Intraday Market Thoughts Archives

Displaying results for week of Nov 17, 2019Yield Curve will Bring Back the Fed

Fed rate cuts are out of the conversation, but that's how the yield curve will bring back the Fed? Full article.

Charts Hesitant on Trade Narrative

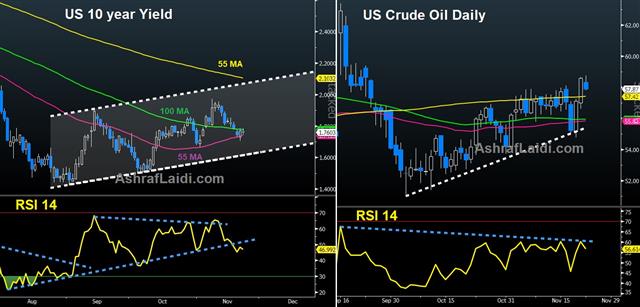

A number of reports pushed back on the negative trade narrative on Thursday but the source of the comments raises eyebrows. The Canadian dollar was the top performer while the Australian dollar lagged. UK services PMI fell back below 50, Canada retail sales fell by less than expected and US Nov manuf and services PMIs rose further above 50, further cementing expectations that Fed will hold rates over the next 3 months. Indices push hesitantly higher, but as Ashraf suggests in the charts be low, US crude's failure at 58.60s and USDCAD's rebound towards 1.3290s is raising doubts over the risk-on swings (more below).

Until today, the pattern in trade headlines over the past two days has been unmistakable --Statements from the US and US reporters has been pessimistic, while those from China have been upbeat, including remarks from president Xi that he wants to work out an initial deal. Pres Trump did reiterate today that a deal with China is close.

One possibility is that those closer to Trump are sensing his unwillingness to do a deal but at the same time Lighthizer and Mnuchin are stringing Beijing along in the hope that the President changes his mind. With regards to Congress' HK bill, Trump is expected to sign it into law, while making his intentions clear to Beijing that he wants a deal.

US dollar strength is gradually returning with stabilising equities, but overall market moves have been modest and that continues to be the case as we bounce from headline to headline.

One mover Thursday was the Canadian dollar as it got a double tailwind from a two-month high in WTI crude (in an impressive reversal) and comments from Poloz that poured cold water on building rate cut expectations. The odds of a BoC 25 bps cut in December hit 25% on Tuesday after Wilkins said there was room to maneuver on rates if needed but Poloz pushed back saying that rates were 'in a good place'. USD/CAD fell to 1.3270 from 1.3320.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash PMI Manufacturing | |||

| 48.3 | 48.8 | 49.6 | Nov 22 9:30 |

| Flash Manufacturing PMI | |||

| 52.2 | 51.5 | 51.3 | Nov 22 14:45 |

| Core Retail Sales (m/m) | |||

| 0.2% | -0.1% | -0.1% | Nov 22 13:30 |

US China Talks Lose Momentum

In the latest trade (tennis) match between US and China, markets are off their lows after Chinese officials announced earlier they were inviting US negotiators for more talks. Markets had dropped to new session lows (SPY 3091) in late Asian trade on mounting threats from Beijing as US Congress sent a bill on Hong Kong human rights to pres Trump to sign into law (more below). If/when he does, expect a firm reaction from China. GBP, NZD and EUR are leading FX ahead of the US session. US jobless claims, Philly Fed survey, existing home sales and LEI are due next. The Premium video focuses on the use of risk reversals in trading EURUSD and unveiling/dissecting that mystery ratio.

Economic news was light Wednesday aside from a Canadian CPI report that was precisely in-line with estimates. Oil rebounded strongly on tighter-than-expected US inventories, thereby helping to provide support to indices. US crude seen capped at 57.95, while USDJPY struggles for fresh momentum at 108.75.80. SPY remains capped at 3091, but a break below would seen stabilizing at 3079, while upside capped at 3114.

Signs are mounting that Trump is less-inclined to make a deal with China than markets believe. A report saying talks could stretch into 2020 weakened risk trades Wednesday, leading to JPY strength and AUD weakness.The main market mover continues to be the hot-and-cold China-US trade game. Signs have been mounting that trouble is brewing but it's been impossible to fight the recurring positive momentum in markets.

A Reuters report Wednesday finally dented the upbeat armor. It said that talks are getting more complicated and could slide into next year. It sent the S&P lower by more than 1% at one point and USD/JPY quickly fell 30 pips.

The dip buyers bought both, as usual, but later there were more signs of trouble. CNBC reported that the deal was 'in trouble', citing four sources. The sides are failing to find common ground on tariff removal.

Then the President himself said he didn't think China was “stepping up to the level that I want.” He also took on the argument that tariffs are hurting the economy by highlighting the strength in employment and equities.

Finally, the US Senate passed the Hong Kong support bill and Trump is expected to sign it. The legislation demands sanctions for anyone found to be interfering in the region. It will undoubtedly anger China.The market believes Trump won't risk an equity selloff and economic consequences but his comments today suggest he doesn't think the impact will be overly damaging to his re-election chances.

At this point, it doesn't appear as though Trump has made up his mind but the risks of a blowup are higher than markets are implying.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.3% | 0.3% | -0.4% | Nov 20 13:30 |

Oil Slumps on Russia's Oil Stance

Oil posted its biggest percentage decline in nearly 2 months after reports indicated Russia is unlikely to lower production at the upcoming OPEC meeting. US crude dropped towards its 7-week trendline support, VIX had its first gap up in three months and equity indices fall in line with what we said on here 2 days ago. The loonie is the biggest loser of the last 24 hours on oil's drump and could be set for further declines ahead of Canada's CPI later on (more below on CAD). GBP drops as Labour's Corbyn had a strong showing in yesterday's debate with PM Johnson. A new Premium trade was posted during Tuesday's London session.

فيديو للمشتركين أدناه يفسر كل التفاصيل وراء هذا المؤشر و صفقة يوم الإثنين

Oil fell 3.3% on Tuesday to the worst levels since November 1. The news was that Russia probably won't agree to a production cut at the Dec 5 OPEC meeting, according to three Reuters sources. Some members have pushed for deeper cuts in order to get Brent back to $70 but many countries are facing budget pressures and haven't yet complied with earlier cuts.

The news isn't really a surprise but it landed in an oil market that was reeling. Crude touched a seven-week high early on Monday but quickly reversed lower and today's news was compounded mild unease about the US-China trade deal.

The weakness in oil boosted USD/CAD to the precipice of a 5-week high. A break of 1.3271 would clear the way to 1.3000 amnd the October highs near 1.3340. The rally was helped along by a speech from BOC senior deputy Wilkins noting that the central bank has room to maneuver on rates. She also highlighted that the economy was in good shape but the comment on rates captured the market's imagination and the implied odds of a Dec cut rose to 24% from 16% in the OIS market.

Looking ahead, Canadian CPI is due at 1330 GMT. It will be a critical report for the BOC ahead of the December 4 meeting. It's forecast to show a 1.9% y/y reading and a 0.3% m/m rise. The BOC's three core measures are all expected to remain close to 2%. The BOC faces more inflation and wage growth than other developed-market central banks and that's why they have been reluctant to cut. However a tick lower may further crack open the door to an insurance cut.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.3% | -0.4% | Nov 20 13:30 | |

هل هذه إشارة مثالية؟

لاحض أن الرسم البياني الأبيض (الذي يمثل نسبة سوقية خاصة) بدأ السقوط من القمم الأربعة السابقة (دائرات زرقاء) ٤ او ٦ جلسات قبل سقوط مؤشر البورصة اليو أس 500 بمقدار 5% أو اكثر . العلاقة صالحة إلا في الحالات التي وصل اليها المخطط الابيض الى مستوى في مؤشر القوة النسبية (الآر أس آي) ما هذا المخطط الأبيض؟ و إذا بقت العلاقة صالحة، فذالك يعني أن اليو أس أن بي 500 سوف يبدأ هبوطه يوم الخميس أو الجمعة

A Perfect Indicator?

Every once in a while, a chart like this comes around. Each peak and subsequent decline in the S&P500 of more than 5% over the past 2 years was predicted 4-6 sessions prior by this mystery instrument at each occasion the ratio tested 70% on the RSI. Is it as perfect as it appears? Find out more.

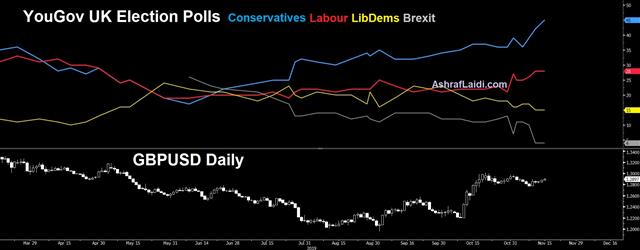

USD Extends Weakness on China, Polls, Powell

USD weakness extended into Monday, while US indices paused from their record-breaking run after reports indicated pessimism prevailed in China regarding the US-China trade talks, while Trump revealed he had an unscheduled meeting with Fed chair Powell where he discussed the strong US dollar, and negative interest rates and manufacturing. GBP was the leading currency against USD, reaching $1.2985 after PM Johnson said each Conservative MP candidate for MP has signed a pledge to vote for his Brexit deal, further pushing opinion polls in favour of the Tories (see more below). on A new Premium trade was released in FX with 2 charts and 7 notes, while the DOW trade was stopped out.

The pessimism comments were reported by CNBC's Beijing bureau chief Eunice Yoon tweeting: "China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.

The new indications emerged after weekend chatter from China highlighted 'constructive discussions' and an agreement to maintain close communication. That hardly moves the needle in terms of news but fighting it on the market side has proven to be impossible. Yet for every step forward on optimism, there's a risk of a plunge backwards if talks fall apart. And for every 3 or 4 statements from the US side on the trade talks, Beijing makes 1 or none.

At the same time, there's a risk that trade news is overshadowing what's happening in the economy. There has been an undercurrent of stabilization in most of the world. On Friday, the US retail sales control group was up 0.3% to match estimates. Overall sales were also slightly stronger at +0.3% vs the +0.2% consensus.

Broad economic concern has shifted to a focus on struggling global manufacturing. Friday's industrial production data in the US showed a 0.8% fall compared to -0.4% expected. It's a similar story nearly everywhere but while manufacturing struggles, the consumer isn't worsening. Unless that changes, there's no reason to believe this paradigm can't extend through year-end.

Latest UK Polls

The latest figures from the UK election polls according to ICM conducted for Reuters showed the Conservatives at 42% (up 3 points) from the previous ICM poll, Labour at 32% (up 1 point), LibDems at 13% (down 2) Brexit Party at 5%, down 3 pointsCFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -58K vs -61K prior GBP -28K vs -29K prior JPY -35K vs -27K prior CHF -15K vs -14K prior CAD +42K vs +52K prior AUD -41K vs -27K prior NZD -41K vs -27K prior

The Australian and New Zealand dollar have shown some signs of life following central bank decisions but the market is deeply sour on both. Watch the 100-day moving average in NZD/USD this week, currently about 35 pips above spot at 0.6440.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| Nov 19 14:00 | |||