is due at 23:50 GMT. The consensus is for a 0.5% q/q rise but the impact on FX may be moderate with more BOJ easing off the table at the moment.| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) [P] | |||

| 2.1% | -7.1% | Nov 16 23:50 | |

| GDP (Q3) (q/q) [P] | |||

| 0.5% | -1.8% | Nov 16 23:50 | |

| GDP Deflator (Q3) (y/y) [P] | |||

| 2% | Nov 16 23:50 | ||