Intraday Market Thoughts Archives

Displaying results for week of May 14, 2017The Post-Truth Trade

Maybe the dollar rally late Thursday had nothing to do with politics, maybe it was an obscure fundamental headline, or flows or a fat finger in cable that morphed into a broad USD bid. 5 straight daily declines in the currency of the world's strongest economy may have a been excessive. Any of that would be a comforting explanation because the alternative is that an Infowars/Zerohedge fake news story was responsible for the move, and that would mean that markets have now been enveloped by the post-truth world.

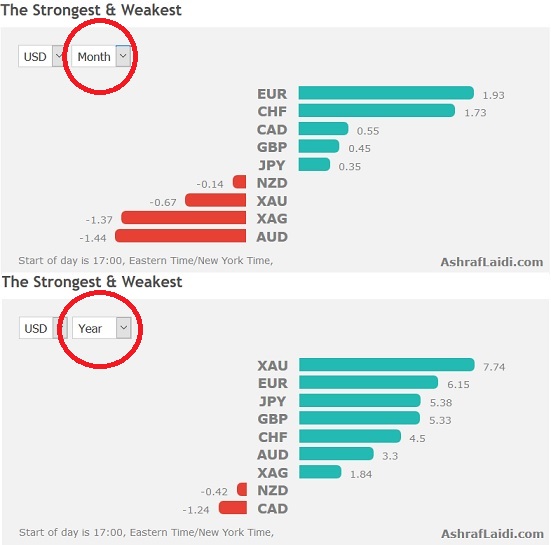

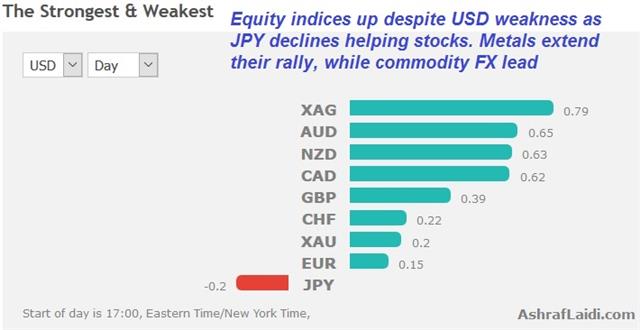

The US dollar was the top performer while the New Zealand dollar lagged. The Asia-Pacific calendar is light. Above is the chart of strongest and weakest currencies vs the USD since the start of the year and the month.

There has been a push-and-pull between politics and fundamentals since the election but fundamentals were winning out. On Wednesday, however, politics took over and it continued Thursday. It started with a gotcha story from Reuters saying Trump's campaign team had at least 16 more undisclosed contacts with Kremlin associates. That set off a round of risk aversion but it slowly faded because the story indicated that the calls were about the kind of things that politicians should be discussing– China, general relations and North Korea.

Skip ahead a few hours and the Infowars/ZeroHedge story begins to circulate. The headlines stated Comey had indicated no one had tried to pressure him to end an investigation on May 3. At the same time, cable flash crashed 100 pips, the dollar started to catch a broad bid and stocks rallied.

Delving deeper the actual clip, Comey was asked if anyone at the Department of Justice had asked the FBI to end an investigation. He wasn't talking about the White House.

It's unfair to lump Reuters with the other sources but the effects were the same. That says something profound about markets.

Untruth is nothing new to markets. There is always a rumour about a corporate takeover or bankruptcy but when you chase a rumour and it's wrong, you're punished. With political rumours it doesn't matter if they turn out to be true or false.

We're confident that fundamentals will ultimately win out – they always do. In the meantime, we're all stuck reading fringe political websites trying to figure out what the average voter will believe is true and false.

Ashraf at Saturday's Expo

I will be speaking this Sturday at the London Forex Expo at 2 pm and participating in a panel at Noon. My topic is : "The Most Overlooked Formation in the US Dollar" - Integrating Fundamentals and Technicals to this Formation - Will USD direction vs EUR diverge from that against JPY? - Is the worst over for GBP/USD? - Trading the Gold vs Oil Battle.See you there

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Treasury Sec Mnuchin Speaks | |||

| May 18 14:00 | |||

Breaking Point

We learned this year that financial markets can tolerate a great deal of political dysfunction; Tuesday showed this also has a limit. The yen soared while the Canadian dollar lagged as risk aversion hit hard. Japanese GDP and Australian jobs are due up next. The Premium short in the DOW30 hit its final target for 330-pt gain.

The trigger for the meltdown in sentiment Tuesday was a revelation that Trump asked FBI Director Comey to drop his investigation of Mike Flynn. Legal and constitutional circles have been debating on whether it could be obstruction of justice but markets didn't wait for the answer.

USD/JPY fell more than 200 pips in the worst decline since July 2016, US 10-year yields dropped 9 bps and the S&P 500 fell nearly 40 points. The selling was relentless.

The next move is to take a step back and search for perspective. It seems highly unlikely this is enough to impeach a President. This isn't Watergate. The Republican agenda also probably isn't in peril. If anything, Congressional Republicans will want to get to work and accomplish something in order to help change the conversation.

But maybe the message from markets isn't about impeachment or the Republican agenda. Maybe it's about governance. The breaking point might be that the market has determined that the new administration is so gaffe prone and the President so impulsive that he will never be able to lead effectively. That's the kind of instability that grates on business and sentiment.

It doesn't mean this is the start of a bear market or a recession but it could dial back expectations. The odds of a June 14 Fed hike are down to 66% from 88%, according to the CME's Fedwatch tool. That's not just about politics, it's also a reflection of sluggish economic data.

What's also instructive is that troubles in the present always seem bigger than they are, especially with geopolitics. The market freaked out about Ebola, Russia's incursion into Ukraine, dozens of things that will never appear in history books. There's a good chance that's what will happen next.

Ultimately, the economy is what will guide markets so we look next to key data from Japan and Australia. Up first at 2350 GMT, Japanese Q1 preliminary GDP data is due. The market is expecting 0.5% y/y growth, or 1.7% annualized.

For Australia, the jobs report is at 0130 GMT and forecast to show 5.0K new jobs and 5.9% unemployment. Given the negative rumblings from China, we will be watching Australian data closely in the coming months.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Prelim GDP (q/q) [P] | |||

| 0.4% | 0.3% | May 17 23:50 | |

| Employment Change | |||

| 4.5K | 60.9K | May 18 1:30 | |

Win for Hard Data but Loss for USD

After months of improved manufacturing PMIs, US industrial production beat estimates. But it didn't provide a lift to the US dollar, which was the laggard on the day, allowing the euro to climb near 1.11. Australian wage data is due next. The matrix below highlights the 12 trades in EURUSD issued by the Premium Insights since December 2015. 9 out of 12 trades were closed at a profit with a net gain of 865 pips assuming clients entered at the higher (lower) end of the long (short) trade and opened ONLY one trade per recommendation. More on the methodology here.

Industrial production rose 1.0% in April, beating the 0.4% consensus estimate. Manufacturing production and capacity utilization were also better than forecast in a sign that hard data is catching up to soft data, as the Fed expects. Housing starts and building permits fell unexpectedly.

The problem is that it's going to take much more than one report. The US Citi Economic Surprise Index is the G10 laggard and at the lowest in a year.

The dollar suffered for the second day, partly because US housing starts were soft. Technically, the break in EUR/USD above 1.10 is significant, partly helped by Eurozone GDP. That level held early in the month but was blown out Tuesday and extended as high as 1.1097, which is the best since election night in the US.

USD/JPY also fell below 113.00 in the first real retracement in a month. USD/CAD fell to the lowest since April 26 but an unexpected crude storage build in the API report early in Asia is a threat to the loonie.

The Australian dollar has climbed for five consecutive days after falling for the five days before that. The bounce has only been half as large as the drop. That could change at 0130 GMT with the release of the Q1 wage price index. It's forecast to rise 0.5% q/q and 1.9% y/y. Anything within 0.2 pp of those numbers is unlikely to cause ripples.

What could cause waves is any fresh worries from China. The Shanghai Composite has climbed for four days after a month-long swoon.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Capacity Utilization Rate | |||

| 76.7% | 76.3% | 76.1% | May 16 13:15 |

| Eurozone Flash GDP (q/q) | |||

| 0.5% | 0.5% | 0.5% | May 16 9:00 |

| Wage Price Index (q/q) | |||

| 0.5% | 0.5% | May 17 1:30 | |

| Building Permits | |||

| 1.23M | 1.27M | 1.27M | May 16 12:30 |

Euro Spreads & Sentiment

Putting aside hard and soft data, yield differentials continue to command FX markets as the German-US 10 year yield spread breaks above its 200-day MA for the 1st time since August to hit -1.90%. The story, however, is not only in the break of the average, but also in the fact that the formation of the spread consists of higher lows and higher highs since the December bottom, which is the same formation for EURUSD, gold and most “anti-USD” instruments.

The next key technical barrier for the spread stands at -1.70%, which marks the trendline resistance from the January 2015 highs. Much technical work remains to be done for euro bulls to secure lasting stability. But with speculative euro futures positioning entering positive territory for the 1st time since 2014 and with these contracts, “sentiment” should further pick up for the currency due to the fact that the 22,399 representing net long contracts, is well below the 121,000 record high from 2007, which argues against the popular but often erroneous notion that rising euro sentiment must be excessive.

Don't Count out OPEC

Not all markets are equal and while it's tempting to doubt OPEC, the oil market has a way of breaking the rules. The Canadian dollar was the top performer Monday on a rally in crude while the yen lagged. Kuroda speaks later. A new Premium Video will be posted ahead of the Tuesday London session.

Oil ministers from Saudi Arabia and Russia sent crude prices nearly $2 higher on Monday by saying they hoped to extend the current quotas until March 2018. An extension to year end had been generally expected and there were rumours of a longer or larger production curb so it wasn't entirely a shock but it certainly provided a jolt.

Along with crude rising, USD/CAD dropped to 1.3600 from 1.3675. Then disappointment set in, crude and CAD both cut the moves in half. The temptation is to now bet against OPEC. They've shown their hand so when the moves come it shouldn't be a surprise.

But we're reminded of two big previous OPEC announcements. The most-recent one was on November 30 when OPEC first announced a supply cut agreement. By the time it was announced it had already leaked and been rumored for at least a week. And yet when the headlines finally hit, oil jumped. The gains continued in the next two weeks as crude climbed more than 10%.

It's not the first time that oil waited for the official OPEC word before moving. In December 2015 OPEC left quotas unchanged. It was even less of a surprise and had been wholly telegraphed. Yet crude fell a whopping 5% that day and a total of 33% by mid-January.

It could be that oil hedgers wait until the official announcement before they pull the trigger. It could be something else, but there is enough history to show that betting on something being 'priced in' to oil is a risk.

The OPEC meeting is May 25.

In the near-term, the Asia-Pacific calendar is generally light but it's punctuated by an appearance from Kuroda at a WSJ meeting at 0455 GMT. USD/JPY above 113.00 is close to the BOJ's sweet spot so he may avoid commentary on the yen.

Populism’s Pendulum Swings Back

A surprisingly strong election result for Merkel's party in Germany's most-populous state along with Macron's win and Trump's stumbles could signal that populism is in reverse. The dollar was the top performer last week while the Swiss franc lagged. Silver is leading the pack in Monday trading, highlighting the continued rebound in metals (see latest Premium note on gold last week). CFTC positioning data showed a rush into euros in some of the biggest one week swings we've seen in years.

The establishment has a knack for pivoting and remaining in power. The Brexit and Trump wins were heralded as a rising tide that would swamp traditional politics but instead it may prove to be a rogue wave that hits hard but quickly washes away.

Brexit may have been a win for populism but it's also on track to be a win for UK Conservatives. By dumping Cameron, installing May and switching the party's position on the EU, the party is poised for a landslide victory in June's election. In the US, it's still early but Trump's struggles may be turning global voters away from his style of politics.

Le Pen clearly lost momentum in the later stages of the campaign and Merkel is once again proving she's a juggernaut. The race for North Rhine-Westphalia was too-close-to-call ahead of Sunday's vote but exit polls showed her CDU party beating out the incumbent SDP by a margin of 34% to 31%. That's a great sign for the chancellor ahead of September's national vote.

In terms of trading, the ebb in populism mitigates one of the prime risks facing markets. With a quiet Summer calendar ahead, the positive drift in markets is likely to persist but we remain on guard for the day when the Chinese tsunami of bad debt finally hits.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +22K vs -2K prior GBP -47K vs -81K prior JPY -36K vs -23K prior CHF -15K vs -18K prior CAD -86K vs -48K prior AUD +26K vs +43K prior NZD -11K vs -12K prior

The scope of the moves this week is unusual. The market is aggressively buying euros and pounds while dumping yen and Canadian dollars.The euro switched to a net long position for the first time since May 2014. In two weeks it switched from -21K to +22K. The market was caught a bit offside early last week as the euro slide but Friday's rally left it at 1.0930.