The Post-Truth Trade

Maybe the dollar rally late Thursday had nothing to do with politics, maybe it was an obscure fundamental headline, or flows or a fat finger in cable that morphed into a broad USD bid. 5 straight daily declines in the currency of the world's strongest economy may have a been excessive. Any of that would be a comforting explanation because the alternative is that an Infowars/Zerohedge fake news story was responsible for the move, and that would mean that markets have now been enveloped by the post-truth world.

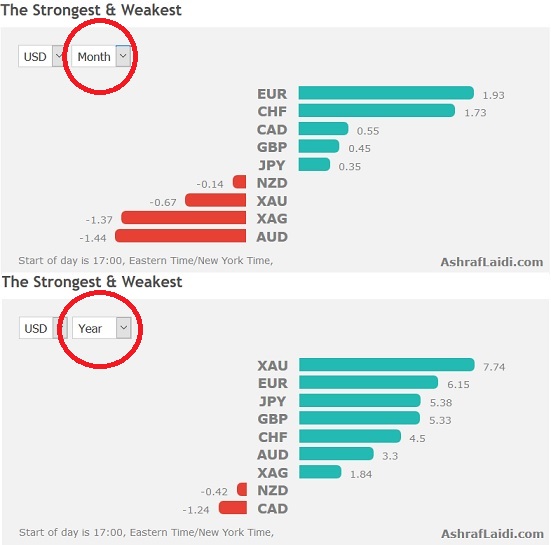

The US dollar was the top performer while the New Zealand dollar lagged. The Asia-Pacific calendar is light. Above is the chart of strongest and weakest currencies vs the USD since the start of the year and the month.

There has been a push-and-pull between politics and fundamentals since the election but fundamentals were winning out. On Wednesday, however, politics took over and it continued Thursday. It started with a gotcha story from Reuters saying Trump's campaign team had at least 16 more undisclosed contacts with Kremlin associates. That set off a round of risk aversion but it slowly faded because the story indicated that the calls were about the kind of things that politicians should be discussing– China, general relations and North Korea.

Skip ahead a few hours and the Infowars/ZeroHedge story begins to circulate. The headlines stated Comey had indicated no one had tried to pressure him to end an investigation on May 3. At the same time, cable flash crashed 100 pips, the dollar started to catch a broad bid and stocks rallied.

Delving deeper the actual clip, Comey was asked if anyone at the Department of Justice had asked the FBI to end an investigation. He wasn't talking about the White House.

It's unfair to lump Reuters with the other sources but the effects were the same. That says something profound about markets.

Untruth is nothing new to markets. There is always a rumour about a corporate takeover or bankruptcy but when you chase a rumour and it's wrong, you're punished. With political rumours it doesn't matter if they turn out to be true or false.

We're confident that fundamentals will ultimately win out – they always do. In the meantime, we're all stuck reading fringe political websites trying to figure out what the average voter will believe is true and false.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46