Intraday Market Thoughts Archives

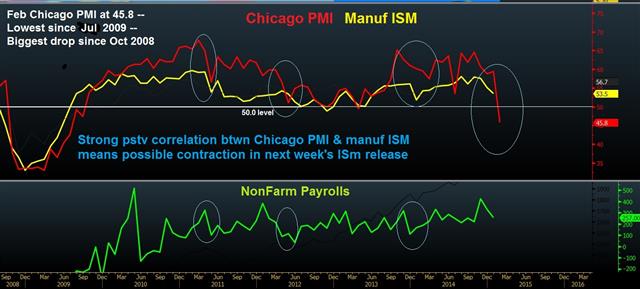

Displaying results for week of Feb 22, 2015Slumping Chicago PMI & ISM Implications

The 14-pt drop in the February Chicago PMI to 45.8 is the biggest decline since October 2008 and the lowest level since Jul 2009. The sharp fall is attributed to inclement weather conditions (North East) and port-related delays (West Coast). The last time the index fell by more than 10 points was in October 2008, when the financial crisis unleashed brought a standstill to manufacturing activity and jobs losses escalated in the months to follow. Full charts & analysis.

The Final Piece of the Fed Puzzle

The Fed is confident that low oil prices will only produce transient disinflation and they believe signals from the bond market about low inflation are wrong but one element of the inflation picture irks them – non-existent wage inflation. Existing Premium trades remain in progress ahead of the last trading day of the month.

The economic models the Fed relies on shows that as jobs rise, wages should rise as well but that hasn't been happening and it's left many members of the Fed waiting 'patiently' for it to appear. The first sign may have come Thursday in the CPI report. The overall report was close to expectations but one number stood out: average weekly wages rose 1.2% in the month compared to the 0.3% consensus.

The data led to one of the largest US dollar rallies so far this year. The euro tumbled more than 1.5 cents to the lowest of the month as the dollar surged right across the board.

The USD got additional fuel from the durable goods orders report. Core orders rose 0.6% compared to 0.4% expected to halt six months of flat industrial order growth.

Technically, cable made a move to watch. It stalled just ahead of the 2015 high and the 100-day moving average and then collapsed 150 pips to form an outside day. Cable had been one of the best trades of the month but it stumbled badly with only one trading day left in February.

Looking ahead, it's a very big data for economic data in Japan. The market continues to fret about what the BOJ will do next and these numbers may be a critical input. The first numbers hit at 2330 GMT including household spending and employment. At the same time, CPI is expected at 2.4% in the January national reading at 2.2% in the Feb Tokyo reading. But watch the core reading, which is forecast to rise 2.1%.

At 2350 GMT, the focus moves to industrial production and retail trade. To wrap it all up, BOJ leader Kuroda speaks at 0230 GMT and may offer his take on the data and what's next.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods Orders (JAN) | |||

| 2.8% | 1.6% | -3.3% | Feb 26 13:30 |

| Durables Ex Transportation (JAN) | |||

| 0.3% | 0.5% | -0.8% | Feb 26 13:30 |

| Overall Household Spending (y/y) | |||

| -5.1% | -4.0% | -3.4% | Feb 26 23:30 |

| Industrial Production (JAN) (m/m) [P] | |||

| 2.7% | 0.8% | Feb 26 23:50 | |

| Industrial Production (JAN) (y/y) [P] | |||

| 1% | Feb 26 23:50 | ||

| Retail Trade s.a (JAN) (m/m) | |||

| -0.3% | Feb 26 23:50 | ||

| Retail Trade (JAN) (y/y) | |||

| -1.3% | 0.2% | Feb 26 23:50 | |

| FOMC's Mester speech | |||

| Feb 27 5:00 | |||

USD looking for month-end boost

USD bulls found more support in today's US inflation and durables data than USD bears did, leading to a squaring off in Friday's release of the revised Q4 GDP figures. More charts & analysis on Canada CPI & UK GDP found here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods Orders (JAN) | |||

| 2.8% | 1.6% | -3.3% | Feb 26 13:30 |

| Durables Ex Transportation (JAN) | |||

| 0.3% | 0.5% | -0.8% | Feb 26 13:30 |

| GDP Annualized (Q4) [P] | |||

| 2.1% | 2.6% | Feb 27 13:30 | |

| GDP Price Index (Q4) [P] | |||

| 0.0% | 1.4% | Feb 27 13:30 | |

| GDP (4Q) (q/q) [P] | |||

| 0.5% | 0.5% | 0.5% | Feb 26 9:30 |

| GDP (4Q) (y/y) [P] | |||

| 2.7% | 2.7% | 2.7% | Feb 26 9:30 |

| Bank Canada CPI Core (JAN) (m/m) | |||

| 0.2% | 0.1% | -0.3% | Feb 26 13:30 |

| CPI (JAN) (m/m) | |||

| -0.2% | -0.4% | -0.7% | Feb 26 13:30 |

| Bank Canada CPI Core (JAN) (y/y) | |||

| 2.2% | 2.1% | 2.2% | Feb 26 13:30 |

| CPI (JAN) (y/y) | |||

| 1.0% | 0.8% | 1.5% | Feb 26 13:30 |

| CPI (JAN) | |||

| 124.3 | 124.5 | Feb 26 13:30 | |

| CPI Core (JAN) (m/m) | |||

| 0.2% | 0.2% | Feb 26 13:30 | |

Draghi Seeing ‘Green Shoots’?

The turning point of the US financial crisis was a comment from Draghi that he was seeing 'green shoots' in the economy. Draghi made a similar comment Wednesday but didn't get the attention in the news or markets. Oil surged after inventory data while the US dollar lagged. Our Premium subscribers have just received today's new GBP trade with 2 important charts, laying out the technical and fundamental arguments for the trade plan. Our 2 existing USDCAD shorts are currently netting a total of +280 pips, while the two AUDNZD shorts are up a net +160 pips. Both GBPUSD longs are in the green, with a total of 260 pips. See Premium Insights.

Neither Yellen nor Draghi were able to jolt the market out of a slumber on Wednesday but a quiet trend of improvement in the European economy is emerging. French jobseekers fell by 19K compared to +8K expected and the ECB's Coene said GDP forecasts could be revised higher.

The larger statement may have come from Draghi, who said he sees the first signs of confidence returning to the economy. Certainly, the stock market has been seeing the same thing in the aftermath of the ECB QE announcement.

The euro also continues to stabilize. That's not particularly impressive after the recent swan dive but it's a start and with the speculative market still crowded into shorts, there is plenty of scope for a rebound.

On the topic of rebounds, crude initially plunged to a session low after an 8.4m barrel rise in US supply data but later jumped more than $2.50. The API data a day earlier had foreshadowed a large build and that led to a squeeze. The reversal traced out a bullish engulfing formation on the daily chart as well.

In the market, cable was impressive once again as it touched a six-week high at 1.5539. It's nearly wiped out YTD losses as the market increasingly believes the BOE will be the second central bank after the Fed to hike rates.

Looking ahead, two events in the coming hours are in focus. The first is Australian capex data for Q4 at 0030 GMT. It's expected to fall 1.6% after a 0.2% rise in Q3. Companies continue to slash spending in Australia so any good news would largely be shrugged off while a poor reading would solidify worries.

More interesting might be at 0200 GMT when New Zealand releases data on currency sales for January. Wheeler has intervened in the past 6 months and continues to jawbone. It would be a surprise if the RBNZ was still selling.

Which GBP Trade Ahead of GDP?

Wednesday's release of the UK Q2 GDP revisions is raising the usual debate as to whether the figures will be revised from the initial release of 0.4% q/q and 2.7% y/y. Some analysts are already talking of overbought momentum in GBP pairs, but the subsequent release of the all-important US CPI and durable goods orders later in the day could rebalance momentum in GBUSD. Or will it? Trading a GBP cross other than cable is an alternative -- such as GBPCAD, GBPJPY or EURGBP. Our Premium subscribers have just received today's new GBP trade with 2 important charts, laying out the technical and fundamental arguments for the trade plan. Our 2 existing USDCAD shorts are currently netting a total of +280 pips, while the two AUDNZD shorts are up a net +160 pips. Both GBPUSD longs are in the green, with a total of 260 pips. Click on here for today's chart & trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q4) (q/q) [P] | |||

| 0.5% | 0.7% | Feb 26 9:30 | |

| GDP (Q4) (y/y) [P] | |||

| 2.7% | 2.7% | Feb 26 9:30 | |

| Durable Goods Orders (JAN) | |||

| 1.9% | -3.4% | Feb 26 13:30 | |

| Durable Goods Orders ex Transportation (JAN) | |||

| 0.5% | -0.8% | Feb 26 13:30 | |

Listen to Ashraf on Benzinga in 55 mins from now

Catch Ashraf's Live Q&A Chat on Benzinga @ 9:20 ET (14:20 GMT), talking currencies & FOMC. Tune in here

Yellen and Poloz Add Suspense

Market watchers came into the day hoping for hints about what the Fed and BOC would do in March but they left with more questions than answers. The loonie was the best performer while the kiwi lagged. It's a major day of Asia-Pacific data including the China manufacturing PMI. In today's Premium trade, we issued a new trade on a CAD pair after Yellen & Poloz speeches. Full details found on the Premium Insights.

We didn't get answers about what the FOMC will do in March but we got clues. Before the FOMC minutes it appeared exceedingly likely the 'patient' reference would be removed but Yellen highlighted low wage growth, international worries and low labor force participation.

The Fed seems especially cloudy on the inflation outlook. They want to look through the temporary oil dip and disregard breakevens but Yellen expressed some discomfort with both assumptions.

The US dollar was weaker across the board after the testimony with USD/JPY especially soft, falling more than a cent from the highs.

The Canadian dollar surged after a speech from Poloz indicated the BOC may not cut next week. The market has priced in an 80% chance of a cut but Poloz emphasized that the January cut gives the BOC some time to wait and see. He also characterised data since then as 'some good, some bad'.

One thing that was curious about Yellen's testimony was in the reference to weak foreign economies, the first one mentioned was China ahead of problem spots like Europe, Japan and Canada. Does the Fed know something?

We may find out more at 0145 GMT with the preliminary HSBC China manufacturing PMI for February. The consensus estimate is a slide to 49.5 from 49.7.

It's part of a brisk day of economic data that includes comments from Wheeler, Aussie skilled vacancies and the Australian Q4 wage cost index. Any of them could be major market movers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Services PMI (FEB) [P] | |||

| 57.0 | 54.1 | 54.2 | Feb 24 14:45 |

| Markit PMI Composite (FEB) [P] | |||

| 56.8 | 54.4 | Feb 24 14:45 | |

| PMI (FEB) [P] | |||

| 49.5 | 49.7 | Feb 25 1:45 | |

| Fed's Yellen testifies | |||

| Feb 25 15:00 | |||

| Eurozone ECB President Draghi's Speech | |||

| Feb 25 14:30 | |||

| Wage Price Index (Q4) (q/q) | |||

| 0.6% | 0.6% | Feb 25 0:30 | |

| Wage Price Index (Q4) (y/y) | |||

| 2.5% | 2.6% | Feb 25 0:30 | |

Yellen’s patience weighs on US dollar

The dollar quickly lost all of the gains triggered by traders' misinterpretation of wire news services' reporting of Fed Chair Yellen's testimony, erroneously stating that “guidance chance to mean liftoff possible at any meeting”. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Yellen testifies | |||

| Feb 25 15:00 | |||

Ashraf's Webinar Tonight

Ashraf's webinar on currencies and indices starts at 20:00 GMT, covering the confirmations of chart patterns and implications of Fed chair Yellen's testimony. Sign up here

Not Just Oil Chilling CAD

The US dollar was broadly higher on Monday has the hours tick down ahead of Humphrey Hawkins. The pound was the top performer to start the week while the Swiss franc was the laggard as it resumed its descent. Japanese small business confidence data is due later but we look at another factor weighing on CAD.

The market wasn't quiet to start the week. Cable made a strong move higher a peaked just show of last week's high despite a slightly soft CBI Reported Sales report. The pound has quietly been a very good performer after falling in the first few trading days of the year. It's particularly noticeable in EUR/GBP, which has been in a steady downtrend and touched the lowest in 7 years on Monday. There is very little near-term support below.

Economic data included US existing home sales, which fell to 4.82m compared to 4.95m expected. There is an increasing focus on US weather in economic forecasts for Q1 after snow last year chopped down GDP. Forecasts bear watching in the month ahead but the bigger risk might be in Canada, which has been hit by an extremely harsh winter. Toronto temperatures hit a record low Monday and the cold could exaggerate the weakness in an already-crippled economy.

In addition, oil prices turned lower once again on Monday. The initial drivers were shipments reopening from Libya and Oman pledging to raise production. The real tell may have been comments from the Nigerian oil minister. She said they may call an emergency OPEC meeting but the $1 bounce in crude washed out in less than an hour. A market that can't rally on good headlines probably can't rally at all.

The main focus in the day ahead will be Yellen and it hinges on whether or not she hints at removing 'patient'. Taking it out would give the Fed some flexibility while not committing them to hiking rates in June and that will be the message Yellen is likely to emphasize.

In the near term, the Asia-Pacific calendar remains light but Feb Japanese small business confidence at 0500 GMT is a highlight. It's expected to tick higher to 47.0 from 46.3.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Existing Home Sales (JAN) (m/m) | |||

| -4.9% | -1.8% | 2.4% | Feb 23 15:00 |

| Existing Home Sales (JAN) | |||

| 4.82M | 4.95M | 5.04M | Feb 23 15:00 |

Back to Fundamentals With Greece Temporarily Sorted

The reaction in trading after the Greek deal late on Friday was to sell the euro and erase the bounce on the rumor. That could be an indication of how eager traders remain to sell the euro. Last week, the Australian dollar was the top performer while the loonie and Swiss franc lagged. The Swissy is under fresh pressure as the new week begins while the rest of the market is virtually unchanged. CFTC positioning data showed euro shorts trimmed. Link to register for Ashraf's Tuesday webinar on Indices/FX 8pm GMT - Sign up https://t.co/BIkHQ1buW3

Greece is mostly on the backburner on Monday. On the weekend, Fin Min Varoufakis said he was confident the Greek list of reforms would be approved. In four months when the current deal expires, it will be more drama but for now the market can focus on fundamentals.

The highlight in the week ahead will be Yellen's Humphrey Hawkins testimony beginning on Tuesday but the market will also refocus on state of the broader Eurozone. Over the past few weeks, data has quietly begun to beat expectations and more of the same could spark a relief rally.

Asia-Pac trading is light to start the week with the exception of the Jan BOJ meeting minutes at 2350 GMT. The main event on the day will be in European trading with German IFO data at 0900 GMT. The consensus is for the current conditions index to rise to 112.5 from 111.7 and for the expectations index to rise one point to 103.0.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -186K vs -195K prior JPY -49K vs -55K prior GBP -29K vs -39K prior AUD -54K vs -53K prior CAD -33K vs -33K prior CHF -6K vs -5K prior

Euro shorts had been near a record but scaled back for the time being. Traders are likely going to need a good reason to pile into a crowded trade. Yen shorts continue to pare while AUD is the second-least liked currency; with last week's rally, that could point to the chance of a squeeze.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Expectations (FEB) | |||

| 103 | 102 | Feb 23 9:00 | |